Question: why is my answer incomplete and can you help with the errors please perpetual inventory costing methods Check my work mode: This show Required information

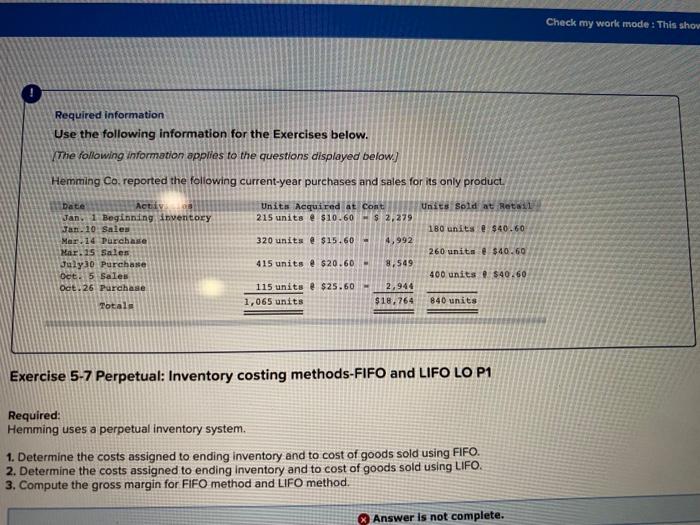

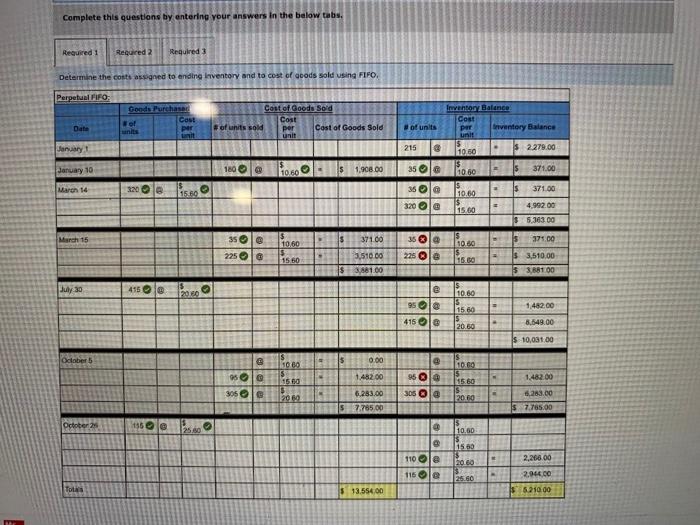

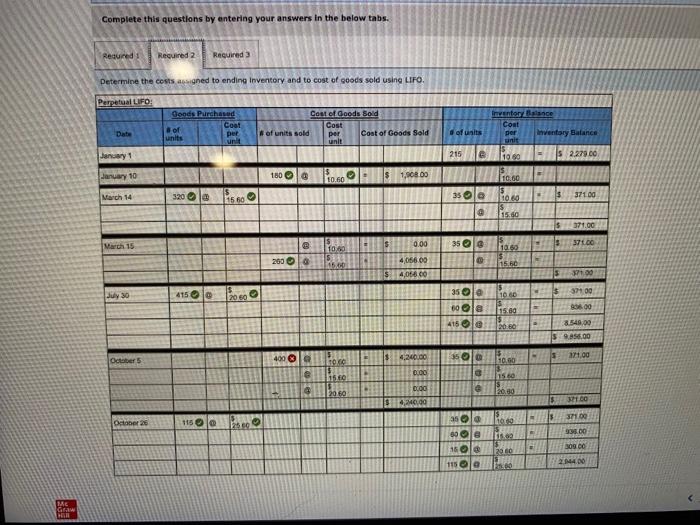

Check my work mode: This show Required information Use the following information for the Exercises below. The following information applies to the questions displayed below.) Hemming Co. reported the following current-year purchases and sales for its only product Units Sold at Retail Units Acquired at Cont 215 units @ $10.60 $2,279 180 units e $40.60 4,992 Date Activ Jan. 1 Beginning invertory Jan. 10 Sales Mar.14 Purchase Mar. 15 Sales July 20 Purchase Oct. 5 Sales Oct.26 Purchase 260 units @ $40.60 8.549 320 units & $15.60 - 415 units e $20.60 115 units e $25.60 1,065 units 400 units $40.60 2,944 $18.764 Totals 840 units Exercise 5-7 Perpetual: Inventory costing methods-FIFO and LIFO LO P1 Required: Hemming uses a perpetual inventory system. 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross margin for FIFO method and LIFO method. Answer is not complete. Complete this questions by entering your answers in the below tabs, Required 1 Required 2 Required Determine the costs aspgned to ending Inventory and to cost of goods sold using FIFO. Perpetual FIFO Goods Purchase of Cost Per Cost of Goods Sod Cost of units sold per Cast of Goods Sold Unit Date of units Inventon Balance Cost por ventory Balance unit 15 10.00 $ 2.279.00 January 215 January 10 180 @ 51.908.00 5 35 10.60 371.00 1060 5 10.60 March 14 320le - Is 371.00 15.60 35 @ 320 Ol@ is.co 4,992.00 $5,303 00 March 15 371.00 5 1060 375.00 35 @ 35 22510 15 10.80 15.30 15 60 225 Q10 3.510.00 $ 3,80100 3,510,00 $ 3,88100 July 30 415 200 0 $ 10.60 95@ 415 15.80 1482.00 8.549.00 20.60 $ 10,031.00 19,034 20 Odaber 1080 15 0.00 950 Gel 1.452.00 10.60 15.60 15.00 950 1.482.00 305 308 Ol@ 2012 6.283.00 $ 7.785,00 20.60 16.283.00 $ 7.765.00 October 26 2560 10.00 15.00 Solo 2,266 06 110 ole 115 2.9400 25.60 TOLAS $ 13,554,00 $ 5.210.00 Complete this questions by entering your answers in the below tabs. Required Required 2 Required 3 Determine the costs a wigned to ending Inventory and to cost of goods sold using LIPO. Perpetual CFO Gonds. Purchased of Coat per units Cost of Goods Sold Cost of units sold per Cost of Goods Sold unit of units Inventes flance Coat per Inventory Balance unit January 1 215 e IS 2.279.00 10.90 SEE 10.60 January 10 1801 10.60 $ 1,908 00 March 14 120 1560 . 35 le 1060 $ 371 00 115.50 $ 371.00 March 15 @ s 0.00 @ Faso 3 371 2000 1060 5 45.00 4,056.00 S 4,0660 15.50 15 100 July 30 4150 > 37100 35 110,00 2000 60 la 15.09 20.80 415 896.00 3.540,00 5.00 15 400 l October 4,240.00 3 15 21,00 15 10.00 5 OK $ 0.00 5510 wat 15.60 20.60 DOOG $ 0.00 IS 21.CO 15 asola 3710 October 26 1150 10e 335.00 . 309.00 290 115 2.400 ME Ga

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts