Question: Why is Interest Expense added and then divided? Please explain this question in detail. Where do each of the items below fall on an Income

Why is Interest Expense added and then divided? Please explain this question in detail. Where do each of the items below fall on an Income Statement?

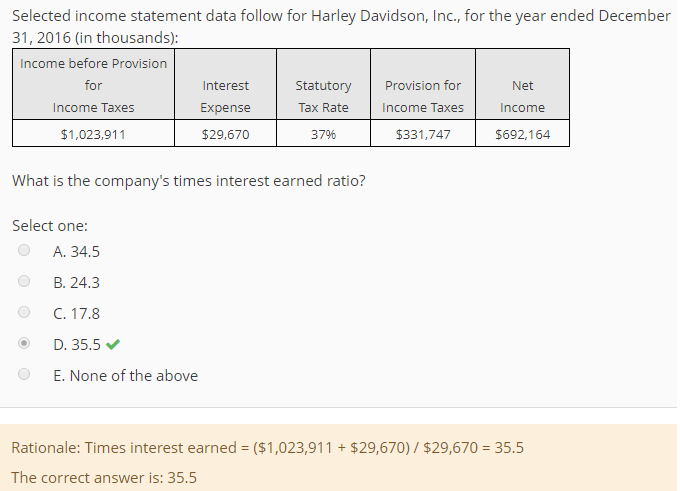

Selected income statement data follow for Harley Davidson, Inc., for the year ended December 31, 2016 (in thousands); Income before Provision for Income Taxes $1,023,911 Interest Expense $29,670 Statutory Provision for Tax Rate Net Income $692,164 Income Taxes 3796 $331,747 What is the company's times interest earned ratio Select one: A. 34.5 B. 24.3 D. 35.5 E. None of the above Rationale: Times interest earned ($1,023,911 $29,670) $29,670 35.5 The correct answer is: 35.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts