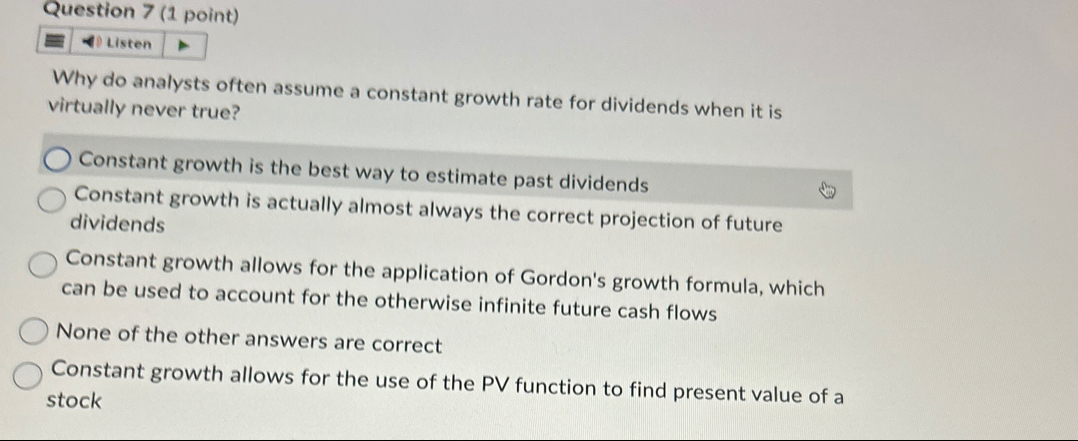

Question: Why do analysts often assume a constant growth rate for dividends when it is virtually never true?Constant growth is the best way to estimate past

Why do analysts often assume a constant growth rate for dividends when it is virtually never true?Constant growth is the best way to estimate past dividendsConstant growth is actually almost always the correct projection of future dividendsConstant growth allows for the application of Gordon's growth formula, which can be used to account for the otherwise infinite future cash flowsNone of the other answers are correctConstant growth allows for the use of the PV function to find present value of a stock

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock