Question: WHY IT IS NOT BALANCE ,PLEASE HELP ME HOW TO MAKE IT BALANCE Thankyou Sweet Treats Berhad Note: All figures should be round up to

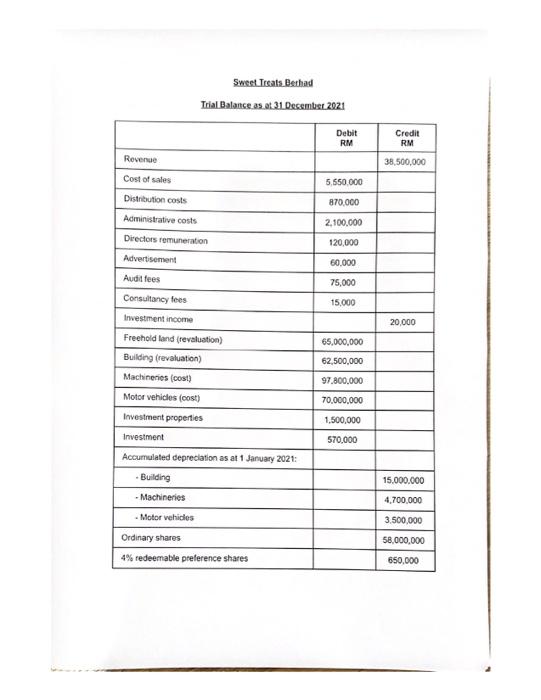

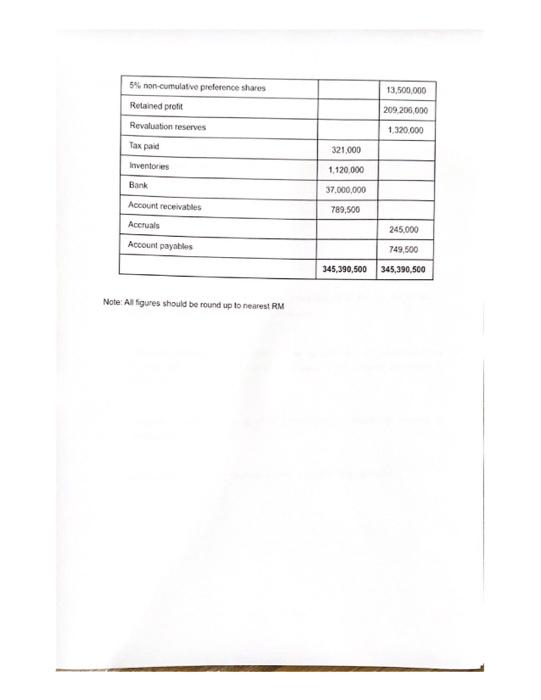

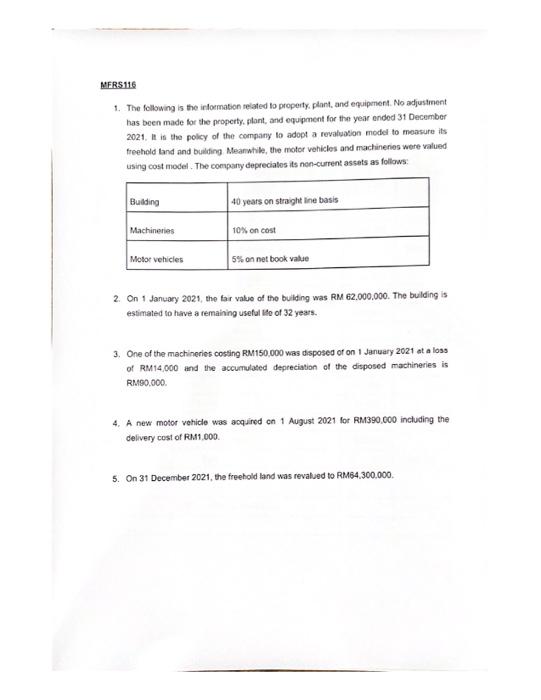

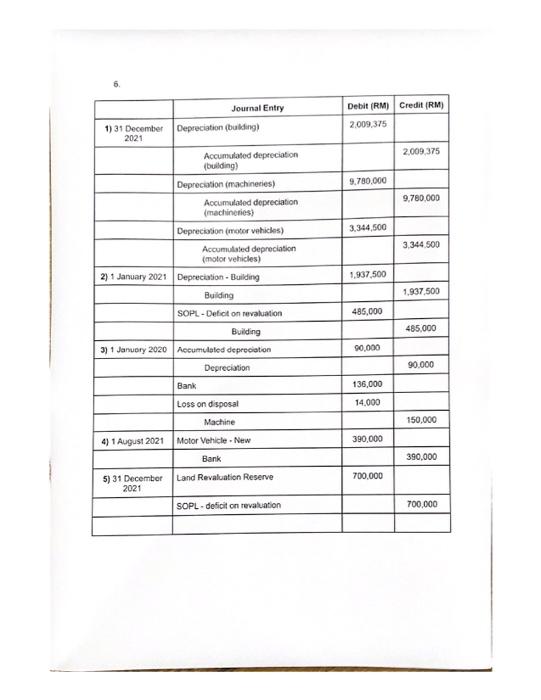

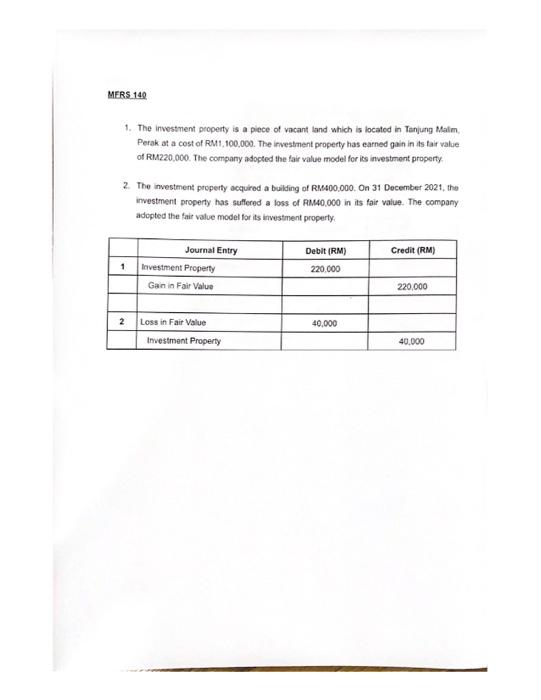

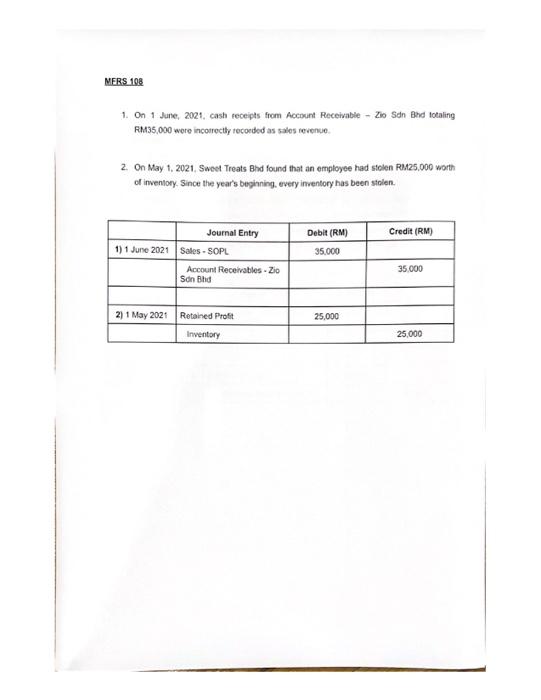

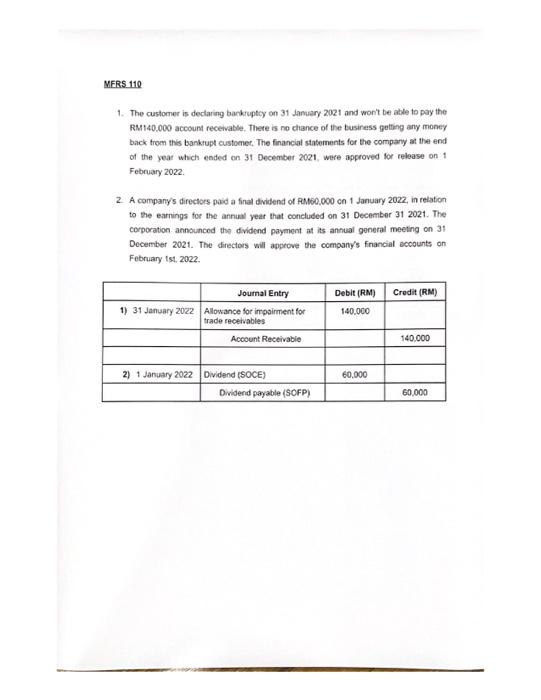

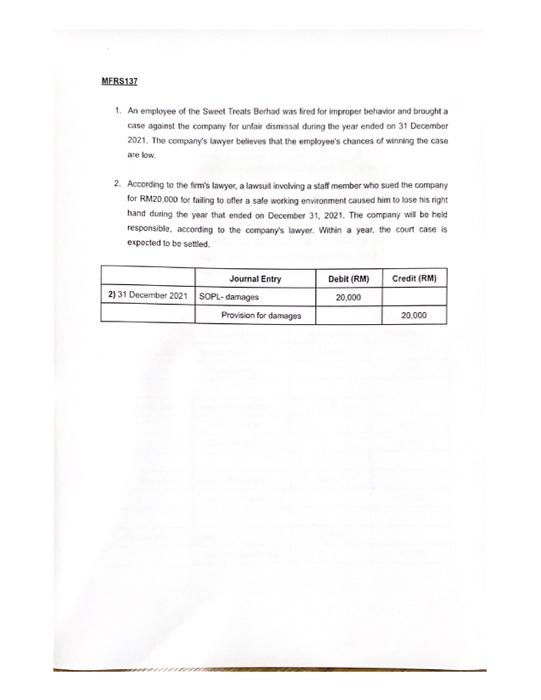

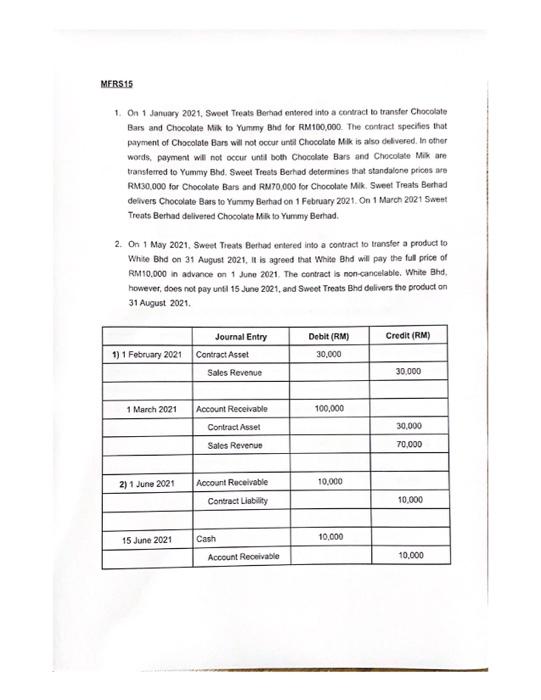

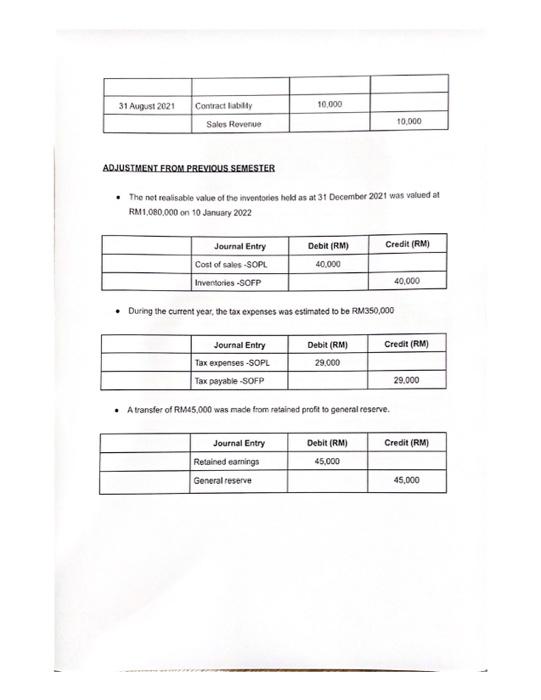

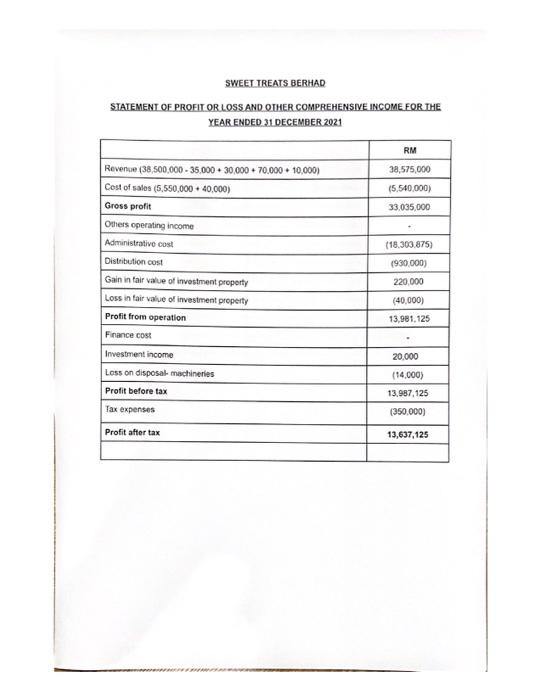

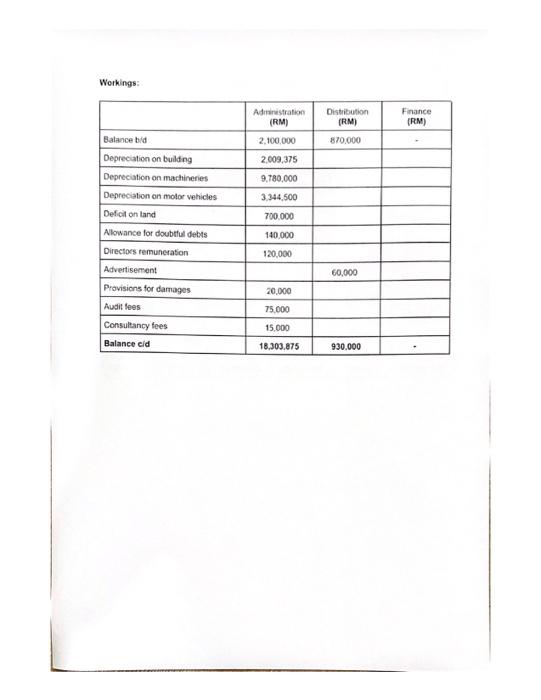

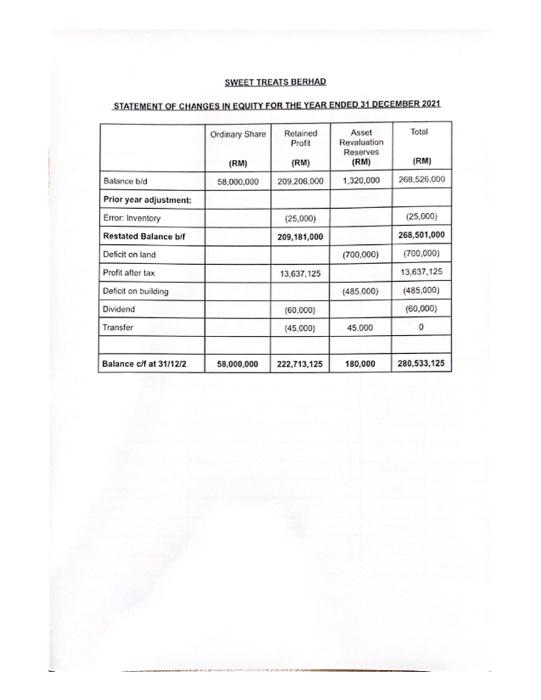

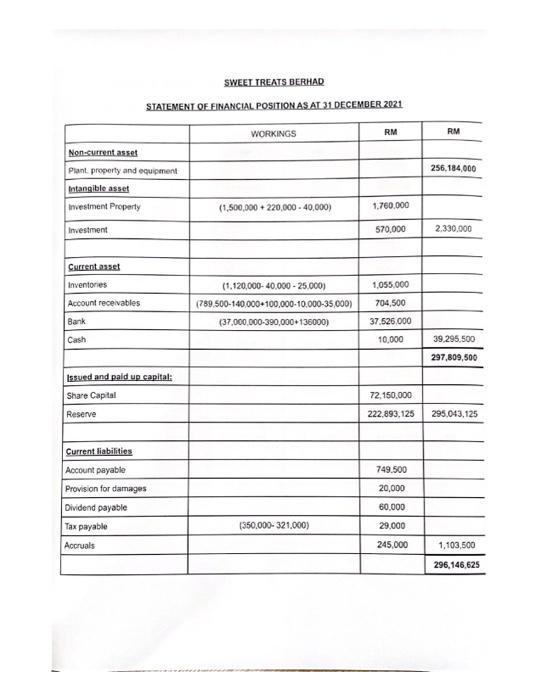

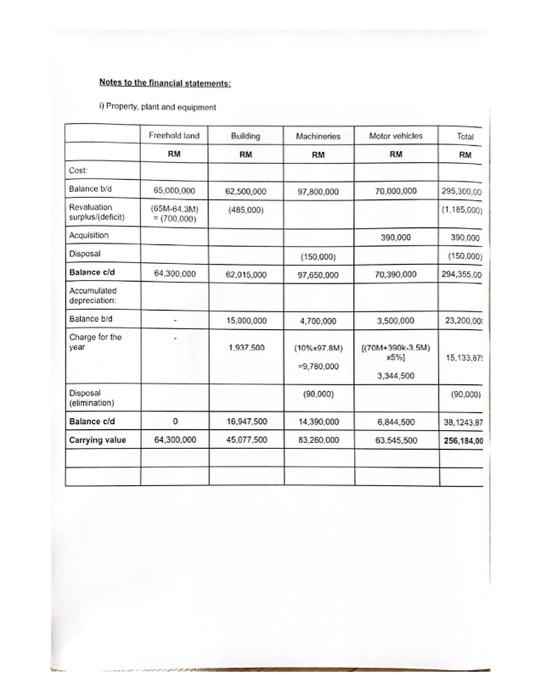

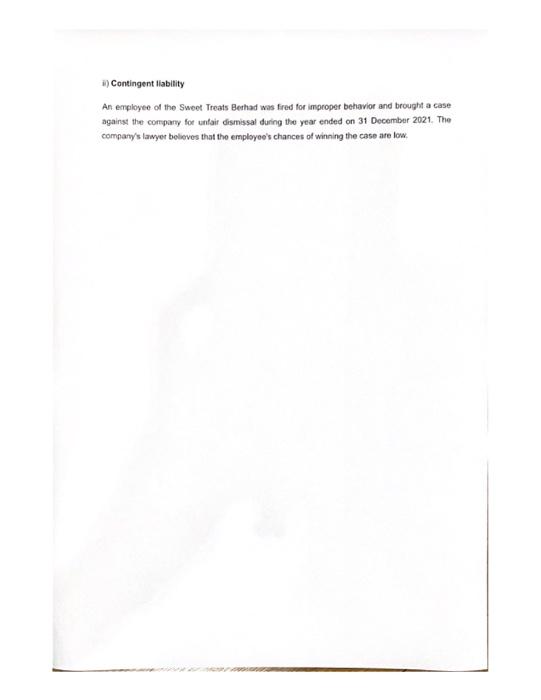

Sweet Treats Berhad Note: All figures should be round up to nearest RM MFRS 116 1. The following is the irformation related to property, plant, and equipment. No adjustinent has been made for the property, plant, and equipment for than year anded 31 December 2021. It is the polcy of the company to adopt a revaluasion model to measure its freehold tand and bulding Mearwhile, the motor vehicles and machinenies were valued using cost model. The company deprecialos its nen-current assets as follows: 2. On 1 January 2021, the far value of the building was RM 62.000.000. The bulding is estimated to have a remaining useful tho of 32 years. 3. One of the machineries costing RM150,000 was disposed of on 1 January 2021 at a loss of RM14,000 and the accumulated depreciation of the disposed machineries is RM90.000. 4. A new motor vehicle was acquired on 1 August 2021 for RM390,000 including the delivery cost of Ras1,000. 5. On 31 December 2021, the freehold land was revalued to RRM3,300.000. 6. 1. The investment property is a piece of vacant land which is located in Tanjung Malm. Perak at a cost of RM1, 100,000 . The irvestrent property has earned gain in its far value of RM220,000. The company adopted the fair value model for its investment property. 2. The investment properfy acquired a building of RM 900,000 . On 31 December 2021, the investment property has suffered a loss of RM40,000 in its fair value. The company adopted the fair value model for its irvestment property. 1. On 1 June, 2021, cash receipts from Account Receivable - Zo Sdn Bnd totaling RM35,000 were incourectly tecoedod as sales tevenue. 2. On May 1, 2021, Sweet Treats Bhd found that an employee had steien Ru.425,000 worth of inventory. Since the year's beginning, every inventory has been stolen. 1. The customer is declaring barkiuptcy on 31 jamuary 2021 and wor't be able to pay the RM140.000 account receivable. There is no chance of the busiress geting any money back trom this bankrupt customer. The financial statements for the company at the end of the yeat which ended on 31 December 2021, were approved for release on 1 February 2022. 2. A company's directors paid a finat dividend of 8M60.000 cn 1 January 2022, in relation to the earnings for the annual year that concluded on 31 December 312021 . The corporation announced the dividend payment at its annual general meeting on 31 December 2021. The directors will appeove the company's financial bocounts on February is1, 2022. 1. An entiloyee of the Sweet Treats Berhad was fired for improper behavior and brought a case against the company for unfait dismiasal during the year ended on 31 Decernbar 2021. The company's lawyer believes that the emplayed's chances of winring the case are low. 2. Accorcing to the fim's lawyoc, a lawsut inveking a staff member who sued the company for RM20.000 for taing to oflet a sale werking envitonment caused him to lose his right hand during the year that ended on December 31, 2021. The company will bo heild responsiblo. according to the company's lawyer. Within a yeat, the count case is expocted to be settled. 1. On 1 January 2021, Sweet Treats Bertad entered into a contract to transfer Chocolate Bars and Cisocolate Mixk to Yummy Bhd for RM 100,000 . The contract specines that payment of Chocolate Bars wall not occut unta Chocolate MIk is also debvered. In ofher Words, payment will not occur untI both Chocelate Bars and Chocolate Mok are translerred to Yumrry Bhd. Sweel Treets Berhad determines that standalone prices are RM30.000 for Chocolate Bars and RM70,000 for Chocolate MMk. Sweet Treats Bechad defivers Chocolate Bass to Yummy Berhad on 1 February 2021. On 1 March 2021 Saeet Treats Berhad delivered Chocolate Mik to Yummy Berhad. 2. On 1 May 2021, Sweet Treats Bethad entered into a contract to transfet a product to Whte Bhd on 31 August 2021, It is agreed that White Bhd will pay the full price of RM 10.000 in advance on 1 June 2021. The contract is non-cancelable. White Bhd, however, does not pay unt1 15 June 2021, and Sweet Treats Bhd delivers the product an 31 August 2021. ADJUSTMENTEROM PREVIOUS.SEMESTER - The not realisable value of the inventodes hold as at 31 December 2021 was valued at RMM 1,080,000 on 10 January 2022 - During the current year, the tax expenses was estimated to be RM350,000 - A transfer of RMA45,000 was made from retained profit to general reserve. SWEET TREATS BERHAD STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2021 Workings: STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 DECEMBFR 2021 SWEET TREATS BERHAD Netes. to the financial statements. i) Property. plant and equipment i) Contingent liability An employee of the Sweet Treats Beshad was fred tor improper behavior and brought a case against the corrpary foe unfair dismissal duing the year ended on 31 December 2021. The company's lawyer believes that the employee's chances of winning the case are low. Sweet Treats Berhad Note: All figures should be round up to nearest RM MFRS 116 1. The following is the irformation related to property, plant, and equipment. No adjustinent has been made for the property, plant, and equipment for than year anded 31 December 2021. It is the polcy of the company to adopt a revaluasion model to measure its freehold tand and bulding Mearwhile, the motor vehicles and machinenies were valued using cost model. The company deprecialos its nen-current assets as follows: 2. On 1 January 2021, the far value of the building was RM 62.000.000. The bulding is estimated to have a remaining useful tho of 32 years. 3. One of the machineries costing RM150,000 was disposed of on 1 January 2021 at a loss of RM14,000 and the accumulated depreciation of the disposed machineries is RM90.000. 4. A new motor vehicle was acquired on 1 August 2021 for RM390,000 including the delivery cost of Ras1,000. 5. On 31 December 2021, the freehold land was revalued to RRM3,300.000. 6. 1. The investment property is a piece of vacant land which is located in Tanjung Malm. Perak at a cost of RM1, 100,000 . The irvestrent property has earned gain in its far value of RM220,000. The company adopted the fair value model for its investment property. 2. The investment properfy acquired a building of RM 900,000 . On 31 December 2021, the investment property has suffered a loss of RM40,000 in its fair value. The company adopted the fair value model for its irvestment property. 1. On 1 June, 2021, cash receipts from Account Receivable - Zo Sdn Bnd totaling RM35,000 were incourectly tecoedod as sales tevenue. 2. On May 1, 2021, Sweet Treats Bhd found that an employee had steien Ru.425,000 worth of inventory. Since the year's beginning, every inventory has been stolen. 1. The customer is declaring barkiuptcy on 31 jamuary 2021 and wor't be able to pay the RM140.000 account receivable. There is no chance of the busiress geting any money back trom this bankrupt customer. The financial statements for the company at the end of the yeat which ended on 31 December 2021, were approved for release on 1 February 2022. 2. A company's directors paid a finat dividend of 8M60.000 cn 1 January 2022, in relation to the earnings for the annual year that concluded on 31 December 312021 . The corporation announced the dividend payment at its annual general meeting on 31 December 2021. The directors will appeove the company's financial bocounts on February is1, 2022. 1. An entiloyee of the Sweet Treats Berhad was fired for improper behavior and brought a case against the company for unfait dismiasal during the year ended on 31 Decernbar 2021. The company's lawyer believes that the emplayed's chances of winring the case are low. 2. Accorcing to the fim's lawyoc, a lawsut inveking a staff member who sued the company for RM20.000 for taing to oflet a sale werking envitonment caused him to lose his right hand during the year that ended on December 31, 2021. The company will bo heild responsiblo. according to the company's lawyer. Within a yeat, the count case is expocted to be settled. 1. On 1 January 2021, Sweet Treats Bertad entered into a contract to transfer Chocolate Bars and Cisocolate Mixk to Yummy Bhd for RM 100,000 . The contract specines that payment of Chocolate Bars wall not occut unta Chocolate MIk is also debvered. In ofher Words, payment will not occur untI both Chocelate Bars and Chocolate Mok are translerred to Yumrry Bhd. Sweel Treets Berhad determines that standalone prices are RM30.000 for Chocolate Bars and RM70,000 for Chocolate MMk. Sweet Treats Bechad defivers Chocolate Bass to Yummy Berhad on 1 February 2021. On 1 March 2021 Saeet Treats Berhad delivered Chocolate Mik to Yummy Berhad. 2. On 1 May 2021, Sweet Treats Bethad entered into a contract to transfet a product to Whte Bhd on 31 August 2021, It is agreed that White Bhd will pay the full price of RM 10.000 in advance on 1 June 2021. The contract is non-cancelable. White Bhd, however, does not pay unt1 15 June 2021, and Sweet Treats Bhd delivers the product an 31 August 2021. ADJUSTMENTEROM PREVIOUS.SEMESTER - The not realisable value of the inventodes hold as at 31 December 2021 was valued at RMM 1,080,000 on 10 January 2022 - During the current year, the tax expenses was estimated to be RM350,000 - A transfer of RMA45,000 was made from retained profit to general reserve. SWEET TREATS BERHAD STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2021 Workings: STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 DECEMBFR 2021 SWEET TREATS BERHAD Netes. to the financial statements. i) Property. plant and equipment i) Contingent liability An employee of the Sweet Treats Beshad was fred tor improper behavior and brought a case against the corrpary foe unfair dismissal duing the year ended on 31 December 2021. The company's lawyer believes that the employee's chances of winning the case are low

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts