Question: Why has a profitable company like Clarkson had to borrow so much? Clarkson Lumber Case -- https://www.coursehero.com/file/34813703/Clarkson-Lumber-case-study-IA-answer-2018400621docx/ Clarkson Lumber Company Income Statements Net Sales Cost

Why has a profitable company like Clarkson had to borrow so much?

Clarkson Lumber Case --

https://www.coursehero.com/file/34813703/Clarkson-Lumber-case-study-IA-answer-2018400621docx/

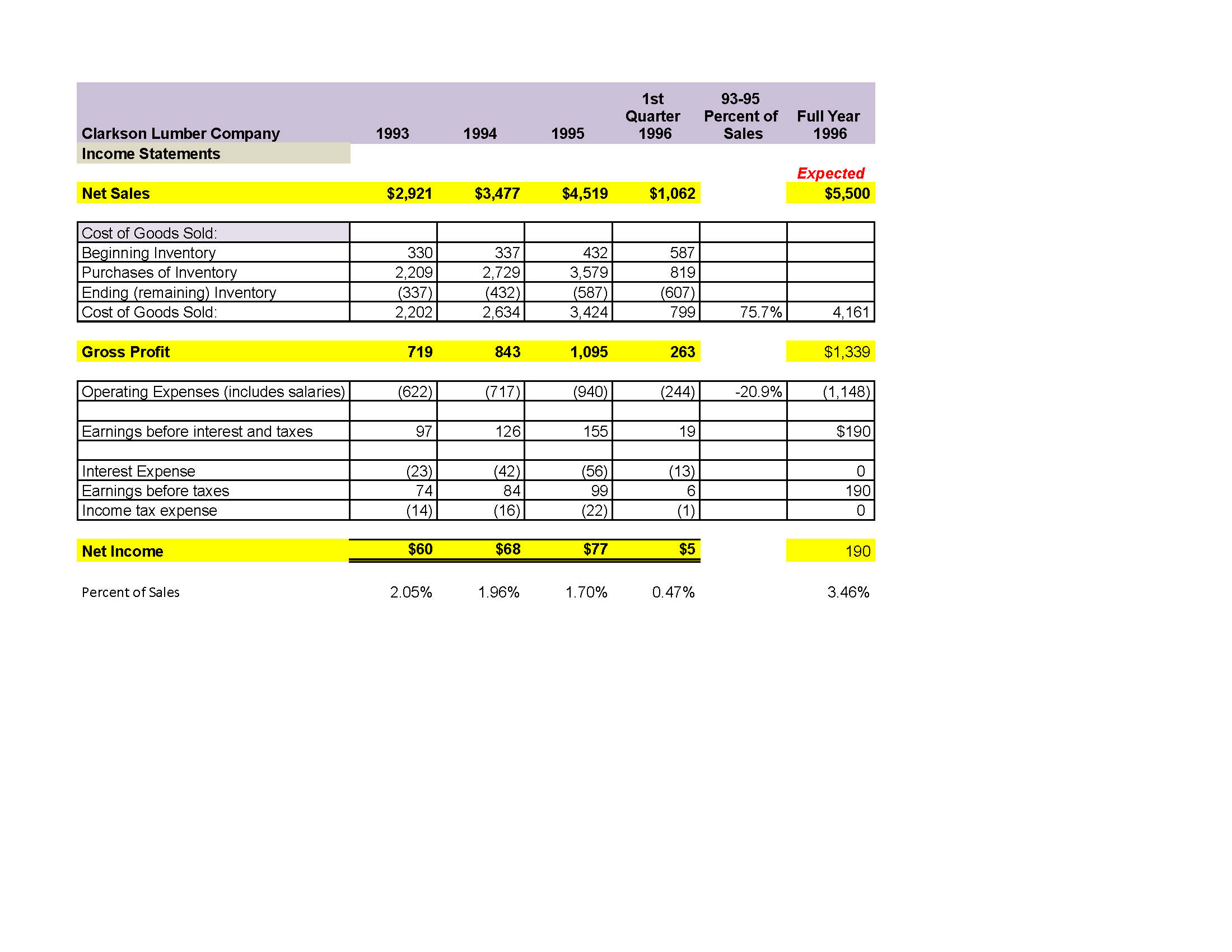

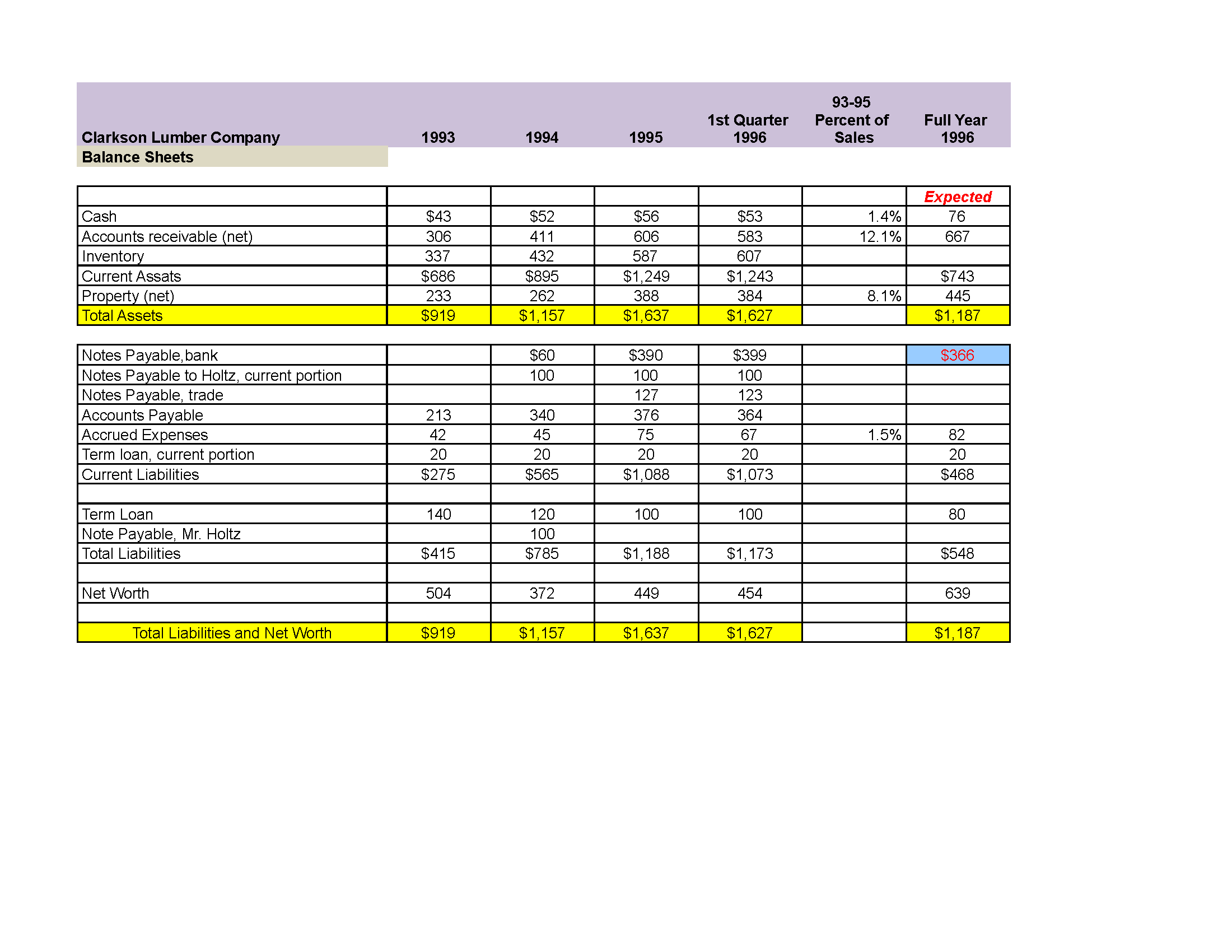

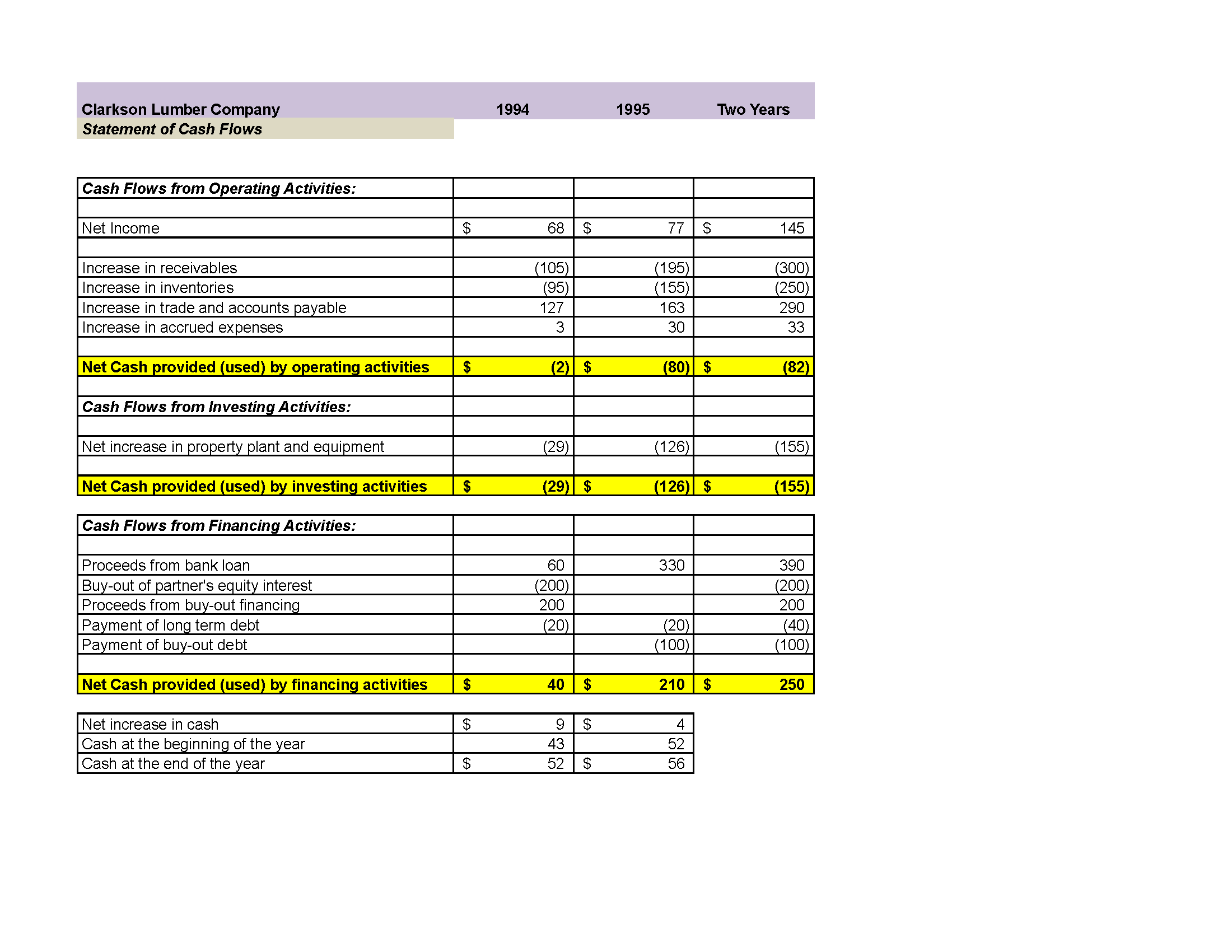

Clarkson Lumber Company Income Statements Net Sales Cost of Goods Sold: Beginning Inventory Purchases of Inventory Ending (remaining) Inventory Cost of Goods Sold: Gross Profit Operating Expenses (includes salaries) Earnings before interest and taxes Interest Expense Earnings before taxes Income tax expense Net Income Percent of Sales 1993 $2,921 330 2,209 (337) 2,202 719 (622) 97 (23) 74 (14) $60 2.05% 1994 $3,477 337 2,729 (432) 2,634 843 (717) 126 (42) 84 (16) $68 1.96% 1995 $4,519 432 3,579 (587) 3,424 1,095 (940) 155 (56) 99 (22) $77 1.70% 1st Quarter 1996 $1,062 587 819 (607) 799 263 (244) 19 (13) 6 (1) $5 0.47% 93-95 Percent of Sales 75.7% -20.9% Full Year 1996 Expected $5,500 4,161 $1,339 (1,148) $190 0 190 0 190 3.46%

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

In the Clarkson Lumber case the companys need for borrowing despite being profitable could be attrib... View full answer

Get step-by-step solutions from verified subject matter experts