Question: Why do generally accepted accounting principles require the application of the revenue recognition principle? Failure to apply the revenue recognition principle could lead to a

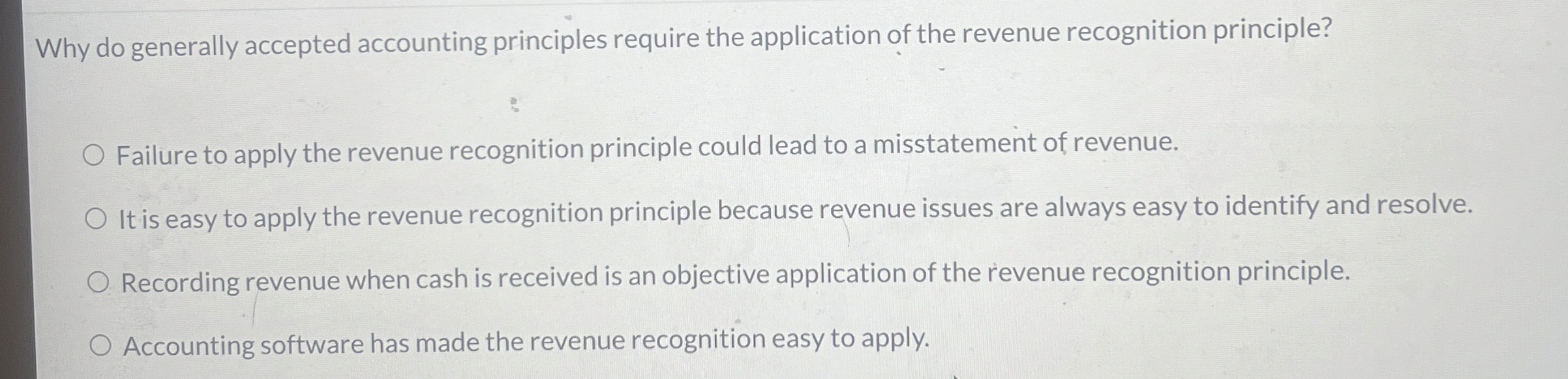

Why do generally accepted accounting principles require the application of the revenue recognition principle?

Failure to apply the revenue recognition principle could lead to a misstatement of revene.

It is easy to apply the revenue recognition principle because revenue issues are always easy to identify and resolve.

Recording revenue when cash is received is an objective application of the revenue recognition principle.

Accounting software has made the revenue recognition easy to apply.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock