Question: WIII ve given for the correct answer only. In order to receive full credit, you must show some work on problems 1 through 6. Showing

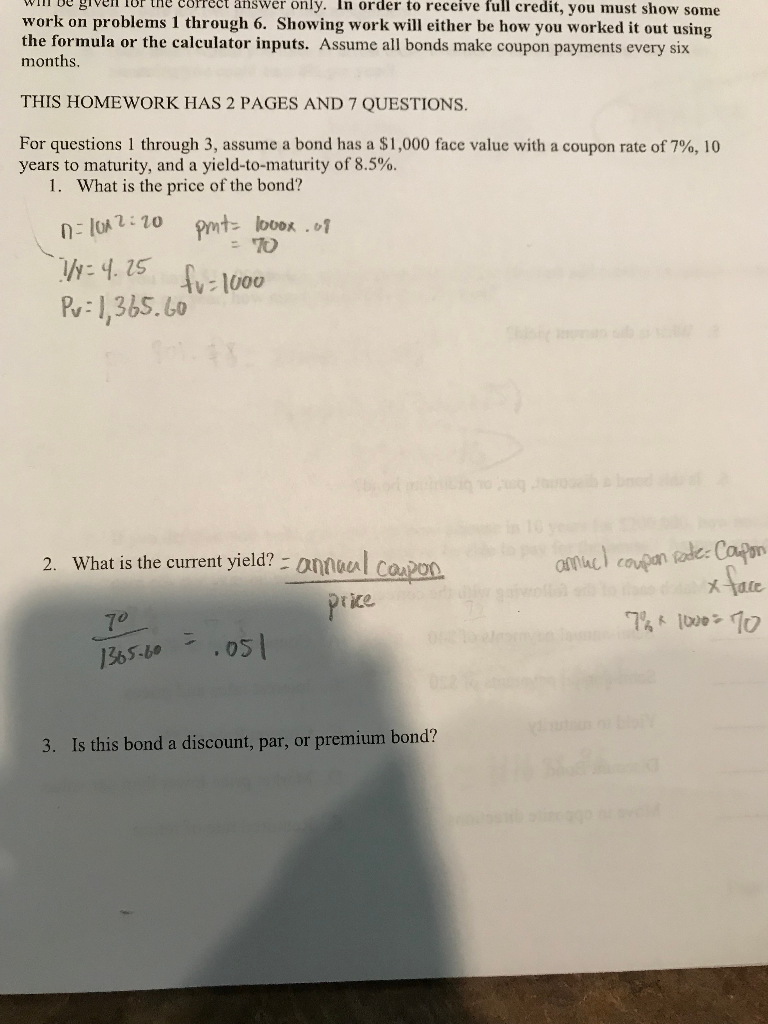

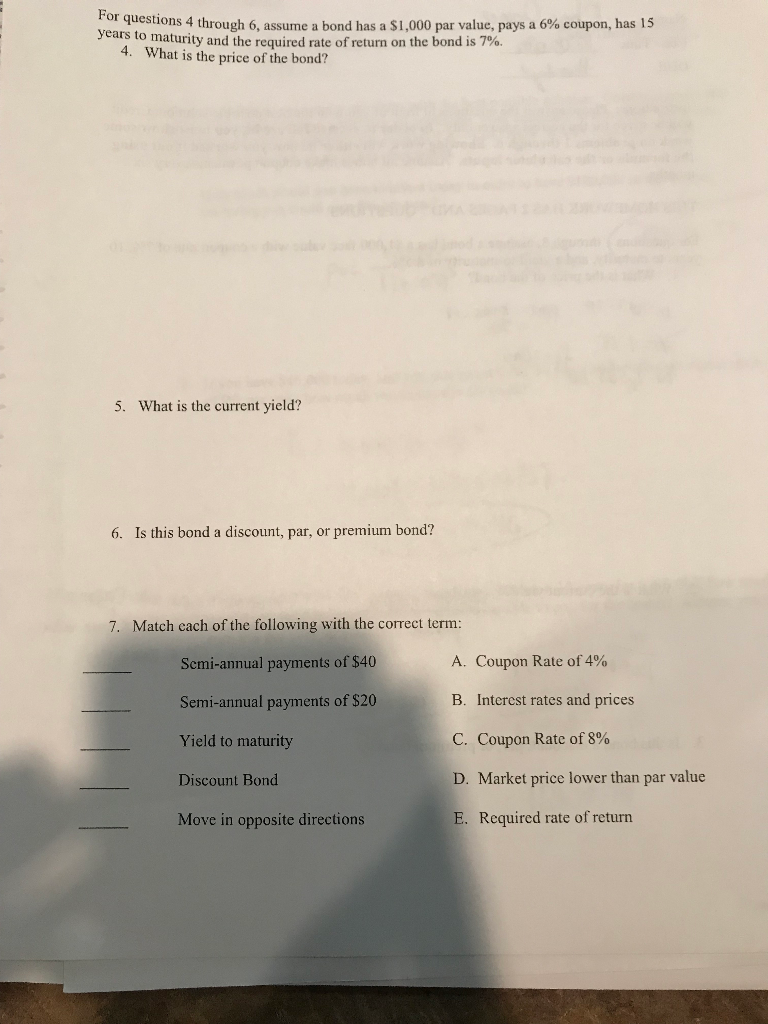

WIII ve given for the correct answer only. In order to receive full credit, you must show some work on problems 1 through 6. Showing work will either be how you worked it out using the formula or the calculator inputs. Assume all bonds make coupon payments every six months. THIS HOMEWORK HAS 2 PAGES AND 7 QUESTIONS. For questions 1 through 3, assume a bond has a $1,000 face value with a coupon rate of 7%, 10 years to maturity, and a yield-to-maturity of 8.5%. 1. What is the price of the bond? 70 1:2012:20 pmt- lovox .08 1/1=4.25 fu=1000 Pw=1,365.60 2. What is the current yield? - annual coupon amacl coupon code:Capon x tace price 70 76* 1000= 70 1365.60 - .051 3. Is this bond a discount, par, or premium bond? ons 4 through 6, assume a bond has a $1,000 par value, pays a 6% coupon, has 15 years to maturity and the required rate of return on the bond is 7%. 4. What is the price of the bond? 5. What is the current yield? 6. Is this bond a discount, par, or premium bond? 7. Match each of the following with the correct term: Scmi-annual payments of $40 A. Coupon Rate of 4% Semi-annual payments of $20 B. Interest rates and prices Yield to maturity C. Coupon Rate of 8% Discount Bond D. Market price lower than par value Move in opposite directions E. Required rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts