Question: Why do we do a Discounted Cash Flow (DCF) Analysis? What are we trying to calculate? We are trying to calculate what the firm is

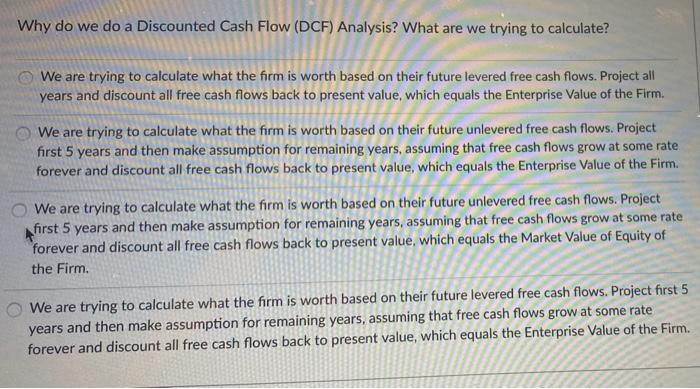

Why do we do a Discounted Cash Flow (DCF) Analysis? What are we trying to calculate? We are trying to calculate what the firm is worth based on their future levered free cash flows. Project all years and discount all free cash flows back to present value, which equals the Enterprise Value of the Firm. We are trying to calculate what the firm is worth based on their future unlevered free cash flows. Project first 5 years and then make assumption for remaining years, assuming that free cash flows grow at some rate forever and discount all free cash flows back to present value, which equals the Enterprise Value of the Firm We are trying to calculate what the firm is worth based on their future unlevered free cash flows. Project first 5 years and then make assumption for remaining years, assuming that free cash flows grow at some rate forever and discount all free cash flows back to present value, which equals the Market Value of Equity of the Firm. We are trying to calculate what the firm is worth based on their future levered free cash flows. Project first 5 years and then make assumption for remaining years, assuming that free cash flows grow at some rate forever and discount all free cash flows back to present value, which equals the Enterprise Value of the Firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts