Question: While solving this problem, please display all computations and formulas. please solve this correctly. Principles of Finance Assignment 1 Read carefully the following financial data

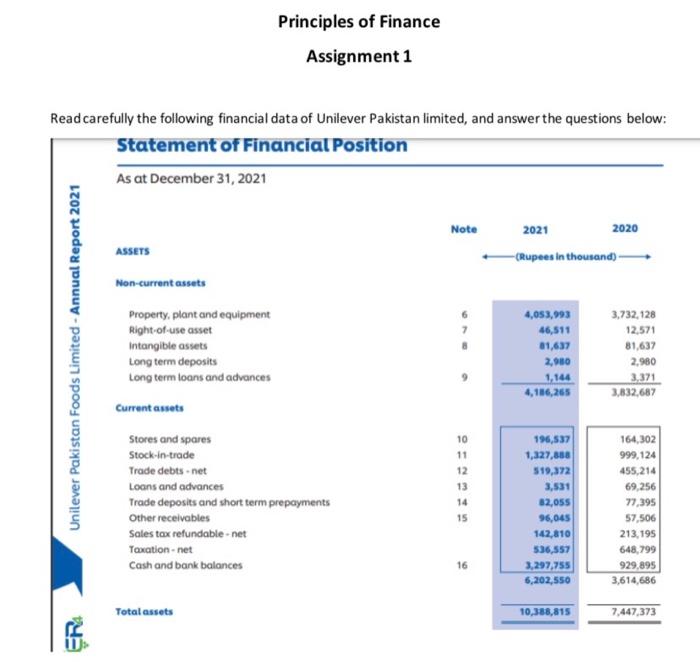

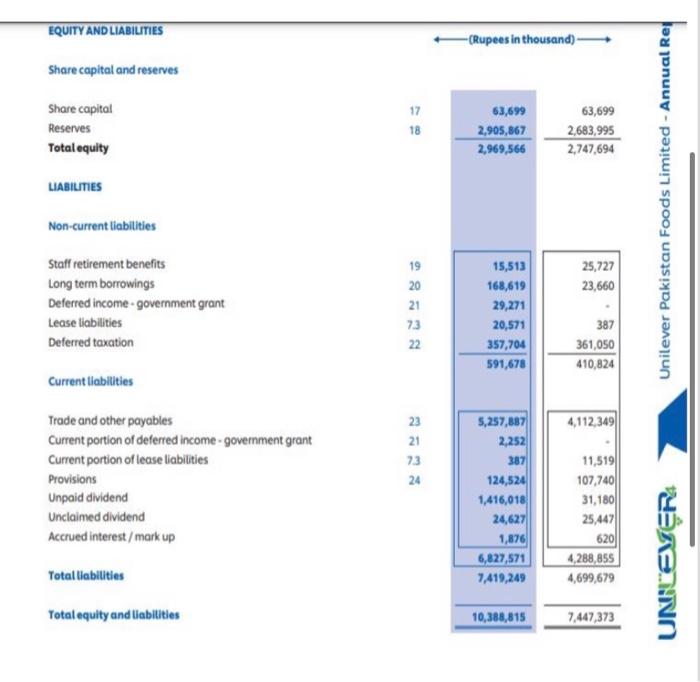

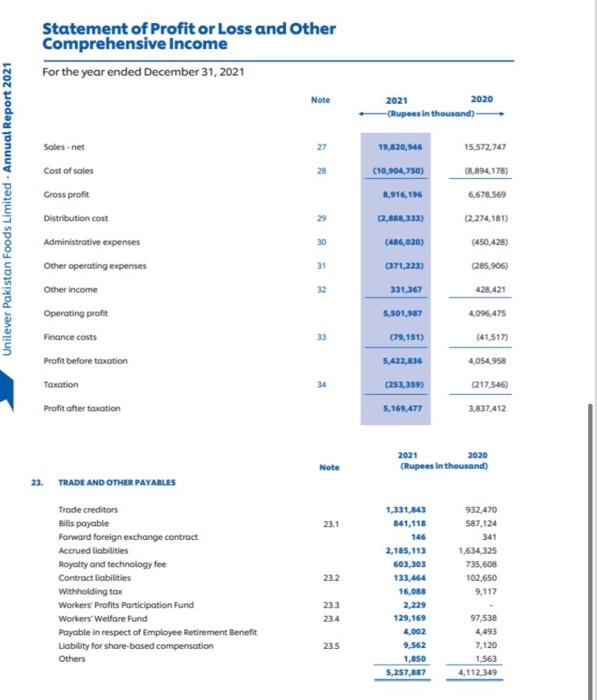

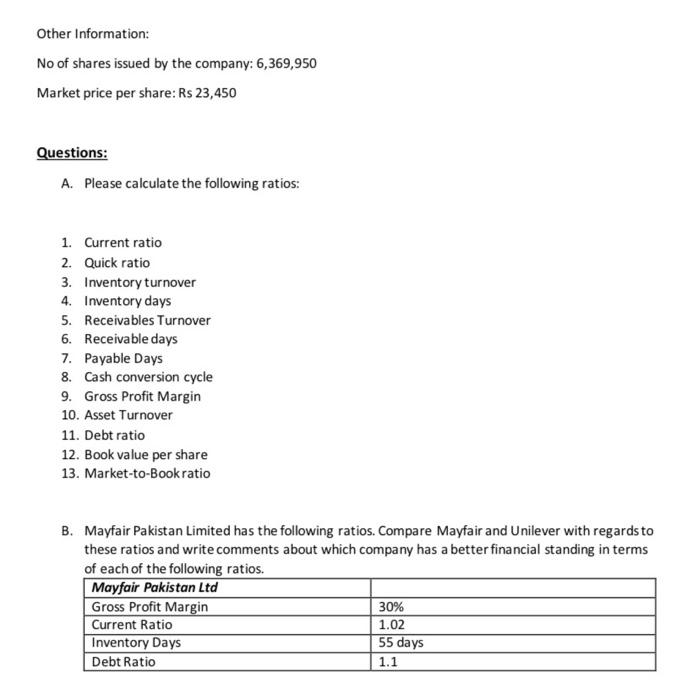

Principles of Finance Assignment 1 Read carefully the following financial data of Unilever Pakistan limited, and answer the questions below: Statement of Financial Position As at December 31, 2021 Note 2021 2020 -Rupees in thousand) ASSETS Non-current assets Unilever Pakistan Foods Limited - Annual Report 2021 Property, plant and equipment Right-of-use asset Intangible assets Long term deposits Long term loans and advances 4,053,993 46,511 11,637 2,980 1,144 4,186,265 3,732,128 12,571 81,637 2,960 3,371 3,832,687 Current assets Stores and spares Stock-in-trade Trade debts.net Loans and advances Trade deposits and short term prepayments Other receivables Sales tax refundable.net Taxation.net Cash and bank balances 10 11 12 13 14 15 196,537 1,327,888 519,372 3,531 82,055 96,045 142,810 536,557 3,297,755 6,202,550 164,302 999,124 455,214 69,256 77.395 57,506 213,195 648,799 929,895 3,614,686 16 Total assets 10,388,815 7,447,373 ER EQUITY AND LIABILITIES -(Rupees in thousand) Share capital and reserves Share capital Reserves Total equity 17 18 63,699 2,905,867 2,969,566 63,699 2,683,995 2,747,694 LIABILITIES Unilever Pakistan Foods Limited - Annual Rej Non-current liabilities 25,727 23,660 Staff retirement benefits Long term borrowings Deferred income-government grant Lease liabilities Deferred taxation 19 20 21 73 22 15,513 168,619 29,271 20,571 357,704 591,678 387 361,050 410,824 Current liabilities 4,112,349 Trade and other payables Current portion of deferred income-government grant Current portion of lease liabilities Provisions Unpaid dividend Unclaimed dividend Accrued interest / mark up 23 21 73 24 5,257,887 2,252 387 124,524 1,416,018 24,627 1,876 6,827,571 7,419,249 11,519 107,740 31,180 25,447 620 4,288,855 4,699,679 UNLEVER: Total liabilities Total equity and liabilitles 10,388,815 7,447,373 Statement of Profit or Loss and Other Comprehensive Income For the year ended December 31, 2021 Note 2021 2020 -Rupees in thousand) 27 28 19,420,346 (10,904,750) 8,916,196 Unilever Pakistan Foods Limited - Annual Report 2021 12.638,333) 30 (486,020) 31 Sales - net Cost of sales Gross profit Distribution cost Administrative expenses Other operating expenses Other income Operating profit Finance costs Profit before taxation Taxation Profit after taxation 15.572,747 (8.294,178) 6,678.569 (2,274,181) (450,428) (285,906) 428,421 4,096,475 (41.517) 4,054.958 (217,546) 3,837 412 (371,223) 331,367 5,501.987 (79,151) 32 33 5,422,836 34 (253,359) 5,169,477 Note 2021 2020 (Rupees in thousand 23 TRADE AND OTHER PAYABLES 23.1 Trade creditors Bills payable Forward foreign exchange contract Accrued liabilities Royalty and technology fee Contract liabilities Withholding tax Workers Profits Participation Fund Workers' Welfare Fund Payable in respect of Employee Retirement Benefit Liability for share-based compensation Others 232 1,331,843 841,118 146 2,185,113 603,303 133,464 16,068 2.229 129,169 4,002 9,562 1,850 5,257,887 932,470 587,124 341 1,634,325 735,608 102,650 9,117 233 234 23.5 97,538 4,493 7,120 1,563 4,112,349 Other Information: No of shares issued by the company: 6,369,950 Market price per share: Rs 23,450 Questions: A. Please calculate the following ratios: 1. Current ratio 2. Quick ratio 3. Inventory turnover 4. Inventory days 5. Receivables Turnover 6. Receivable days 7. Payable Days 8. Cash conversion cycle 9. Gross Profit Margin 10. Asset Turnover 11. Debt ratio 12. Book value per share 13. Market-to-Book ratio B. Mayfair Pakistan Limited has the following ratios. Compare Mayfair and Unilever with regards to these ratios and write comments about which company has a better financial standing in terms of each of the following ratios. Mayfair Pakistan Ltd Gross Profit Margin 30% Current Ratio 1.02 Inventory Days 55 days 1.1 Debt Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts