Question: why do we use the capital dividends to offset contribution instead of using the capital loss and offset it by capital dividends? A taxpayer reported

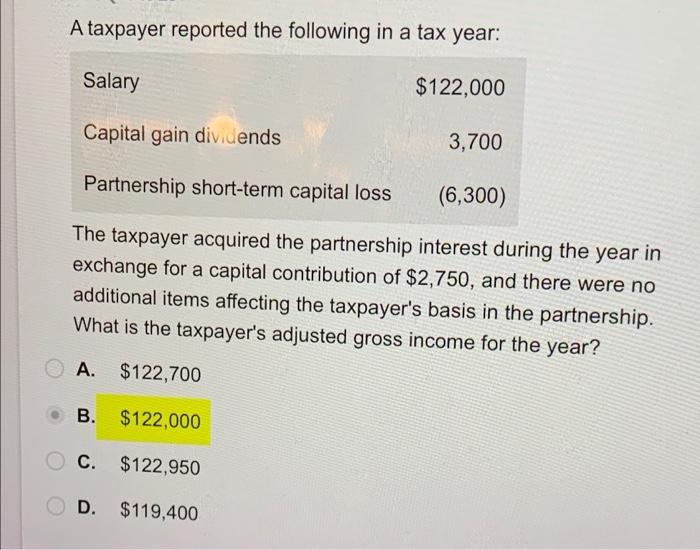

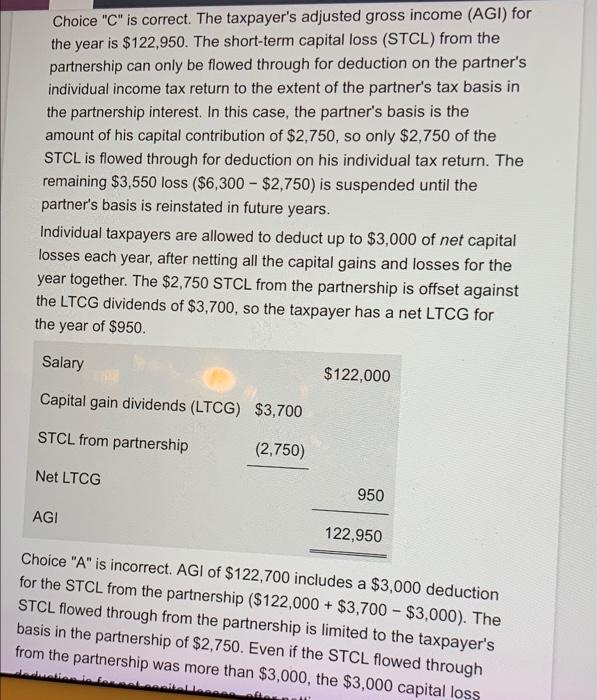

A taxpayer reported the following in a tax year: Salary $122,000 Capital gain dividends 3,700 Partnership short-term capital loss (6,300) The taxpayer acquired the partnership interest during the year in exchange for a capital contribution of $2,750, and there were no additional items affecting the taxpayer's basis in the partnership. What is the taxpayer's adjusted gross income for the year? A. $122,700 B. $122,000 C. $122,950 D. $119,400 Choice "C" is correct. The taxpayer's adjusted gross income (AGI) for the year is $122,950. The short-term capital loss (STCL) from the partnership can only be flowed through for deduction on the partner's individual income tax return to the extent of the partner's tax basis in the partnership interest. In this case, the partner's basis is the amount of his capital contribution of $2,750, so only $2,750 of the STCL is flowed through for deduction on his individual tax return. The remaining $3,550 loss ($6,300 - $2,750) is suspended until the partner's basis is reinstated in future years. Individual taxpayers are allowed to deduct up to $3,000 of net capital losses each year, after netting all the capital gains and losses for the year together. The $2,750 STCL from the partnership is offset against the LTCG dividends of $3,700, so the taxpayer has a net LTCG for the year of $950. Salary $122,000 Capital gain dividends (LTCG) $3,700 STCL from partnership (2,750) Net LTCG 950 AGI 122,950 Choice "A" is incorrect. AGI of $122,700 includes a $3,000 deduction for the STCL from the partnership ($122,000+ $3,700 - $3,000). The STCL flowed through from the partnership is limited to the taxpayer's basis in the partnership of $2,750. Even if the STCL flowed through from the partnership was more than $3,000, the $3,000 capital loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts