Question: Who does this exercise, can you please show the step by step to learn how to do it? Thanks so much!! Problem 10-08 A firm

Who does this exercise, can you please show the step by step to learn how to do it? Thanks so much!!

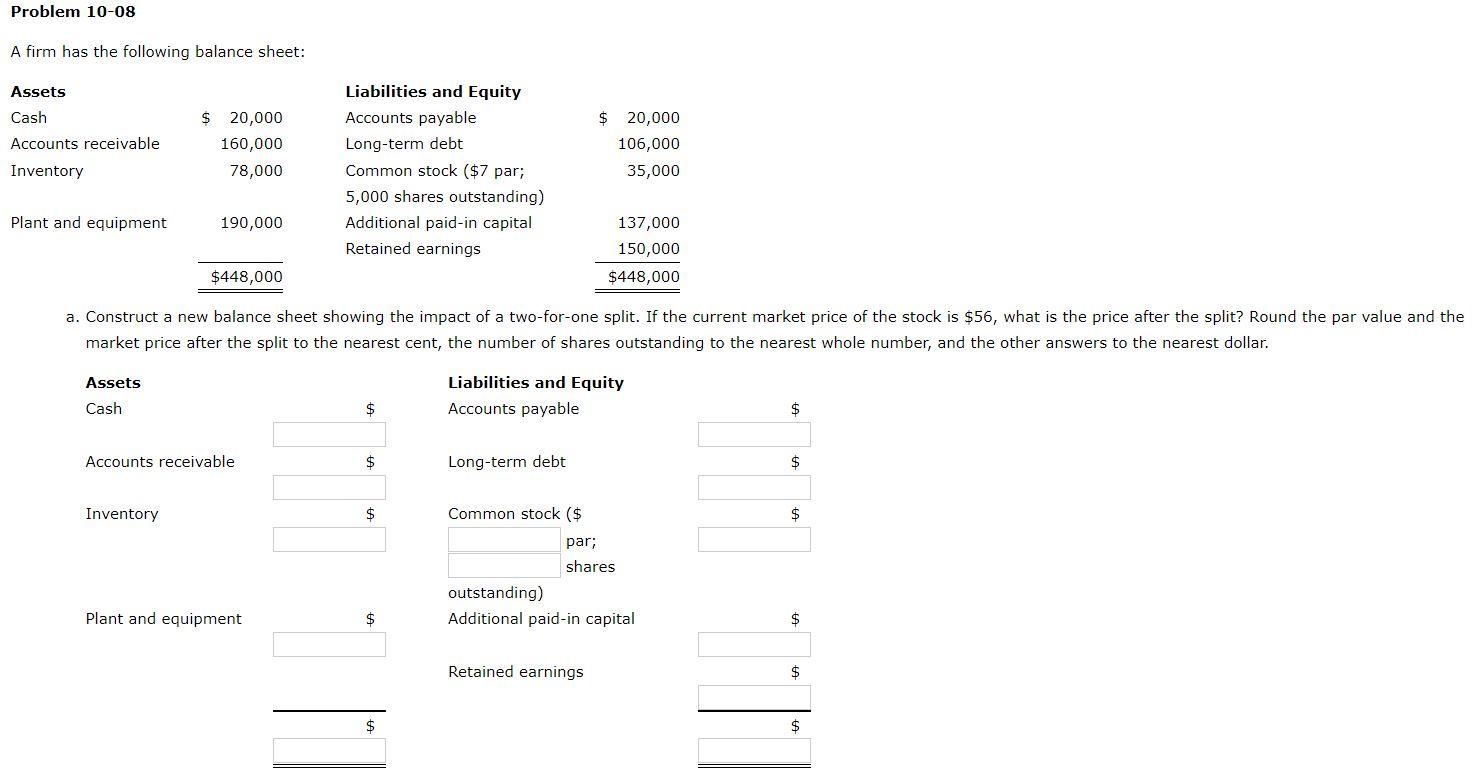

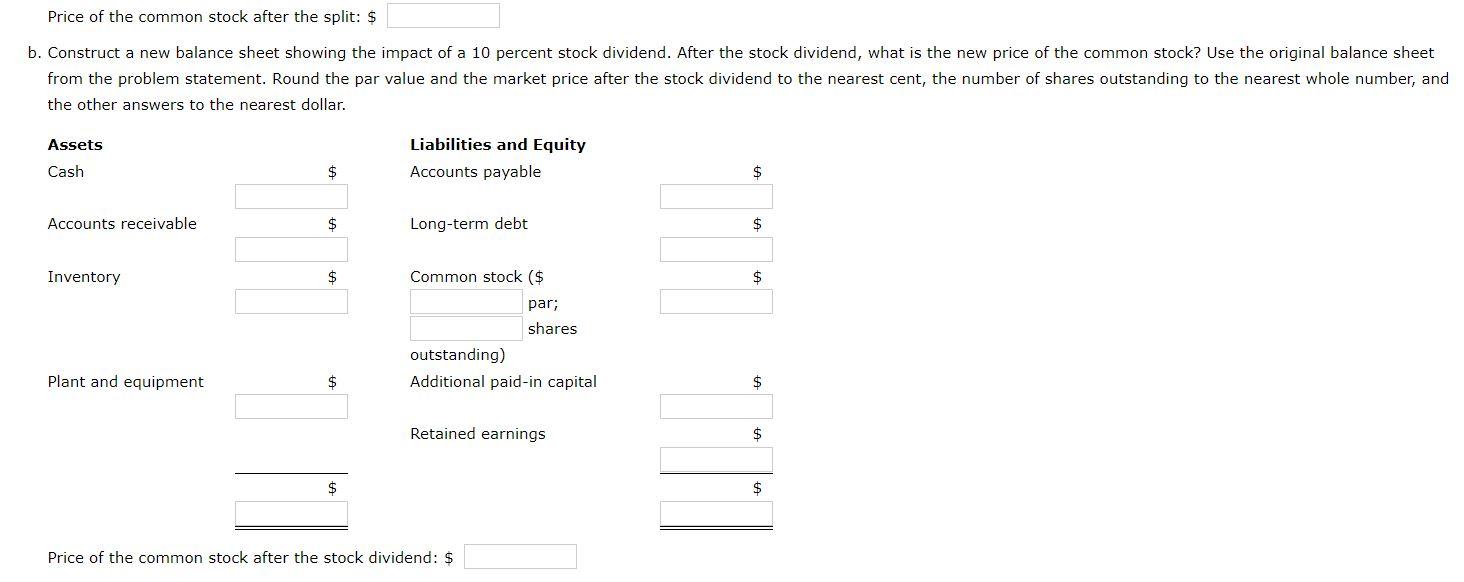

Problem 10-08 A firm has the following balance sheet: Assets Cash Accounts receivable $ 20,000 160,000 78,000 Liabilities and Equity Accounts payable Long-term debt Common stock ($7 par; 5,000 shares outstanding) Additional paid-in capital Retained earnings $ 20,000 106,000 35,000 Inventory Plant and equipment 190,000 137,000 150,000 $448,000 $448,000 a. Construct a new balance sheet showing the impact of a two-for-one split. If the current market price of the stock is $56, what is the price after the split? Round the par value and the market price after the split to the nearest cent, the number of shares outstanding to the nearest whole number, and the other answers to the nearest dollar. Assets Cash Liabilities and Equity Accounts payable $ $ Accounts receivable Long-term debt Inventory $ Common stock ($ $ par; shares outstanding) Additional paid-in capital Plant and equipment $ $ Retained earnings $ $ $ Price of the common stock after the split: $ b. Construct a new balance sheet showing the impact of a 10 percent stock dividend. After the stock dividend, what is the new price of the common stock? Use the original balance sheet from the problem statement. Round the par value and the market price after the stock dividend to the nearest cent, the number of shares outstanding to the nearest whole number, and the other answers to the nearest dollar. Assets Liabilities and Equity Accounts payable Cash $ $ Accounts receivable $ Long-term debt Inventory $ Common stock ($ par; shares outstanding) Additional paid-in capital LLLLLL Plant and equipment $ Retained earnings $ Price of the common stock after the stock dividend: $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts