Question: why the endownment point e moves horizontally when first period tax increases and why it moves vertically when second period tax increases? Temporary and Permanent

why the endownment point e moves horizontally when first period tax increases and why it moves vertically when second period tax increases?

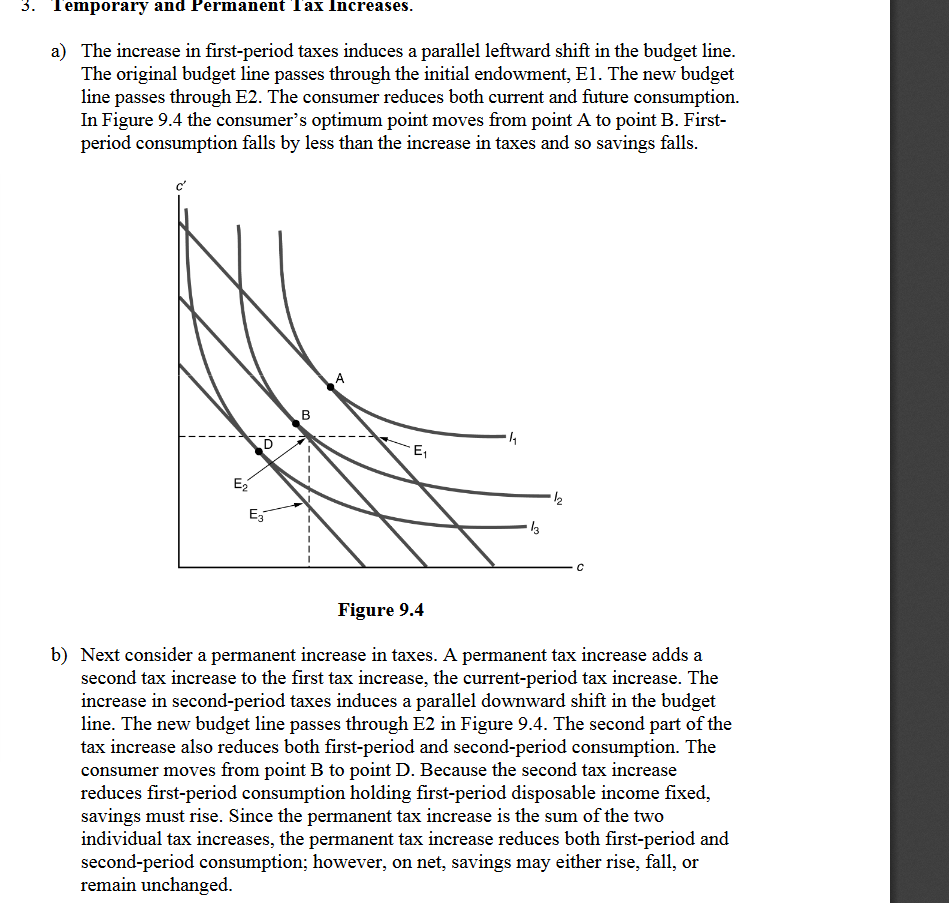

Temporary and Permanent Tax Increases. a) The increase in first-period taxes induces a parallel leftward shift in the budget line. The original budget line passes through the initial endowment, El. The new budget line passes through E2. The consumer reduces both current and future consumption. In Figure 9.4 the consumer's optimum point moves from point A to point B. First- period consumption falls by less than the increase in taxes and so savings falls. - 2 A E1 E2 E3 Figure 9.4 b) Next consider a permanent increase in taxes. A permanent tax increase adds a second tax increase to the first tax increase, the current-period tax increase. The increase in second-period taxes induces a parallel downward shift in the budget line. The new budget line passes through E2 in Figure 9.4. The second part of the tax increase also reduces both first-period and second-period consumption. The consumer moves from point B to point D. Because the second tax increase reduces first-period consumption holding first-period disposable income fixed, savings must rise. Since the permanent tax increase is the sum of the two individual tax increases, the permanent tax increase reduces both first-period and second-period consumption; however, on net, savings may either rise, fall, or remain unchanged

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts