Question: Why Max Solutions's target capital structure calls for 40 percent debt, 10 percent preferred stock, and 50 percent common equity. WMS's current after-tax cost of

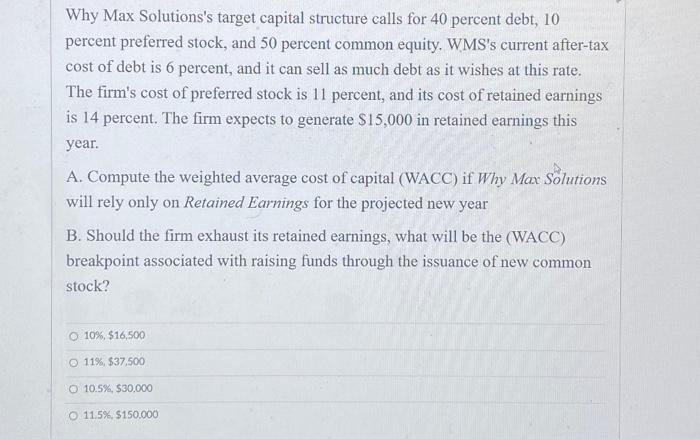

Why Max Solutions's target capital structure calls for 40 percent debt, 10 percent preferred stock, and 50 percent common equity. WMS's current after-tax cost of debt is 6 percent, and it can sell as much debt as it wishes at this rate. The firm's cost of preferred stock is 11 percent, and its cost of retained earnings is 14 percent. The firm expects to generate $15,000 in retained earnings this year. A. Compute the weighted average cost of capital (WACC) if Why Max Solutions will rely only on Retained Earnings for the projected new year B. Should the firm exhaust its retained earnings, what will be the (WACC) breakpoint associated with raising funds through the issuance of new common stock? 10%,$16,50011%,$37,50010.5%,$30,00011.5%,$150,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts