Question: Why do we have to divide it by 2 (the red circle)? Please explain. Q4.8 What price should you pay for a $500,000 Treasury bond

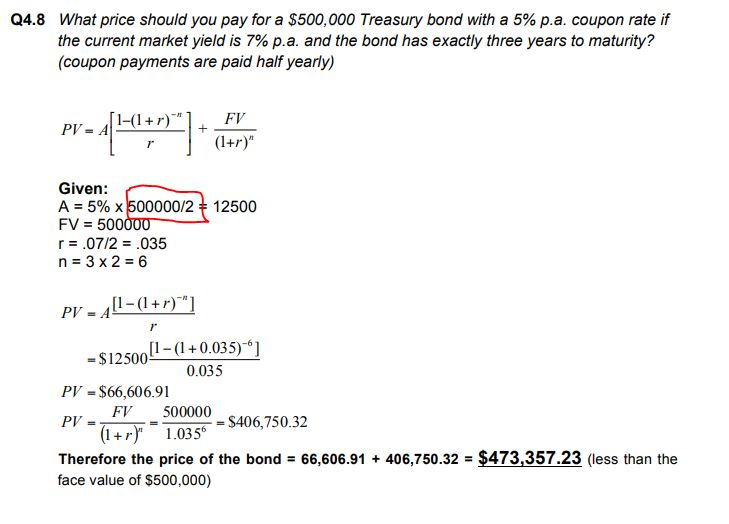

Why do we have to divide it by 2 (the red circle)? Please explain.

Q4.8 What price should you pay for a $500,000 Treasury bond with a 5% p.a. coupon rate if the current market yield is 7% p.a. and the bond has exactly three years to maturity? (coupon payments are paid half yearly) [1-(1+r) FV PV A (1+r)" Given: A 5% x 500000/2 FV 500000 r .07/2 .035 n 3 x 2 6 12500 PV A-(+r)" -$12500-(1+0.035)- 0.035 PV $66,606.91 FV 500000 PV (1r 1.035- $406,750.32 Therefore the price of the bond 66,606.91 406,750.32 $473,357.23 (less than the + face value of $500,000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts