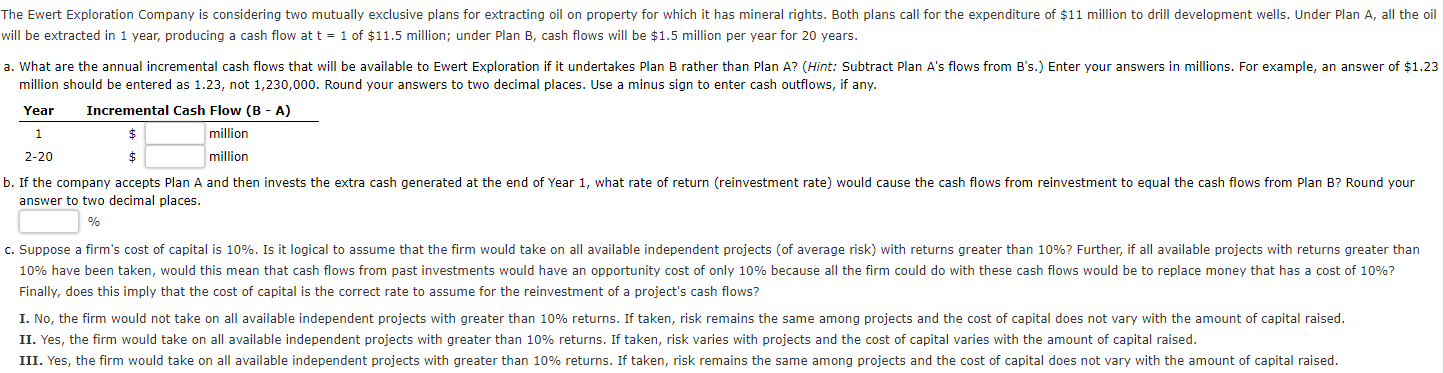

Question: will be extracted in 1 year, producing a cash flow at t=1 of $11.5 million; under Plan B, cash flows will be $1.5 million per

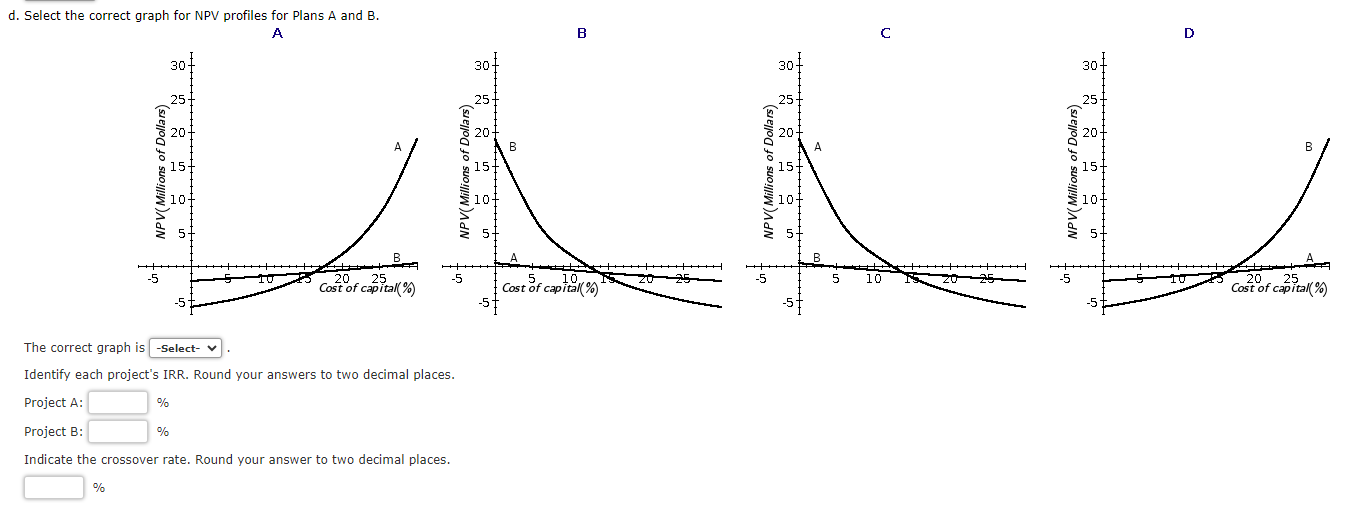

will be extracted in 1 year, producing a cash flow at t=1 of $11.5 million; under Plan B, cash flows will be $1.5 million per year for 20 years. million should be entered as 1.23 , not 1,230,000. Round your answers to two decimal places. Use a minus sign to enter cash outflows, if any. answer to two decimal places. % Finally, does this imply that the cost of capital is the correct rate to assume for the reinvestment of a project's cash flows? II. Yes, the firm would take on all available independent projects with greater than 10% returns. If taken, risk varies with projects and the cost of capital varies with the amount of capital raised. d. Select the correct graph for NPV profiles for Plans A and B. A The correct graph is Identify each project's IRR. Round your answers to two decimal places. Project A: % Project B: % Indicate the crossover rate. Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts