Question: Why is a dividends - received deduction disallowed if the stock on which the corporation pays the dividend is debt - financed? A . The

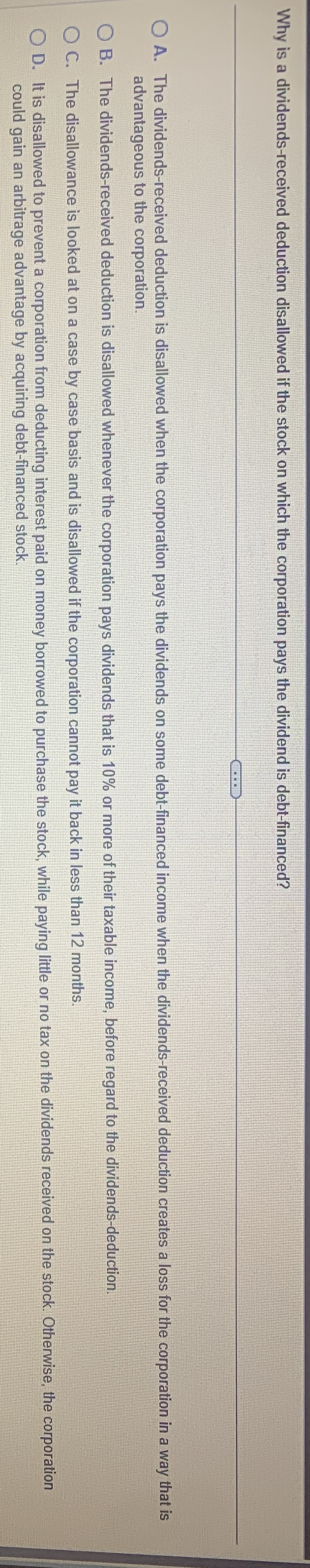

Why is a dividendsreceived deduction disallowed if the stock on which the corporation pays the dividend is debtfinanced?

A The dividendsreceived deduction is disallowed when the corporation pays the dividends on some debtfinanced income when the dividendsreceived deduction creates a loss for the corporation in a way that is advantageous to the corporation.

B The dividendsreceived deduction is disallowed whenever the corporation pays dividends that is or more of their taxable income, before regard to the dividendsdeduction.

C The disallowance is looked at on a case by case basis and is disallowed if the corporation cannot pay it back in less than months.

D It is disallowed to prevent a corporation from deducting interest paid on money borrowed to purchase the stock, while paying little or no tax on the dividends received on the stock. Otherwise, the corporation could gain an arbitrage advantage by acquiring debtfinanced stock.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock