Question: why is for the calculation of NPV various methods are used? like sometimes it is like the NPV of a project is determined by dividing

why is for the calculation of NPV various methods are used? like sometimes it is like the NPV of a project is determined by dividing the given cash flows for the year by given WACC whereas on the contrary, NPV is calculated by multiplying the given cash flows with present value factors? this sounds a bit crazy as well but i am confused. so can you please explain this?

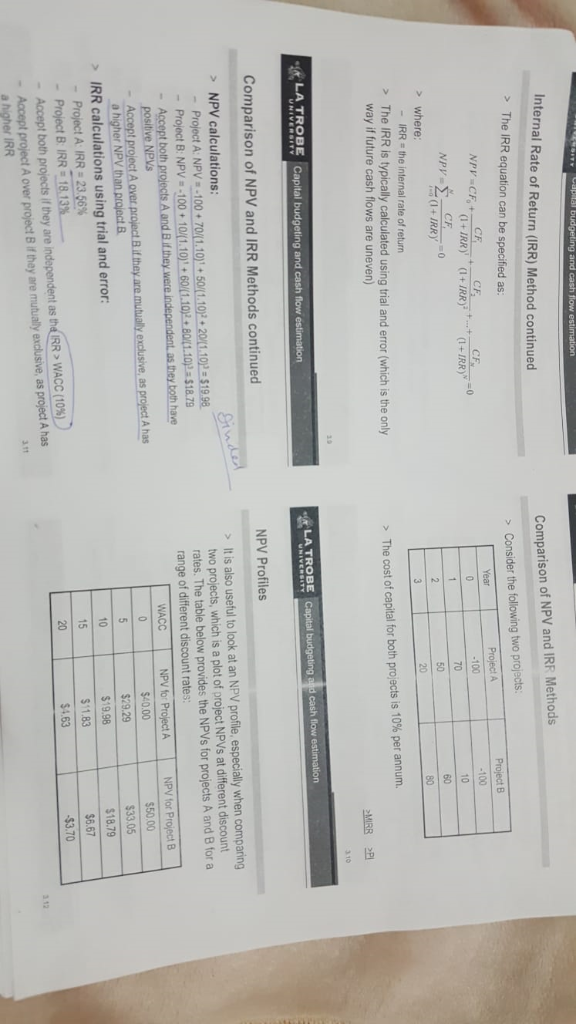

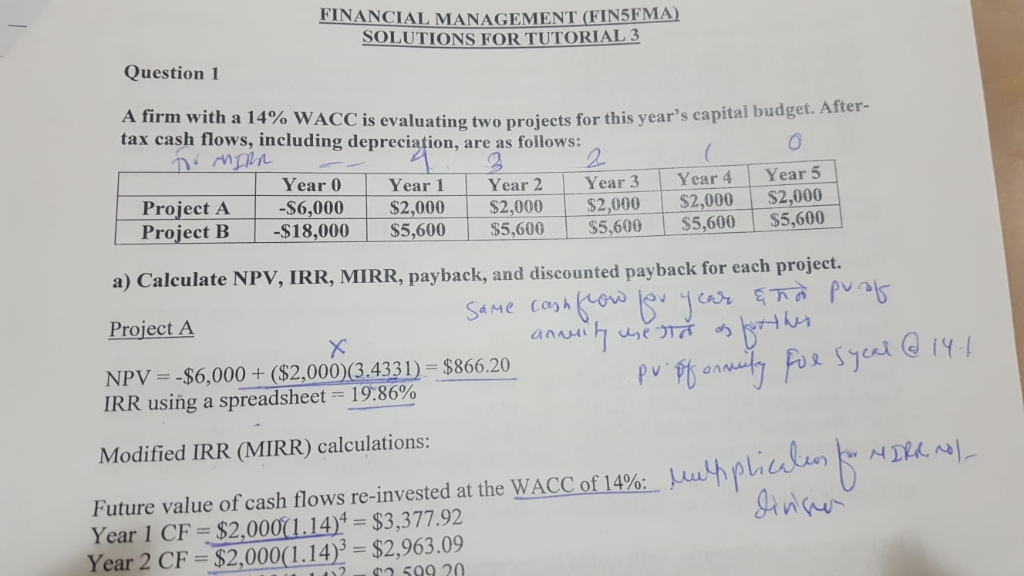

aptal budgeting and cash flow estimation Internal Rate of Return (IRR) Method continued Comparison of NPV and IRR Methods The IRR equation can e specified as: Consider the following two projects Project A Project B CE Year CF NPVCF,+ IRRY(1+IRRY (1+IRR) =0 -100 -100 10 NPV2+ IRR) CE 70 1 50 60 2 >where 20 IRR the internal rate of return >The IRR is typically calculated using trial and error (which is the only way if future cash flows are uneven) > The cost of capital for both projects is 10 % per annum MIRR LA TROBE Capital budgeting and cash flow estimation LA TROBE UNIVERSITY cash flow estimation Capital budgeting a Comparison of NPV and IRR Methods continued NPV Profiles > It is also useful to look at an NPV profile, especially when comparing two projects, which is a plot of project NPVS at differer rates. The table below provides the NPVS for projects A and B for a range of different discount rates: > NPV calculations: inde diecount Project A: NPV-100+70/(1.10) + 50/(1.10)2 20(1.10)2 = $19.98 Project B: NPV=-100+ 10/(1.10) + 60/(1.10)2+80/L1.10)$18.79 Accept both projects A and B if they were independent as they both have positive NPVS Accept project A over project B.if they.are mutually exclusive, as project A has a higher NPV than project B IRR calculations using trial and - Project A: IRR 23.56% - Project B: IRR 18.13% Accept both projects if they are independent as the IRR > WACC (10% ) Accept project A over project B if they are mutually exclusive, WACC NPV for Project A NPV for Project B $40.00 $50,00 5 $29.29 $33.05 error: 10 $19.98 $18.79 15 $11.83 $6.67 20 $4.63 $3.70 as project A has 3.11 higher IRR FINANCIAL MANAGEMENT (FIN5FMA) SOLUTIONS FOR TUTORIAL 3 Question 1 A firm with a 14% WACC is evaluating two projects for this year's capital budget. After- tax cash flows, including depreciation, are as follows: O DMILA Year 0 Year 5 Year 1 Year 4 Year 2 Year 3 Project A Project B $2,000 $5,600 -S6,000 -$18,000 $2,000 $5,600 $2,000 $5,600 $2,000 $5,600 $2,000 $5,600 a) Calculate NPV, IRR, MIRR, payback, and discounted payback for each project. SaMe Cashkow ann Project A NPV= -$6,000+ ($2,000)(3.4331)= $866.20 IRR using a spreadsheet = 19:86% Modified IRR (MIRR) calculations: uthplicint Future value of cash flows re-invested at the WACC of 14%: Year 1 CF= $2,000 1.14)4 = $3,377.92 Year 2 CF= $2,000(1 .14)3 $2,963.09 599 20 42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts