Question: Why is 4 the right answer? I chose Project 4 but I cant remember the exact reasoning behind this to explain it to someone else.

Why is 4 the right answer? I chose Project 4 but I cant remember the exact reasoning behind this to explain it to someone else.

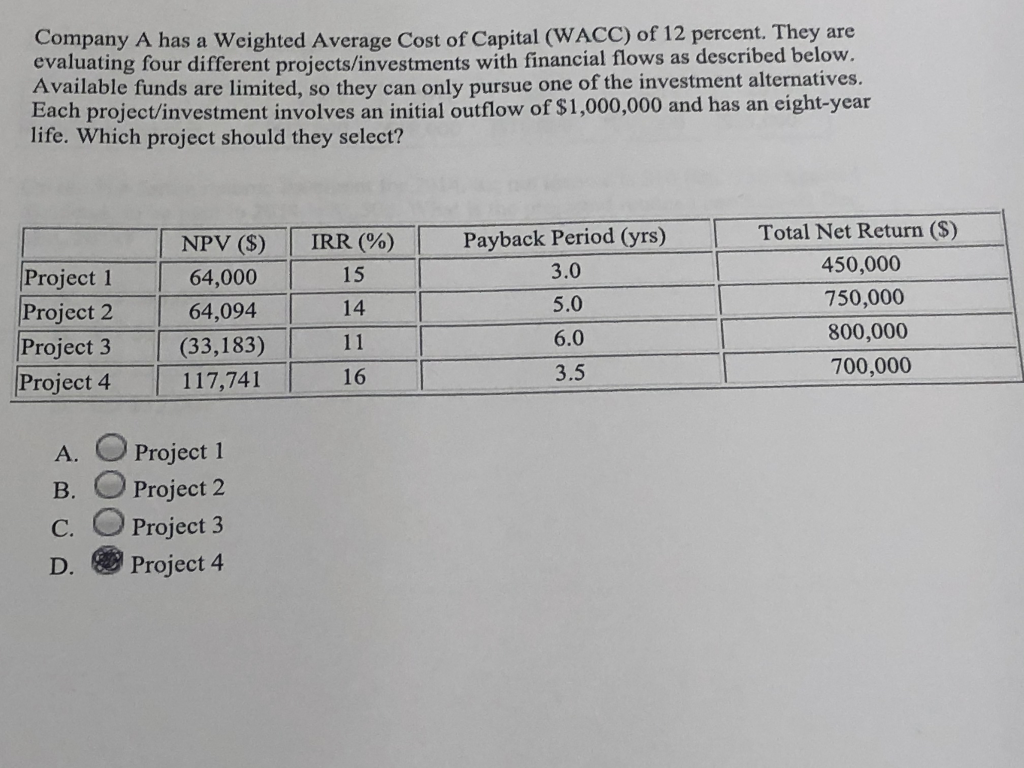

Company A has a Weighted Average Cost of Capital (WACC) of 12 percent. They are evaluating four different projects/investments with financial flows as described below. Available funds are limited, so they can only pursue one of the investment alternatives. Each project/investment involves an initial outflow of $1,000,000 and has an eight-year life. Which project should they select? NPV ($) 64,000 64,094 (33,183) 117,741 Project 1 Project 2 Project 3 Project 4 I IRR (%) 15 14 11 16 Payback Period (yrs) 3.0 5.0 6.0 3.5 Total Net Return ($) 450,000 750,000 800,000 700,000 T A. O Project 1 B. O Project 2 c. O Project 3 D. Project 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts