Question: Widgets & Co. is trying to estimate its optimal capital structure. Right now, the company has a capital structure that consists of 10 percent debt

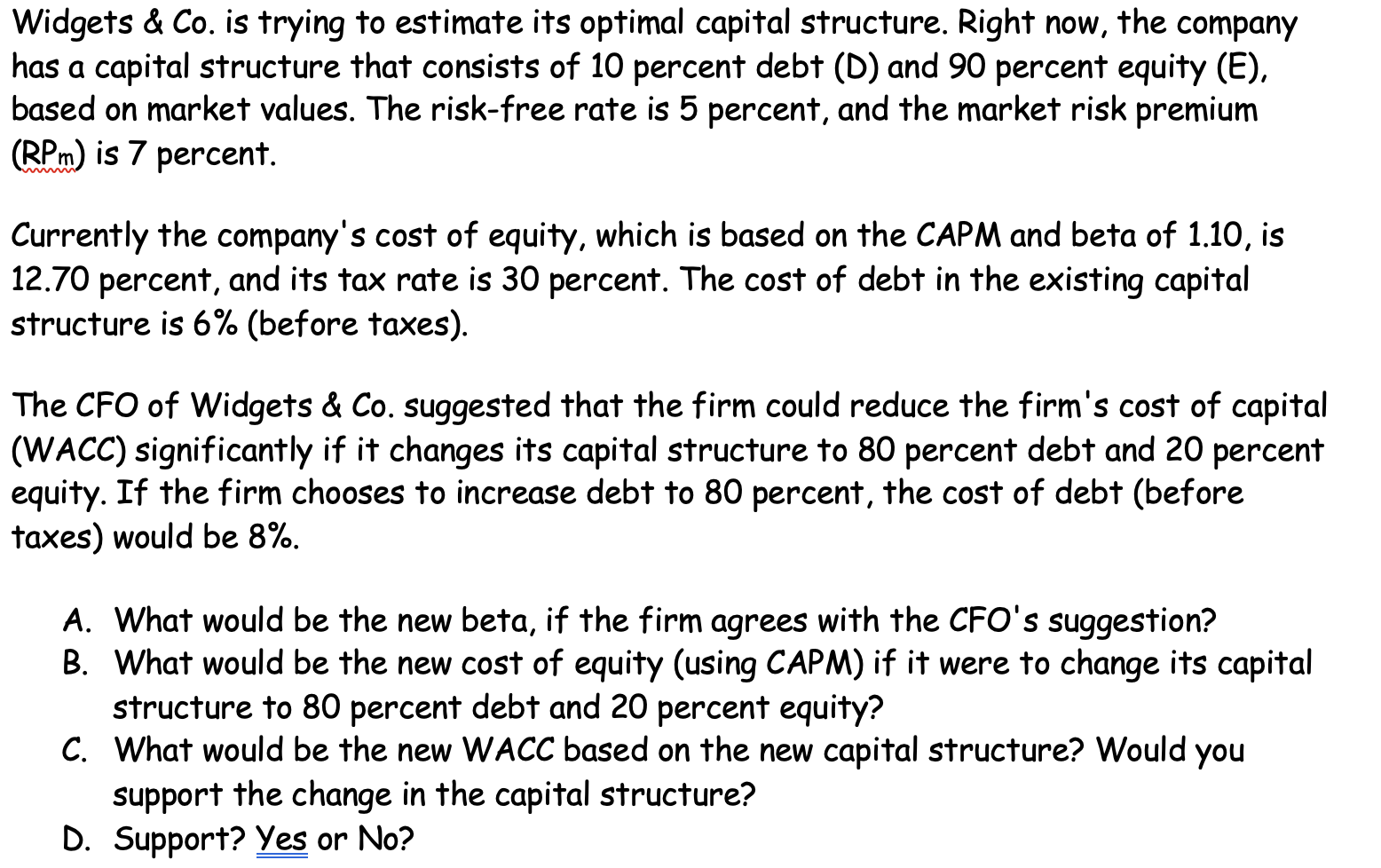

Widgets & Co. is trying to estimate its optimal capital structure. Right now, the company has a capital structure that consists of 10 percent debt (D) and 90 percent equity (E). based on market values. The risk-free rate is 5 percent, and the market risk premium (RPM) is 7 percent. Currently the company's cost of equity, which is based on the CAPM and beta of 1.10, is 12.70 percent, and its tax rate is 30 percent. The cost of debt in the existing capital structure is 6% (before taxes). The CFO of Widgets & Co. suggested that the firm could reduce the firm's cost of capital (WACC) significantly if it changes its capital structure to 80 percent debt and 20 percent equity. If the firm chooses to increase debt to 80 percent, the cost of debt (before taxes) would be 8%. A. What would be the new beta, if the firm agrees with the CFO's suggestion? B. What would be the new cost of equity (using CAPM) if it were to change its capital structure to 80 percent debt and 20 percent equity? C. What would be the new WACC based on the new capital structure? Would you support the change in the capital structure? D. Support? Yes or No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts