Question: why are there two different processes to find New pretax income. In question 1 you just add $560 + $25 but in question 2 you

why are there two different processes to find New pretax income. In question 1 you just add $560 + $25 but in question 2 you add

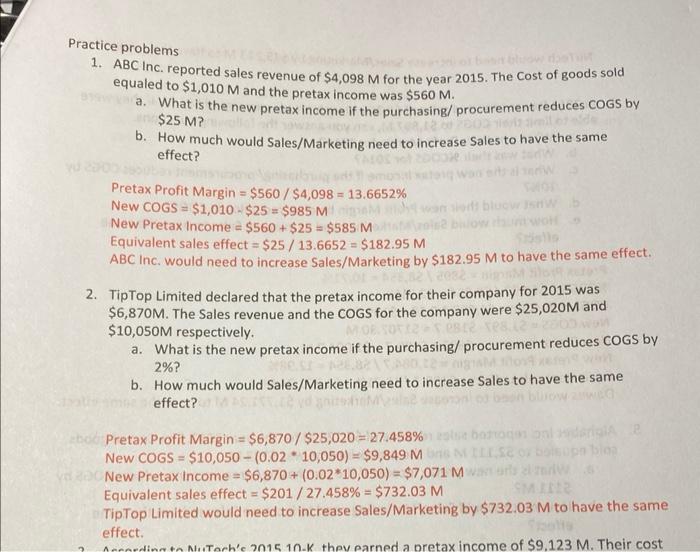

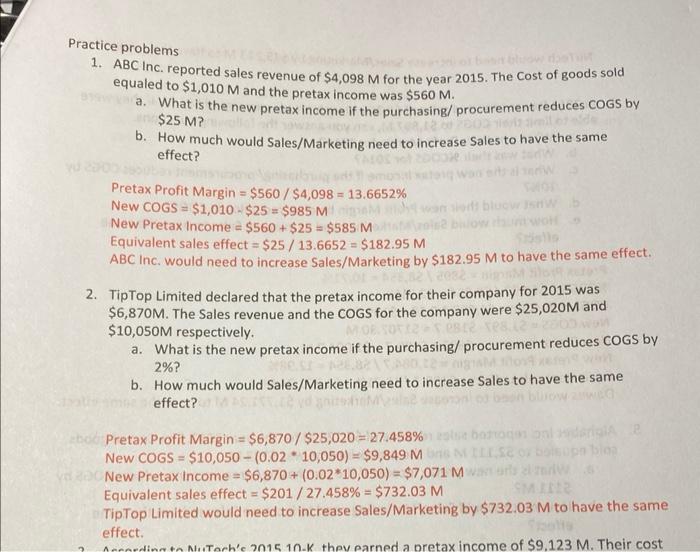

New COGS =$1,010$25=$985M New Pretax Income =$560+$25=$585M Equivalent sales effect =$25/13.6652=$182.95M ABC Inc. would need to increase Sales/Marketing by $182.95M to have the same effect. 2. TipTop Limited declared that the pretax income for their company for 2015 was $6,870M. The Sales revenue and the COGS for the company were $25,020M and $10,050M respectively. a. What is the new pretax income if the purchasing/ procurement reduces COGS by 2% ? b. How much would Sales/Marketing need to increase Sales to have the same effect? Pretax Profit Margin =$6,870/$25,020=27.458% New COGS =$10,050(0.0210,050)=$9,849M New Pretax Income =$6,870+(0.0210,050)=$7,071M

$6,870+ (0.02 * $10,050). I don't understand why that is. Please explain with steps

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock