Question: Why do individuals commit fraud? If the instructor (CEO) has a supervisor at his company. Then a situation recently happened that the supervisor has had

Why do individuals commit fraud? If the instructor (CEO) has a supervisor at his company. Then a situation recently happened that the supervisor has had 2 individuals over the last year commit fraud in the supervisor department and they have been charged criminally and fired from the company. Which the supervisor is in the department of a computer software company (Credit Right Software Corp) that produces and sells the leading accounting software product in the US marketplace. What should the supervisor write down to better understand of how fraud happens and what causes individuals to commit fraud and how it happens. What should the supervisor prevent additional fraud from happening in the department. WRITE DOWN IN A MEMO DOCUMENT make sure to list and discuss the elements of the fraud triangle and whether focusing on any of those elements can aid our efforts in limiting fraud from occurring.

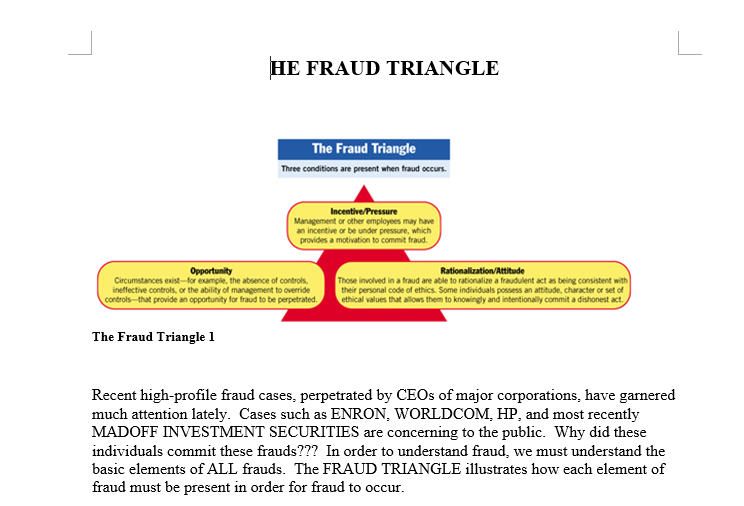

THE IMAGES BELOW show an example of the fraud triangle.... Please answer as soon as possible if need additional information please ask.

Thank you..

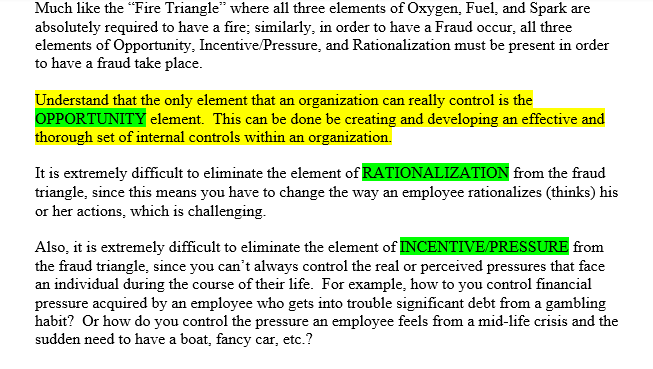

HE FRAUD TRIANGLE The Fraud Triangle 1 Recent high-profile fraud cases, perpetrated by CEOs of major corporations, have garnered much attention lately. Cases such as ENRON, WORLDCOM, HP, and most recently MADOFF INVESTMENT SECURITIES are concerning to the public. Why did these individuals commit these frauds??? In order to understand fraud, we must understand the basic elements of ALL frauds. The FRAUD TRIANGLE illustrates how each element of fraud must be present in order for fraud to occur. Much like the "Fire Triangle" where all three elements of Oxygen, Fuel, and Spark are absolutely required to have a fire; similarly, in order to have a Fraud occur, all three elements of Opportunity, Incentive/Pressure, and Rationalization must be present in order to have a fraud take place. Understand that the only element that an organization can really control is the OPPORTUNITY element. This can be done be creating and developing an effective and thorough set of internal controls within an organization. It is extremely difficult to eliminate the element of RATIONALIZATION from the fraud triangle, since this means you have to change the way an employee rationalizes (thinks) his or her actions, which is challenging. Also, it is extremely difficult to eliminate the element of INCENTIVE/PRESSURE from the fraud triangle, since you can't always control the real or perceived pressures that face an individual during the course of their life. For example, how to you control financial pressure acquired by an employee who gets into trouble significant debt from a gambling habit? Or how do you control the pressure an employee feels from a mid-life crisis and the sudden need to have a boat, fancy car, etc.? HE FRAUD TRIANGLE The Fraud Triangle 1 Recent high-profile fraud cases, perpetrated by CEOs of major corporations, have garnered much attention lately. Cases such as ENRON, WORLDCOM, HP, and most recently MADOFF INVESTMENT SECURITIES are concerning to the public. Why did these individuals commit these frauds??? In order to understand fraud, we must understand the basic elements of ALL frauds. The FRAUD TRIANGLE illustrates how each element of fraud must be present in order for fraud to occur. Much like the "Fire Triangle" where all three elements of Oxygen, Fuel, and Spark are absolutely required to have a fire; similarly, in order to have a Fraud occur, all three elements of Opportunity, Incentive/Pressure, and Rationalization must be present in order to have a fraud take place. Understand that the only element that an organization can really control is the OPPORTUNITY element. This can be done be creating and developing an effective and thorough set of internal controls within an organization. It is extremely difficult to eliminate the element of RATIONALIZATION from the fraud triangle, since this means you have to change the way an employee rationalizes (thinks) his or her actions, which is challenging. Also, it is extremely difficult to eliminate the element of INCENTIVE/PRESSURE from the fraud triangle, since you can't always control the real or perceived pressures that face an individual during the course of their life. For example, how to you control financial pressure acquired by an employee who gets into trouble significant debt from a gambling habit? Or how do you control the pressure an employee feels from a mid-life crisis and the sudden need to have a boat, fancy car, etc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts