Question: Why the answer here is B? It's supposed to be C. Multiple Part Questions Use the following information to answer the next two (2) questions.

Why the answer here is B? It's supposed to be C.

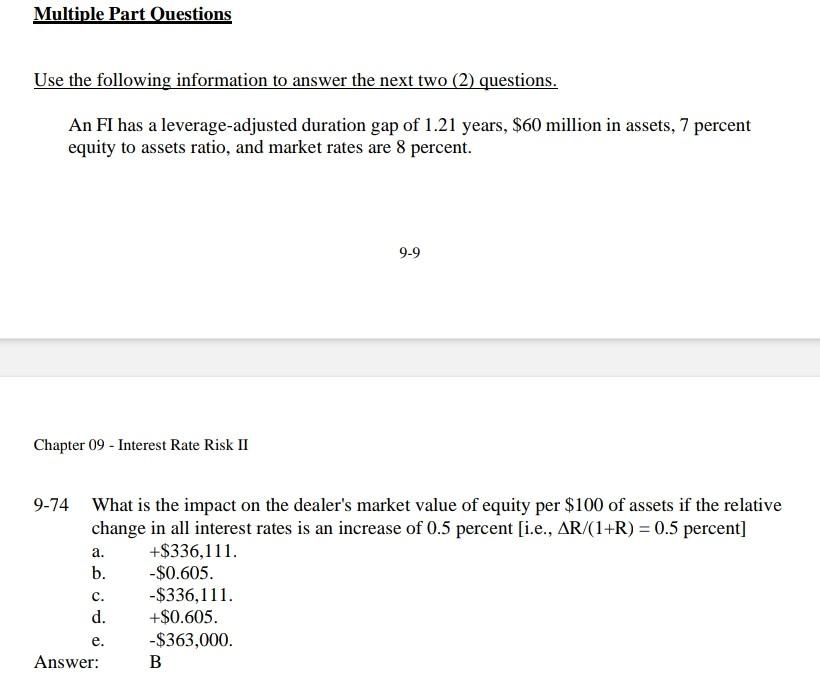

Multiple Part Questions Use the following information to answer the next two (2) questions. An FI has a leverage-adjusted duration gap of 1.21 years, $60 million in assets, 7 percent equity to assets ratio, and market rates are 8 percent. 9-9 Chapter 09 - Interest Rate Risk II 9-74 What is the impact on the dealer's market value of equity per $100 of assets if the relative change in all interest rates is an increase of 0.5 percent [i.e., AR/(1+R) = 0.5 percent] a. +$336,111 b. -$0.605. -$336,111. d. +$0.605. -$363,000. Answer: B c. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts