Question: Whispering Inc. had 5 0 2 , 0 0 0 common shares outstanding for the entire fiscal year ended August 3 1 , 2 0

Whispering Inc. had common shares outstanding for the entire fiscal year ended August Whispering also had

$ cumulative, nopar value preferred shares outstanding for the full year. Options were written at the start of the fiscal year

to purchase common shares at $ per share. The average market price of Whispering's common shares during the year ended

August was $ per share. The options expire in and none were actually exercised during the current year. Also

outstanding for the entire year was a bond with a face value of $ convertible to common shares. Whispering

Inc.s net income for the year was $ and the income tax rate for the fiscal year was

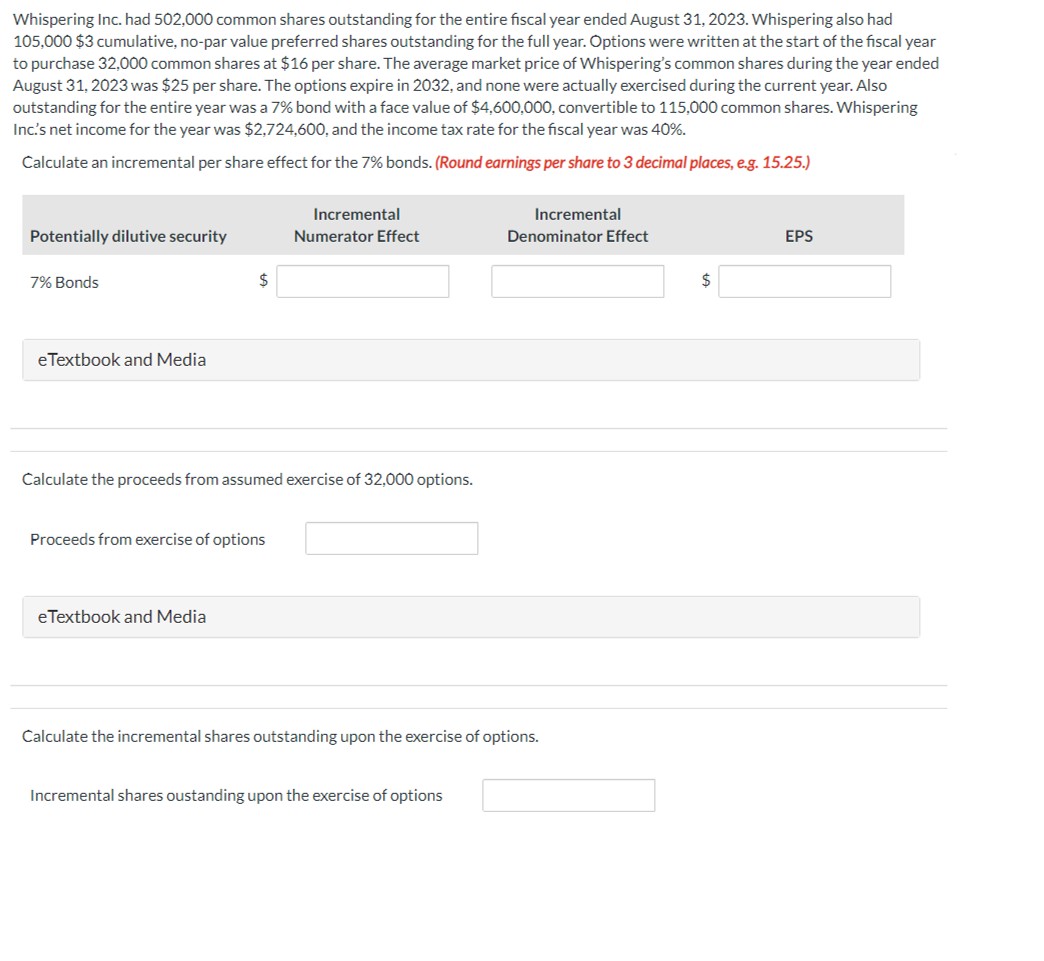

Calculate an incremental per share effect for the bonds. Round earnings per share to decimal places, eg

Potentially dilutive security

Bonds

Incremental

Numerator Effect

Numerator Effect

$

eTextbook and Media

Calculate the proceeds from assumed exercise of options.

Proceeds from exercise of options

eTextbook and Media

Calculate the incremental shares outstanding upon the exercise of options.

Incremental shares oustanding upon the exercise of options

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock