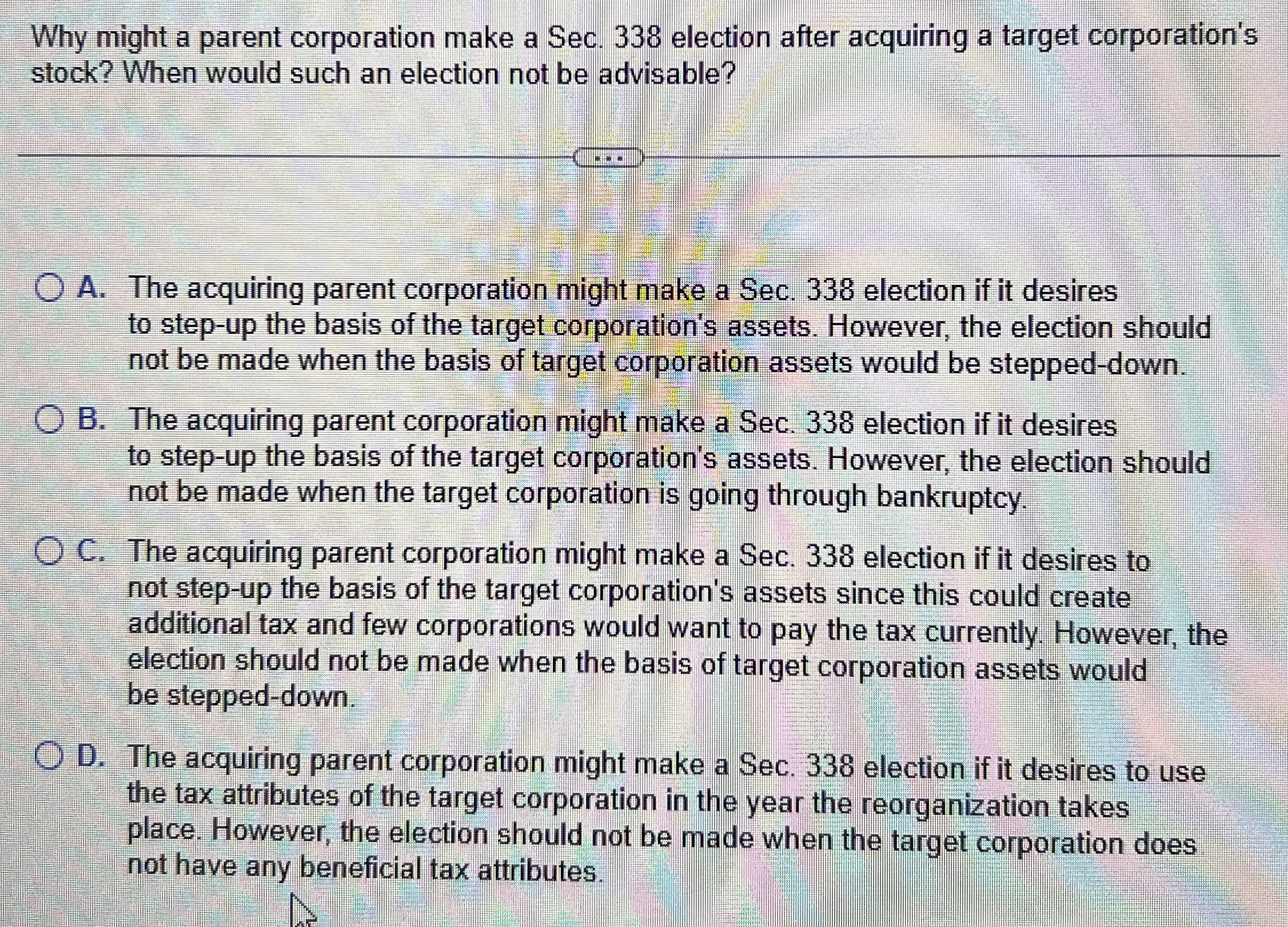

Question: Why might a parent corporation make a Sec. 3 3 8 election after acquiring a target corporation's stock? When would such an election not be

Why might a parent corporation make a Sec. election after acquiring a target corporation's stock? When would such an election not be advisable?

A The acquiring parent corporation might make a Sec. election if it desires to stepup the basis of the target corporation's assets. However, the election should not be made when the basis of target corporation assets would be steppeddown.

B The acquiring parent corporation might make a Sec. election if it desires to stepup the basis of the target corporation's assets. However, the election should not be made when the target corporation is going through bankruptcy.

C The acquiring parent corporation might make a Sec. election if it desires to not stepup the basis of the target corporation's assets since this could create additional tax and few corporations would want to pay the tax currently. However, the election should not be made when the basis of target corporation assets would be steppeddown.

D The acquiring parent corporation might make a Sec. election if it desires to use the tax attributes of the target corporation in the year the reorganization takes place. However, the election should not be made when the target corporation does not have any beneficial tax attributes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock