Question: Widget Corp. has to choose between two mutually exclusive projects. If it chooses project A. Widget Corp. will have the opportunity to make a

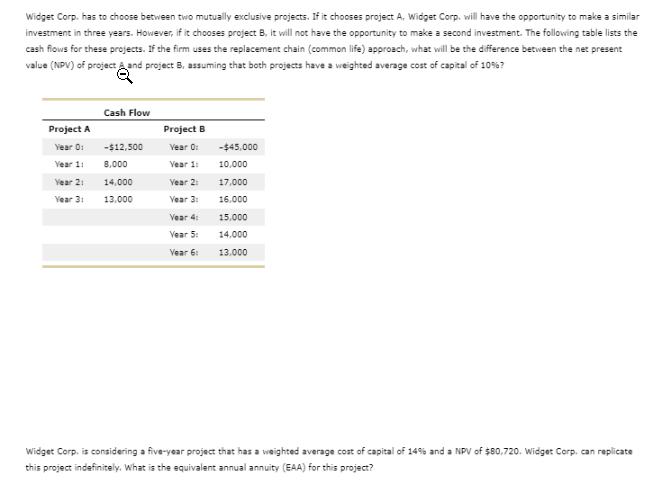

Widget Corp. has to choose between two mutually exclusive projects. If it chooses project A. Widget Corp. will have the opportunity to make a similar investment in three years. However, if it chooses project B, it will not have the opportunity to make a second investment. The following table lists the cash flows for these projects. If the firm uses the replacement chain (common life) approach, what will be the difference between the net present value (NPV) of project and project B, assuming that both projects have a weighted average cost of capital of 10%? Q Project A Year 0: Year 11 Year 21 Year 31 Cash Flow -$12,500 8,000 14,000 13.000 Project B Year 0: Year 1: Year 2: Year 3: Year 4: Year 5: Year 6: -$45,000 10,000 17,000 16.000 15,000 14.000 13.000 Widget Corp. is considering a five-year project that has a weighted average cost of capital of 14% and a NPV of $80,720. Widget Corp. can replicate this project indefinitely. What is the equivalent annual annuity (EAA) for this project?

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

To answer the first question we need to calculate the net present value NPV of both projects using t... View full answer

Get step-by-step solutions from verified subject matter experts