Question: Will all be based on how you do in Part 2 - you do not have to turn this Part 1 in ABC Company has

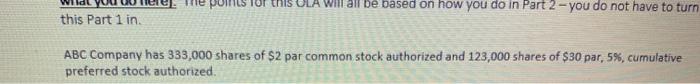

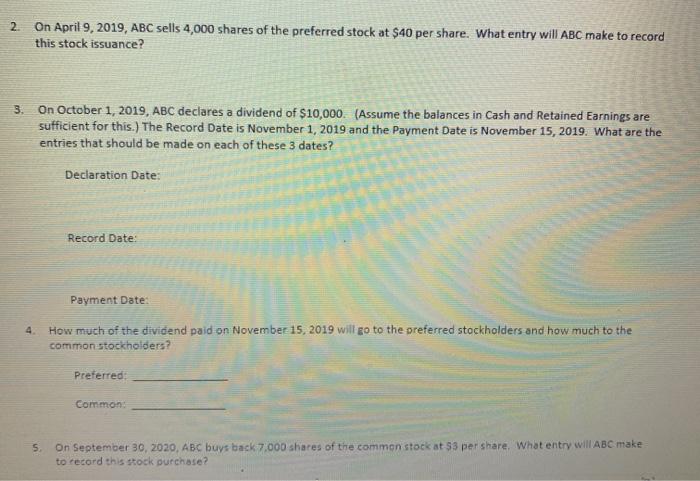

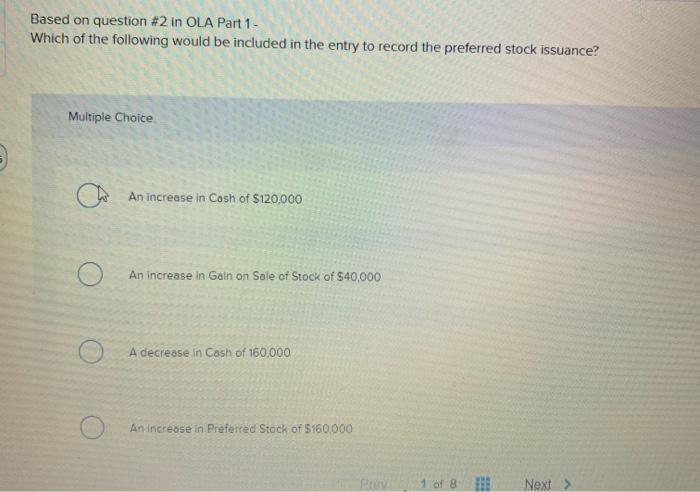

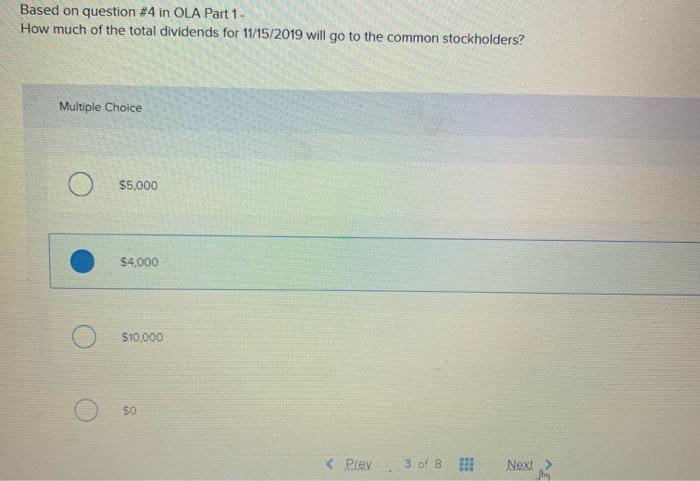

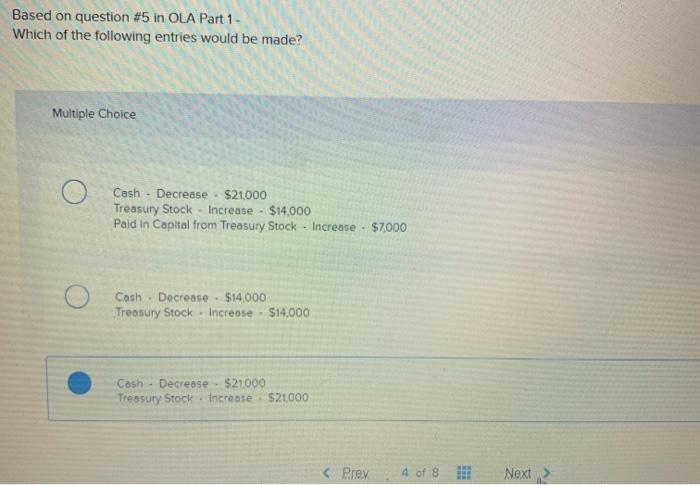

Will all be based on how you do in Part 2 - you do not have to turn this Part 1 in ABC Company has 333,000 shares of $2 par common stock authorized and 123,000 shares of $30 par, 5%, cumulative preferred stock authorized 2 On April 9, 2019, ABC sells 4,000 shares of the preferred stock at $40 per share. What entry will ABC make to record this stock issuance? 3. On October 1, 2019, ABC declares a dividend of $10,000. (Assume the balances in Cash and Retained Earnings are sufficient for this.) The Record Date is November 1, 2019 and the Payment Date is November 15, 2019. What are the entries that should be made on each of these 3 dates? Declaration Date: Record Date: Payment Date: How much of the dividend paid on November 15, 2019 will go to the preferred stockholders and how much to the common stockholders? Preferred Common 5 On September 30, 2020, ABC buys back 7.000 shares of the common stock at $3 per share. Whatentry will ABC make to record this stock purchase? Based on question #2 in OLA Part 1 - Which of the following would be included in the entry to record the preferred stock issuance? Multiple Choice An increase in Cash of $120,000 An increase in Gain on Sale of Stock of $40,000 A decrease in Cash of 160.000 An increase in Preferred Stock of $160.000 RE 1 of 8 Next > Based on question #3 in OLA Part 1 - Which of the following entries would be made on the Declaration Date? Multiple Choice Cash - Decrease - $10,000 Dividends Payable - Decrease - $10,000 No entry is made on the Declaration Date an entry will be made when the dividends are paid Dividends. Increase - $10,000 Cash - Decrease - $10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts