Question: Why is the cost - allocation method used by an organization an important part of its cost accounting system? A . Companies must assign all

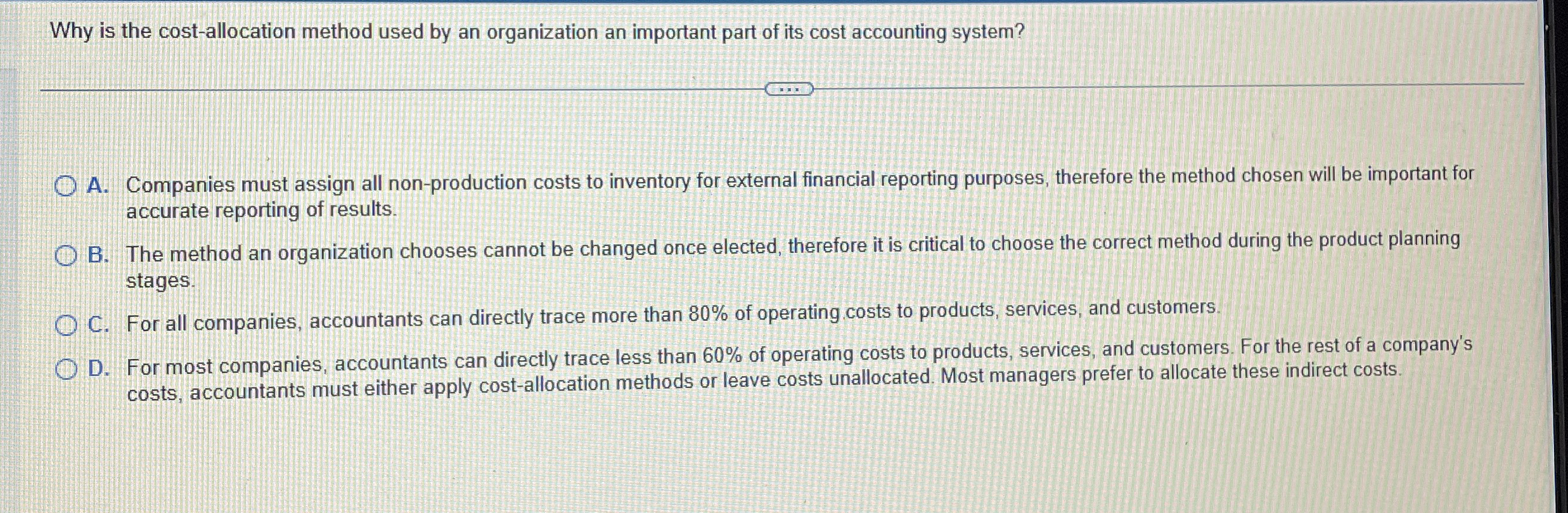

Why is the costallocation method used by an organization an important part of its cost accounting system?

A Companies must assign all nonproduction costs to inventory for external financial reporting purposes, therefore the method chosen will be important for accurate reporting of results.

B The method an organization chooses cannot be changed once elected, therefore it is critical to choose the correct method during the product planning stages.

C For all companies, accountants can directly trace more than of operating costs to products, services, and customers.

D For most companies, accountants can directly trace less than of operating costs to products, services, and customers. For the rest of a company's costs, accountants must either apply costallocation methods or leave costs unallocated. Most managers prefer to allocate these indirect costs.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock