Question: Why they use different solutions when they solve the weighted average cost ? 7000 7.000 10 For each case, show the computation of the ending

Why they use different solutions when they solve the weighted average cost ?

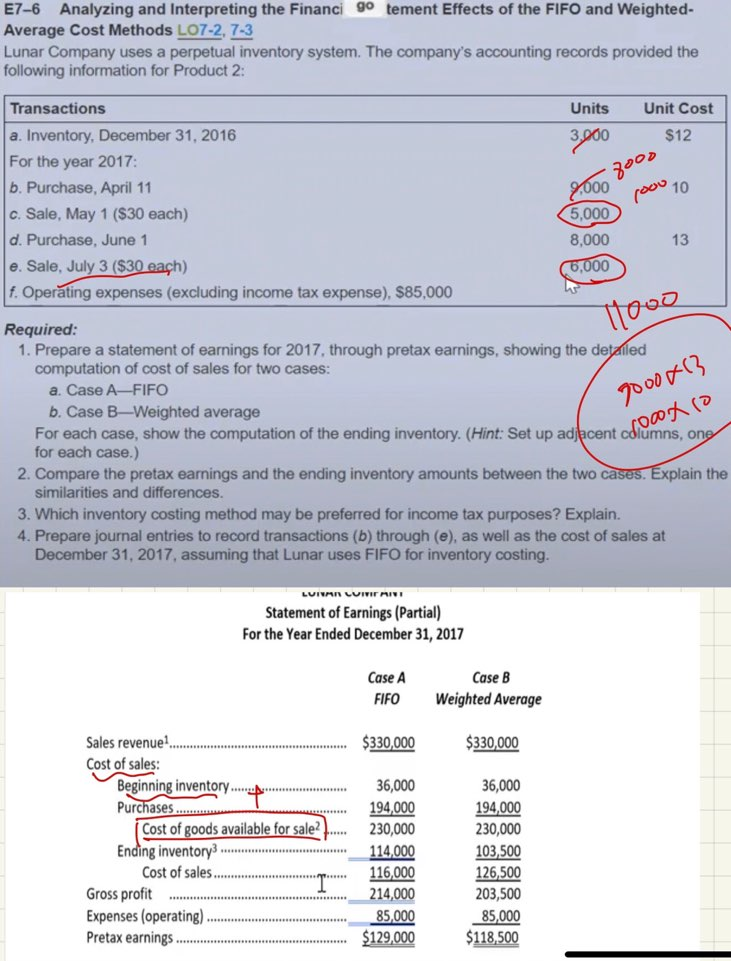

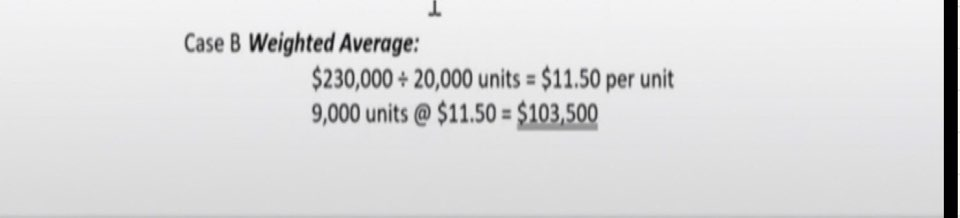

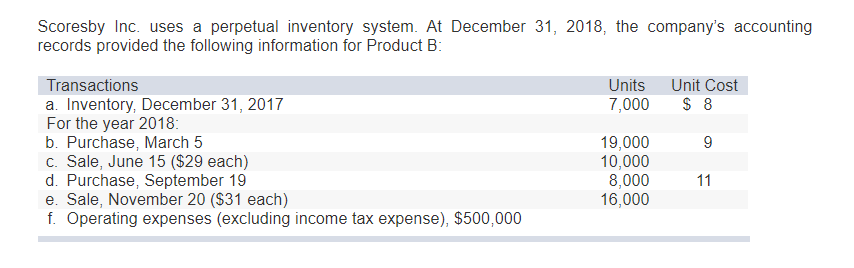

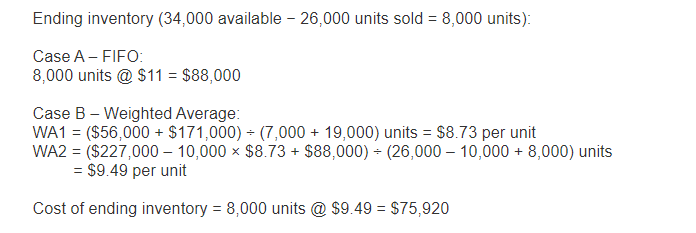

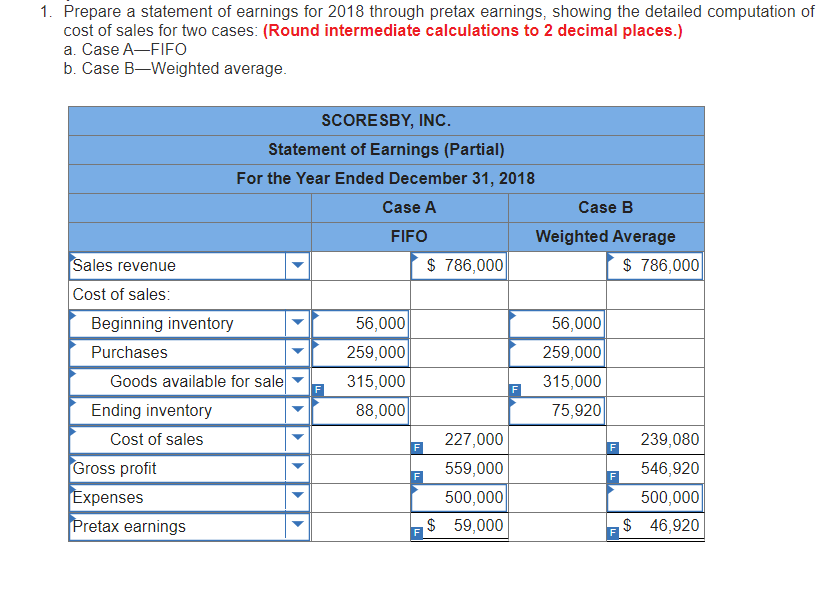

7000 7.000 10 For each case, show the computation of the ending inventory. (Hint: Set up adjacent od 00X E7-6 Analyzing and Interpreting the Financigo tement Effects of the FIFO and Weighted- Average Cost Methods L07-2, 7-3 Lunar Company uses a perpetual inventory system. The company's accounting records provided the following information for Product 2: Transactions Units Unit Cost a. Inventory, December 31, 2016 3.000 $12 For the year 2017: b. Purchase, April 11 C. Sale, May 1 ($30 each) d. Purchase, June 1 e. Sale, July 3 ($30 each) f. Operating expenses (excluding income tax expense). $85,000 Required: 1. Prepare a statement of earnings for 2017, through pretax earnings, showing the detailed computation of cost of sales for two cases: a. Case A-FIFO b. Case B-Weighted average 5,000 8,000 6,000 13 Hooo 200043 one for each case.) 2. Compare the pretax earnings and the ending inventory amounts between the two cases. Explain the similarities and differences. 3. Which inventory costing method may be preferred for income tax purposes? Explain. 4. Prepare journal entries to record transactions (b) through (e), as well as the cost of sales at December 31, 2017, assuming that Lunar uses FIFO for inventory costing. LUISAN LUIVIERII Statement of Earnings (Partial) For the Year Ended December 31, 2017 Case A FIFO Case B Weighted Average $330,000 $330,000 Sales revenue Cost of sales: Beginning inventory..... Purchases... Cost of goods available for sale?.... Ending inventory Cost of sales Gross profit Expenses (operating) Pretax earnings 36,000 194,000 230,000 114,000 116,000 214,000 85,000 $129,000 36,000 194,000 230,000 103,500 126,500 203,500 85,000 $118,500 Case B Weighted Average: $230,000 + 20,000 units = $11.50 per unit 9,000 units @ $11.50 = $103,500 Scoresby Inc. uses a perpetual inventory system. At December 31, 2018, the company's accounting records provided the following information for Product B: Units 7,000 Unit Cost $ 8 9 Transactions a. Inventory, December 31, 2017 For the year 2018: b. Purchase, March 5 c. Sale, June 15 ($29 each) d. Purchase, September 19 e. Sale, November 20 ($31 each) f. Operating expenses (excluding income tax expense), $500,000 19,000 10,000 8,000 16,000 11 Ending inventory (34,000 available - 26,000 units sold = 8,000 units): Case A - FIFO: 8,000 units @ $11 = $88,000 Case B - Weighted Average: WA1 = ($56,000+ $171,000) = (7,000 + 19,000) units = $8.73 per unit WA2 = ($227,000 10,000 - $8.73 + $88,000) = (26,000 10,000 + 8,000) units = $9.49 per unit Cost of ending inventory = 8,000 units @ $9.49 = $75,920 1. Prepare a statement of earnings for 2018 through pretax earnings, showing the detailed computation of cost of sales for two cases: (Round intermediate calculations to 2 decimal places.) a. Case A-FIFO b. Case BWeighted average. SCORESBY, INC. Statement of Earnings (Partial) For the Year Ended December 31, 2018 Case A Case B FIFO Weighted Average Sales revenue $ 786,000 $ 786,000 Cost of sales: Beginning inventory 56,000 56,000 Purchases 259,000 259,000 Goods available for sale 315,000 315,000 Ending inventory 88,000 75,920 Cost of sales 227,000 239,080 Gross profit 559,000 546,920 Expenses 500,000 500,000 Pretax earnings $ 59,000 $ 46,920 F F F F F F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts