Question: why when calculating the new COGS variable we have to multiply by 70% rather than 880% ? of Fanning Company's four divisions. The following presentation

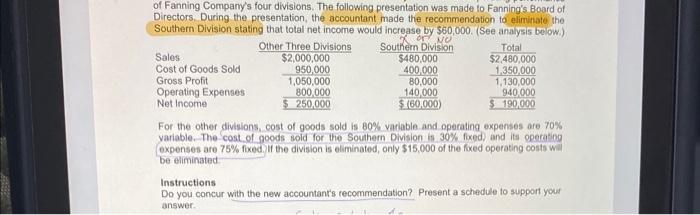

of Fanning Company's four divisions. The following presentation was made to Fanning's Board of Directors. During the presentation, the accountant made the recommendation to elimiliate the Southern Division stating that total net income would increase by $30,000. (See analysis below.) For the other divisions, cost of goods sold is 80% varlable and operating expenses are 70% yariable. The-cost of poods sold for the Southem Division is 30\% fixed. and its operating expenses are 75% foxed. II the division is eliminated, only $15,000 of the fred operating costs will be eliminated- Instructions Do you concur with the new accountant's recommendation? Present a schedule to support your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts