Question: Wiley 22 - If you're not able to answer each question. Please skip entirely. Thank you. 1) ____________________________________________________ 2) Barnes Company reports the following operating

Wiley 22 - If you're not able to answer each question. Please skip entirely. Thank you.

1)  ____________________________________________________

____________________________________________________

2) Barnes Company reports the following operating results for the month of August: sales $300,000 (units 5,000); variable costs $223,000; and fixed costs $70,800. Management is considering the following independent courses of action to increase net income. Compute the net income to be earned under each alternative.

_____________________________________________________________

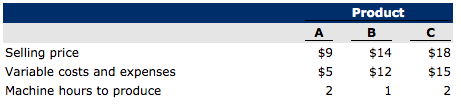

3) Mars Company manufactures and sells three products. Relevant per unit data concerning each product are given below.

_____________________________________________________________________________

4)

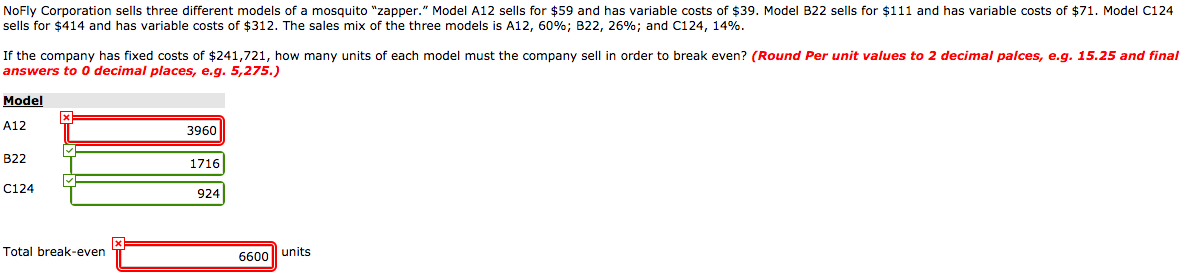

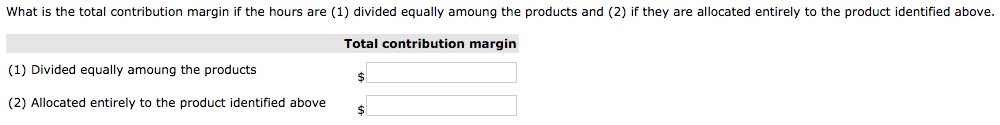

NoFly Corporation sells three different models of a mosquito "zapper." Model A12 sells for $59 and has variable costs of $39. Model B22 sells for $111 and has variable costs of $71. Model C124 sells for $414 and has variable costs of $312. The sales mix of the three models is A12, 60%; B22, 26%; and C124, 14%. If the company has fixed costs of $241,721, how many units of each model must the company sell in order to break even? (Round Per unit values to 2 decimal palces, e.g. 15.25 and final answers to 0 decimal places, e.g. 5,275.) Model x A12 3960 B22 1716 C124 924 X Total break-even 6600 units 1. Increase selling price by 10% with no change in total variable costs or sales volume. Net income 36,100 2. Reduce variable costs to 56% of sales. Net income 168,000 3. Reduce fixed costs by $18,000. Net income Which course of action will produce the highest net income LINK TO TEXT Alternative 1 Alternative 2 Alternative 3 Selling price Variable costs and expenses Machine hours to produce $9 $5 NUL Product B $14 $12 1 $18 $15 2 What is the total contribution margin if the hours are (1) divided equally amoung the products and (2) if they are allocated entirely to the product identified above. Total contribution margin (1) Divided equally amoung the products (2) Allocated entirely to the product identified above Crate Express Co. produces wooden crates used for shipping products by ocean liner. In 2017, Crate Express incurred the following costs. $57,000 $400 $42,600 Wood used in crate production Nails (considered insignificant and a variable expense) Direct labor Utilities for the plant: $1,300 each month, plus $0.40 for each kilowatt-hour used each month Rent expense for the plant for the year $23,600 Assume Crate Express used an average 700 kilowatt-hours each month over the past year. (a) What is Crate Express's total manufacturing cost if it uses a variable costing approach? Total manufacturing costs $ (b) What is Crate Express's total manufacturing cost if it uses an absorption costing approach? Total manufacturing costs $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts