Question: Why is the capital-budgeting process so important? Why is it difficult to find exceptionally profitable projects? What is the payback period on each project? If

- Why is the capital-budgeting process so important?

- Why is it difficult to find exceptionally profitable projects?

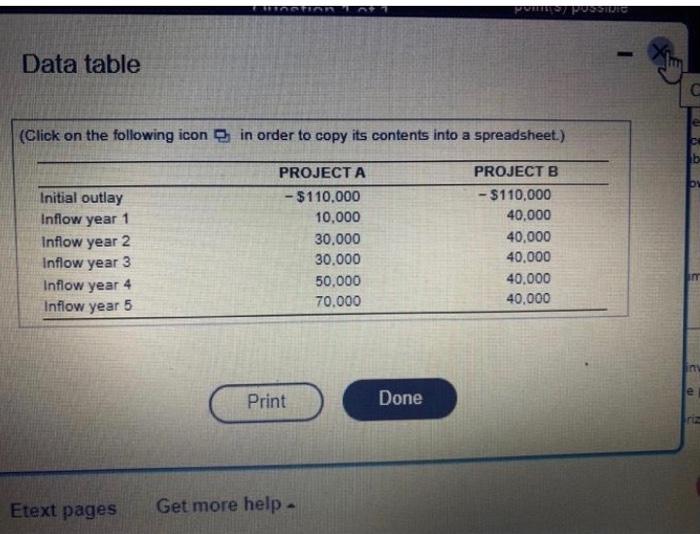

- What is the payback period on each project? If Caledonia imposes a 3-year maximum acceptable payback period, which of these projects should be accepted?

- What are the criticisms of the payback period?

- Determine the NPV for each of these projects. Should either project be accepted?

- Describe the logio behind the NPV

- Determine the P/ for each of these projects. Should either project be accepted?

- Would you expect the IPV and PI methods to give consistent accept/reject decisions? Why or why not?

- What would happen to the IPVand P/for each project if the required rate of return increased? if the required rate of return decreased?

i. Determine the IRRfor each project. Should either proiect be accepted?

k. How does a change in the required rate of return affect the project's internal rate of return?

I. What reinvestment rate assumptions are implicitly made by the

APV and IRR methods? Which one is better?

Data table (Click on the following icon in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts