Question: Why is the expected, rather than actual, return used in computing pension expense? A pension fund is a long - term buy - and -

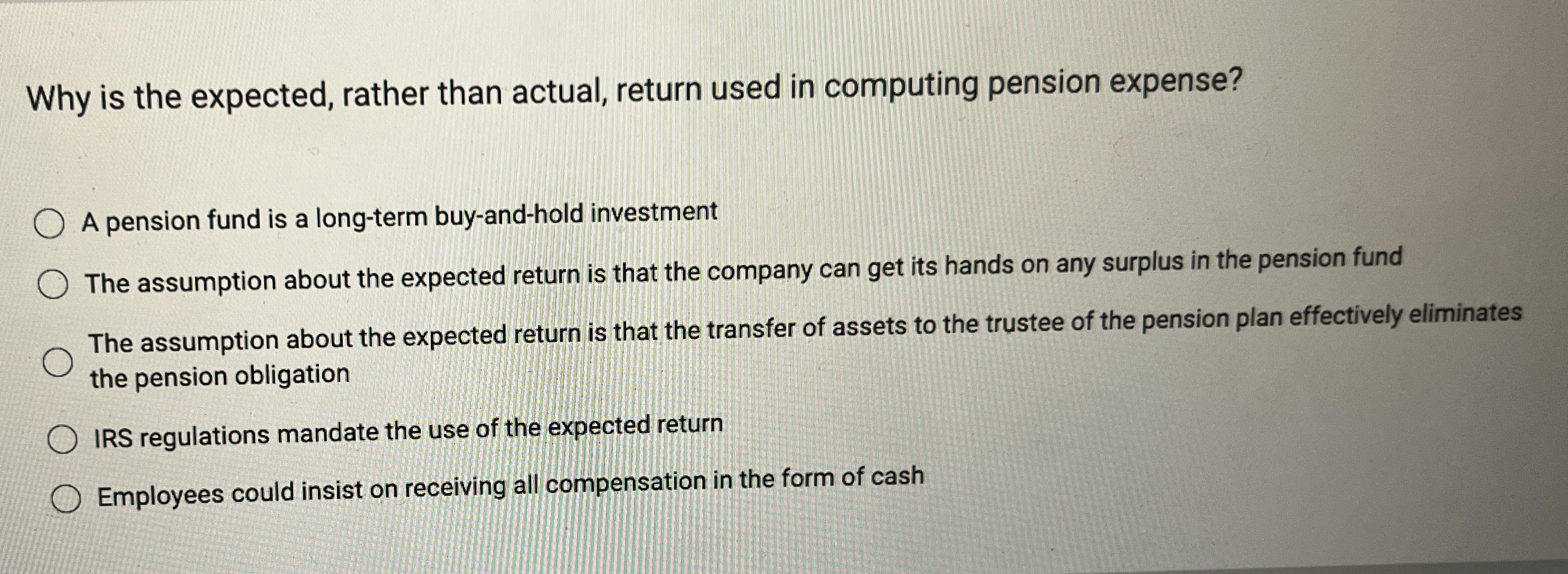

Why is the expected, rather than actual, return used in computing pension expense?

A pension fund is a longterm buyandhold investment

The assumption about the expected return is that the company can get its hands on any surplus in the pension fund

The assumption about the expected return is that the transfer of assets to the trustee of the pension plan effectively eliminates the pension obligation

IRS regulations mandate the use of the expected return

Employees could insist on receiving all compensation in the form of cash

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock