Question: Why does the sales value at splitoff method use the sales value of the total production in the accounting period and not just the revenues

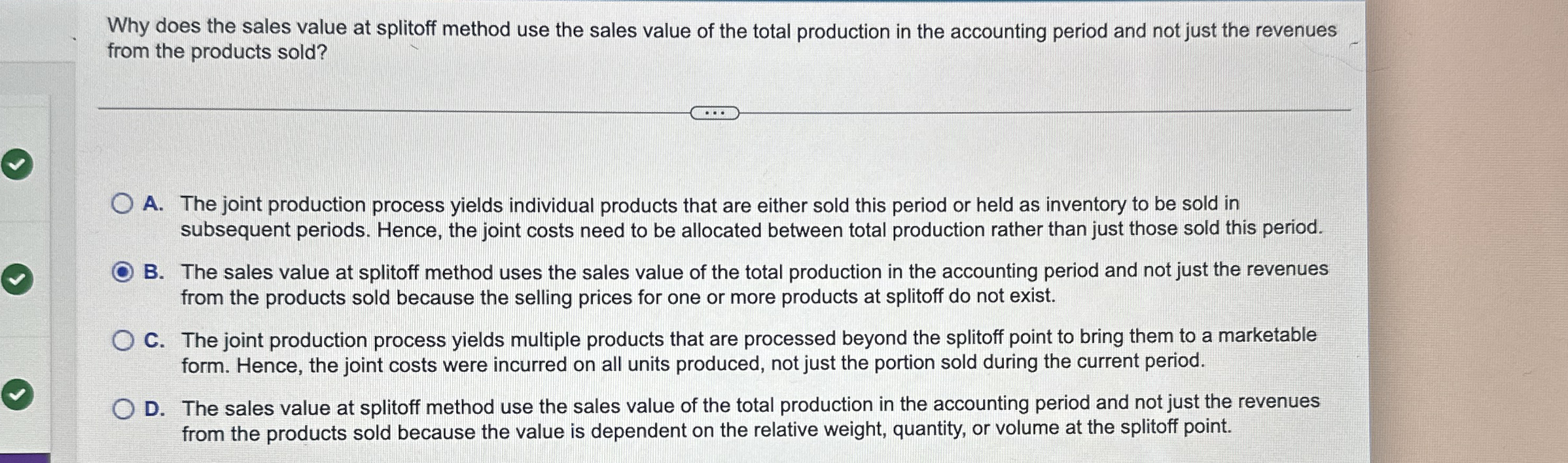

Why does the sales value at splitoff method use the sales value of the total production in the accounting period and not just the revenues from the products sold?

A The joint production process yields individual products that are either sold this period or held as inventory to be sold in subsequent periods. Hence, the joint costs need to be allocated between total production rather than just those sold this period.

B The sales value at splitoff method uses the sales value of the total production in the accounting period and not just the revenues from the products sold because the selling prices for one or more products at splitoff do not exist.

C The joint production process yields multiple products that are processed beyond the splitoff point to bring them to a marketable form. Hence, the joint costs were incurred on all units produced, not just the portion sold during the current period.

D The sales value at splitoff method use the sales value of the total production in the accounting period and not just the revenues from the products sold because the value is dependent on the relative weight, quantity, or volume at the splitoff point.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock