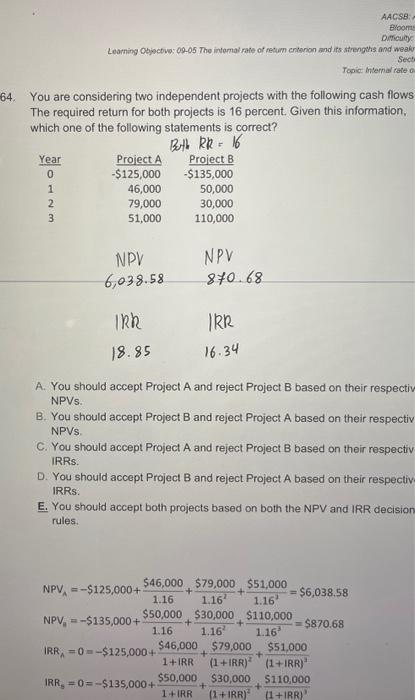

Question: why they chooce E that they both acceptance and there is a diffrernt in npv project A and project B You are considering two independent

You are considering two independent projects with the following cash flows The required return for both projects is 16 percent. Given this information. which one of the following statements is correct? A. You should accept Project A and reject Project B based on their respectiv NPVs. B. You should accept Project B and reject Project A based on their respectiv NPVs. C. You should accept Project A and reject Project B based on their respectiv IRRs. D. You should accept Project B and reject Project A based on their respectiv IRRs. E. You should accept both projects based on both the NPV and IRR decision rules. NPVA=$125,000+1.16$46,000+1.162$79,000+1.162$51,000=$6,038,58NPVA=$135,000+1.16$50,000+1.162$30,000+1.163$110,000=$870.68IRA=0=$125,000+1+RR$46,000+(1+RR)2$79,000+(1+IRR)2$51,000IR5=0=$135,000+1+RR$50,000+(1+RR)2$30,000+(1+RR)2$110,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts