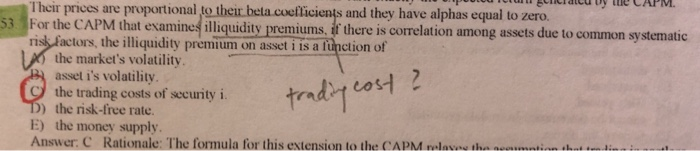

Question: why is the answer C? why does this question assumes that trading is not costless? Their prices are proportional to their bela coefficients and they

Their prices are proportional to their bela coefficients and they have alphas equal to zero. 53. For the CAPM that examines illiquidity premiums, if there is correlation among assets due to common systematic risk factors, the illiquidity premium on asset i is a function of the market's volatility. B assel i's volatility. tadry cost ? i the trading costs of security i. D) the risk-free rate. E) the money supply Answer Rationale: The formula for this extension to the CAPM wala tha

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts