Question: WIDGETCO produces widgets. Each widget generates $ 4 6 0 in revenue and requires one ounce of gold as an input. WIDGETCO plans to produce

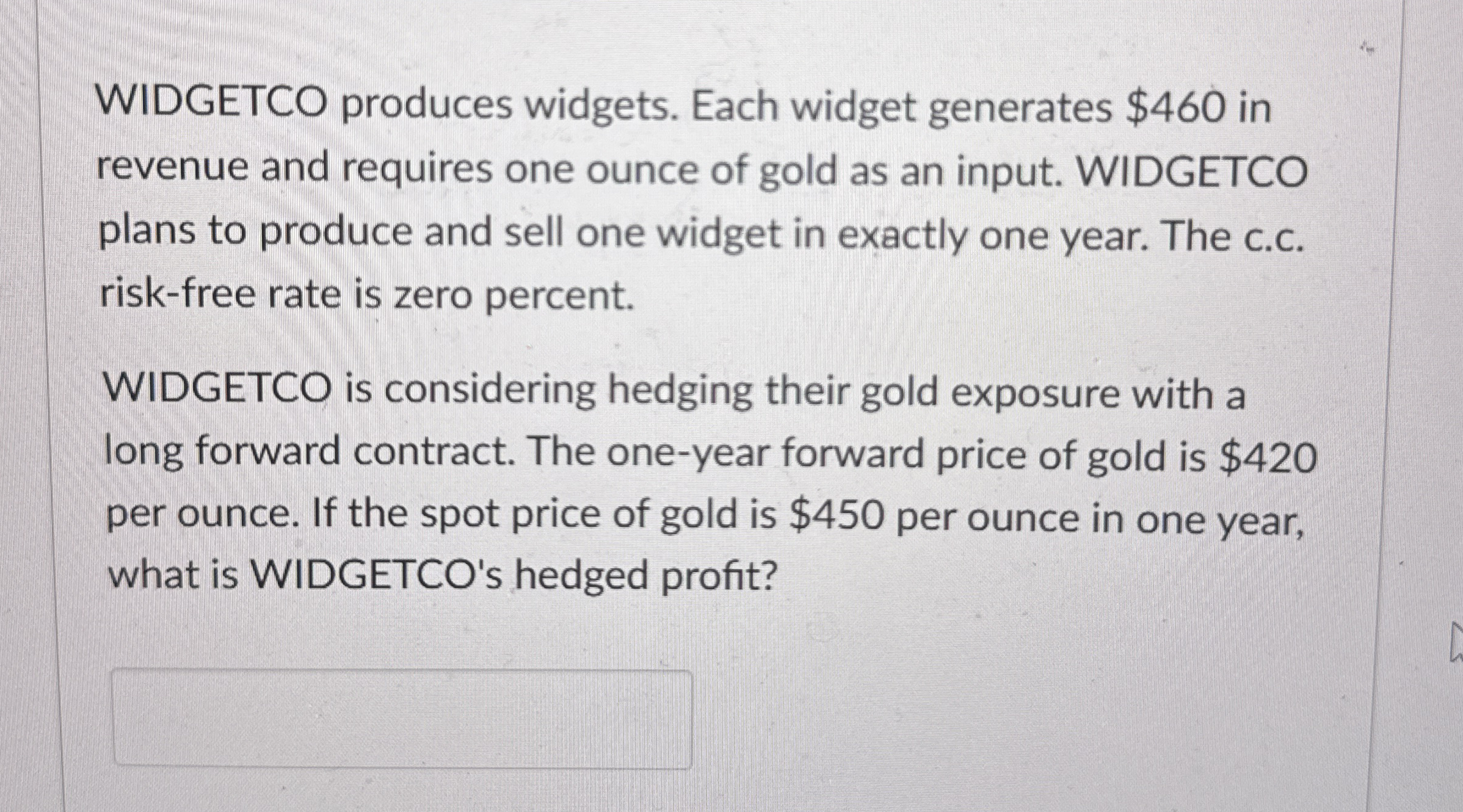

WIDGETCO produces widgets. Each widget generates $ in

revenue and requires one ounce of gold as an input. WIDGETCO

plans to produce and sell one widget in exactly one year. The cc

riskfree rate is zero percent.

WIDGETCO is considering hedging their gold exposure with a

long forward contract. The oneyear forward price of gold is $

per ounce. If the spot price of gold is $ per ounce in one year,

what is WIDGETCO's hedged profit?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock