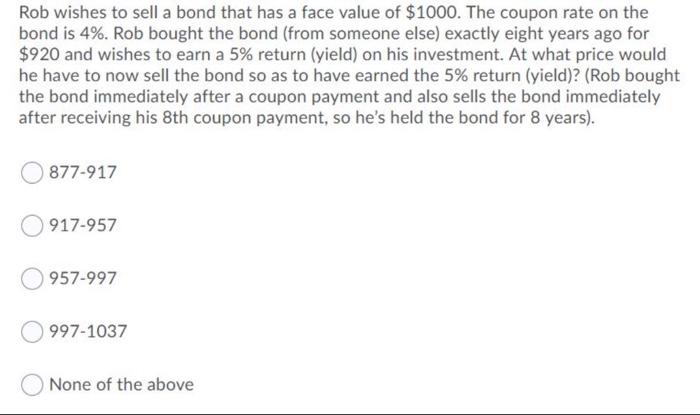

Question: Why do tou have to set this equal to 920? Wouldn't that mean he's receiving the same amount and no return? Rob wishes to sell

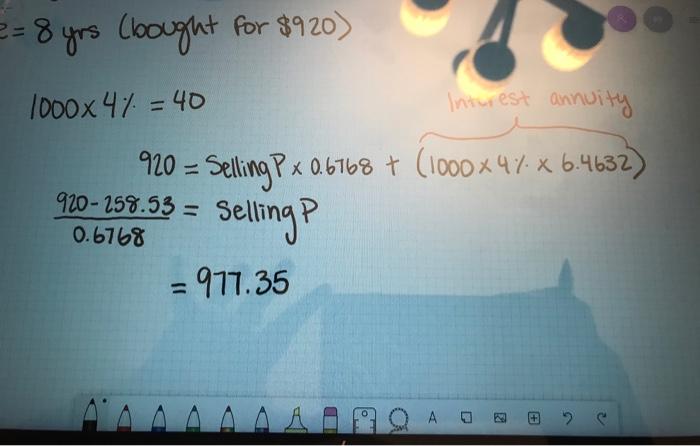

Rob wishes to sell a bond that has a face value of $1000. The coupon rate on the bond is 4%. Rob bought the bond (from someone else) exactly eight years ago for $920 and wishes to earn a 5% return (yield) on his investment. At what price would he have to now sell the bond so as to have earned the 5% return (yield)? (Rob bought the bond immediately after a coupon payment and also sells the bond immediately after receiving his 8th coupon payment, so he's held the bond for 8 years). 877-917 917-957 957-997 997-1037 None of the above 2 = 8 yrs (bought for $920) 1000x4% = 40 Intwrest annuity 920 = Selling P x 0.6168 + (1000x 47 x 6.4632) Selling P = 977.35 920-258.53 = Se 0.6768 A R

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts