Question: Why do bonds with lower seniority have higher yields than equivalent bonds with higher seniority? (Select all of the choices that apply.) A. Debentures and

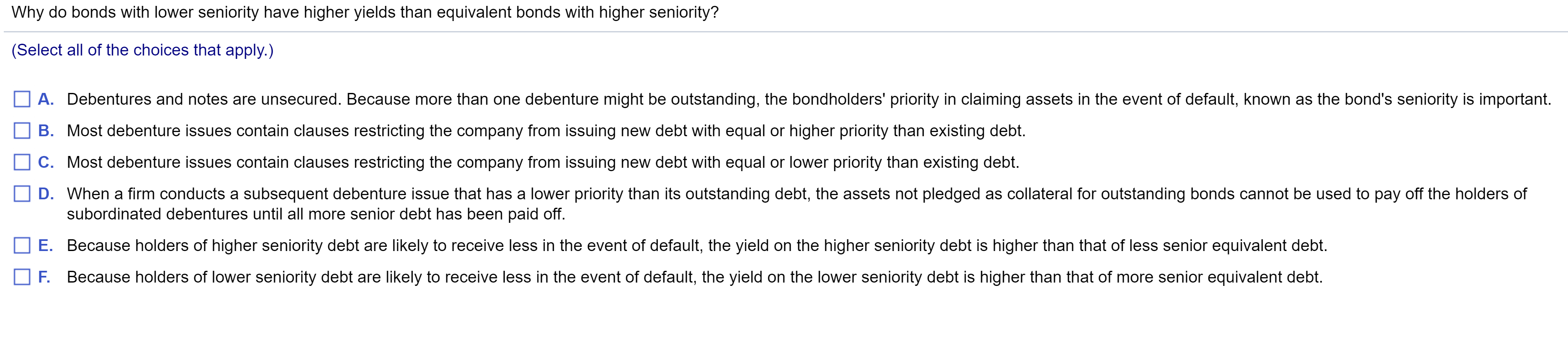

Why do bonds with lower seniority have higher yields than equivalent bonds with higher seniority? (Select all of the choices that apply.) A. Debentures and notes are unsecured. Because more than one debenture might be outstanding, the bondholders' priority in claiming assets in the event of default, known as the bond's seniority is important. B. Most debenture issues contain clauses restricting the company from issuing new debt with equal or higher priority than existing debt. C. Most debenture issues contain clauses restricting the company from issuing new debt with equal or lower priority than existing debt. D. When a firm conducts a subsequent debenture issue that has a lower priority than its outstanding debt, the assets not pledged as collateral for outstanding bonds cannot be used to pay off the holders of subordinated debentures until all more senior debt has been paid off. E. Because holders of higher seniority debt are likely to receive less in the event of default, the yield on the higher seniority debt is higher than that of less senior equivalent debt. F. Because holders of lower seniority debt are likely to receive less in the event of default, the yield on the lower seniority debt is higher than that of more senior equivalent debt. Why do bonds with lower seniority have higher yields than equivalent bonds with higher seniority? (Select all of the choices that apply.) A. Debentures and notes are unsecured. Because more than one debenture might be outstanding, the bondholders' priority in claiming assets in the event of default, known as the bond's seniority is important. B. Most debenture issues contain clauses restricting the company from issuing new debt with equal or higher priority than existing debt. C. Most debenture issues contain clauses restricting the company from issuing new debt with equal or lower priority than existing debt. D. When a firm conducts a subsequent debenture issue that has a lower priority than its outstanding debt, the assets not pledged as collateral for outstanding bonds cannot be used to pay off the holders of subordinated debentures until all more senior debt has been paid off. E. Because holders of higher seniority debt are likely to receive less in the event of default, the yield on the higher seniority debt is higher than that of less senior equivalent debt. F. Because holders of lower seniority debt are likely to receive less in the event of default, the yield on the lower seniority debt is higher than that of more senior equivalent debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts