Question: Why answer A? Please show works on how to get the answer. 3) We want to minimize the variance of the portfolio from Q 2),

Why answer A? Please show works on how to get the answer.

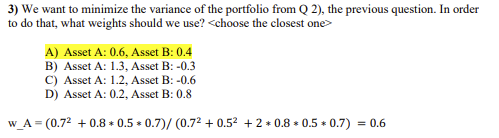

3) We want to minimize the variance of the portfolio from Q 2), the previous question. In order to do that, what weights should we use? A) Asset A: 0.6, Asset B: 0.4 B) Asset A: 1.3, Asset B: -0.3 C) Asset A: 1.2, Asset B: -0.6 D) Asset A: 0.2, Asset B: 0.8 \[ \text { w_A } A=\left(0.7^{2}+0.8 * 0.5 * 0.7 ight) /\left(0.7^{2}+0.5^{2}+2 * 0.8 * 0.5 * 0.7 ight)=0.6 \] 3) We want to minimize the variance of the portfolio from Q 2), the previous question. In order to do that, what weights should we use? A) Asset A: 0.6, Asset B: 0.4 B) Asset A: 1.3, Asset B: -0.3 C) Asset A: 1.2, Asset B: -0.6 D) Asset A: 0.2, Asset B: 0.8 \[ \text { w_A } A=\left(0.7^{2}+0.8 * 0.5 * 0.7 ight) /\left(0.7^{2}+0.5^{2}+2 * 0.8 * 0.5 * 0.7 ight)=0.6 \]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts