Question: why the correct answer is d: 104,000? Stone Co. reported $225,000 in income before income taxes for 2027. Stone's 2027 book depreciation exceeded its tax

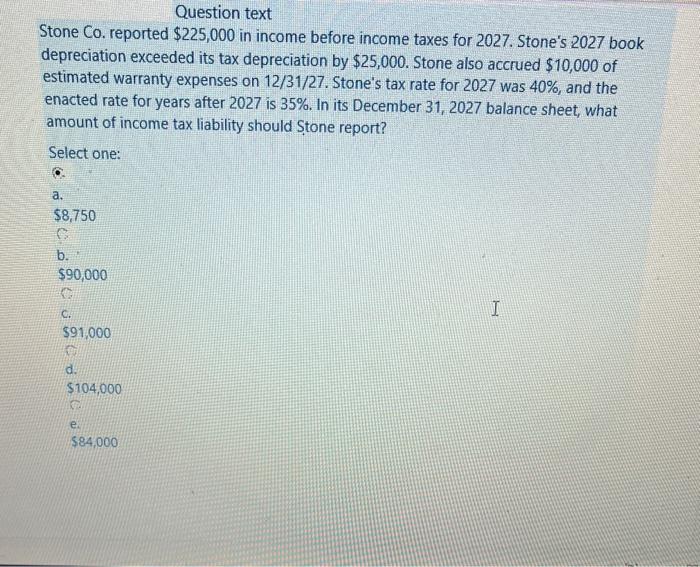

Stone Co. reported $225,000 in income before income taxes for 2027. Stone's 2027 book depreciation exceeded its tax depreciation by $25,000. Stone also accrued $10,000 of estimated warranty expenses on 12/31/27. Stone's tax rate for 2027 was 40%, and the enacted rate for years after 2027 is 35%. In its December 31,2027 balance sheet, what amount of income tax liability should tone report? Select one: a. $8,750 b. $90,000 C. $91,000 d. $104,000 e. $84,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts