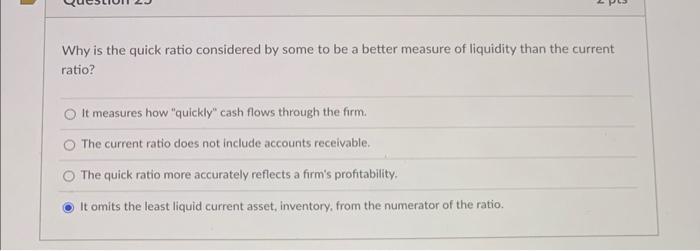

Question: Why is the quick ratio considered by some to be a better measure of liquidity than the current ratio? It measures how quickly cash flows

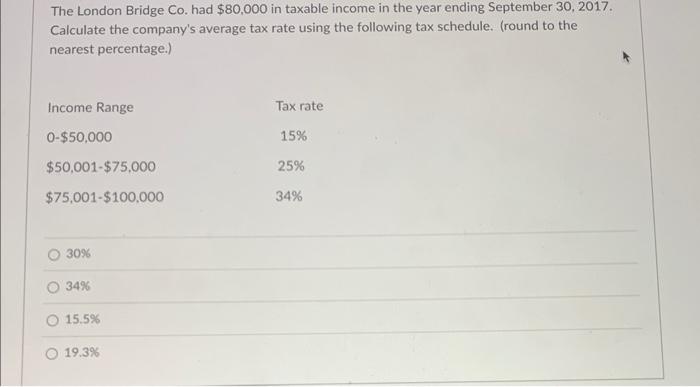

Why is the quick ratio considered by some to be a better measure of liquidity than the current ratio? It measures how "quickly" cash flows through the firm. The current ratio does not include accounts receivable. The quick ratio more accurately reflects a firm's profitability. It omits the least liquid current asset, inventory, from the numerator of the ratio. The London Bridge Co. had $80,000 in taxable income in the year ending September 30,2017. Calculate the company's average tax rate using the following tax schedule. (round to the nearest percentage.) 309 34% 15.5% 19.3%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock