Question: Will give a good rating for the correct answer. 1. (35) Consider a variation of the Glosten-Milgrom sequential trade model where the asset's value V

Will give a good rating for the correct answer.

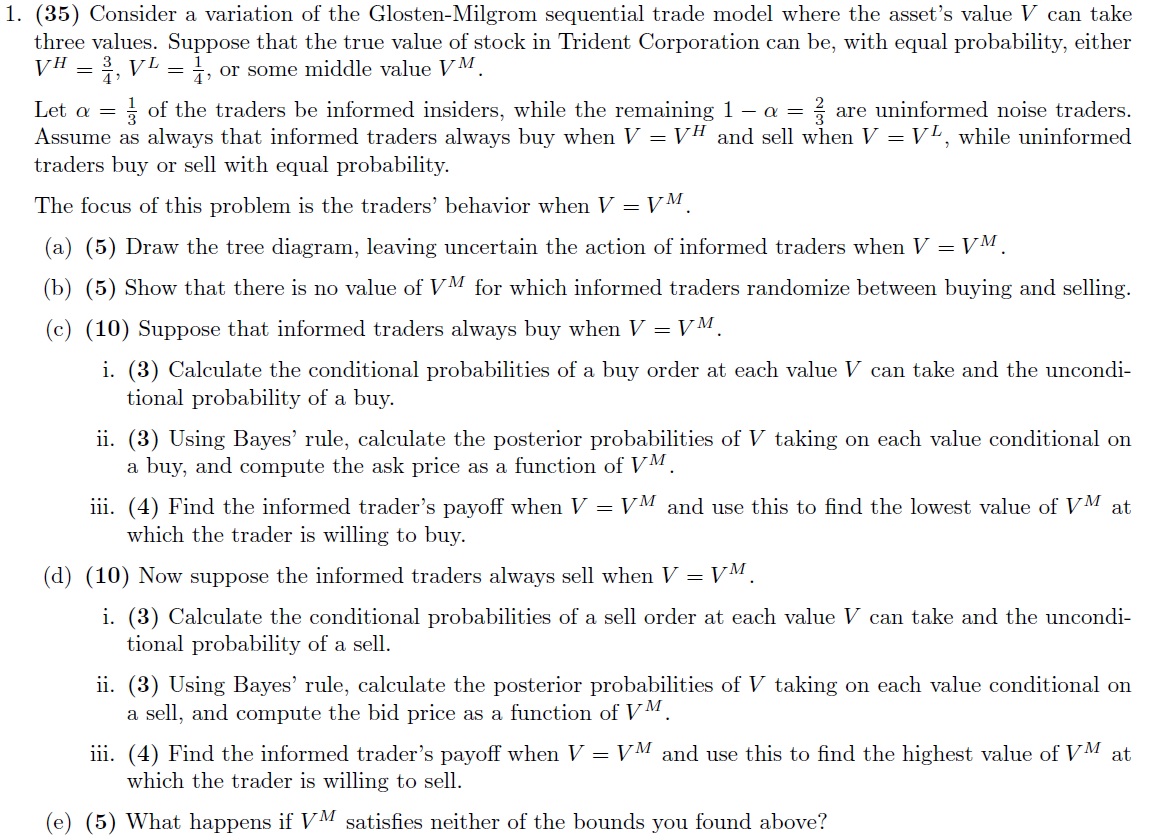

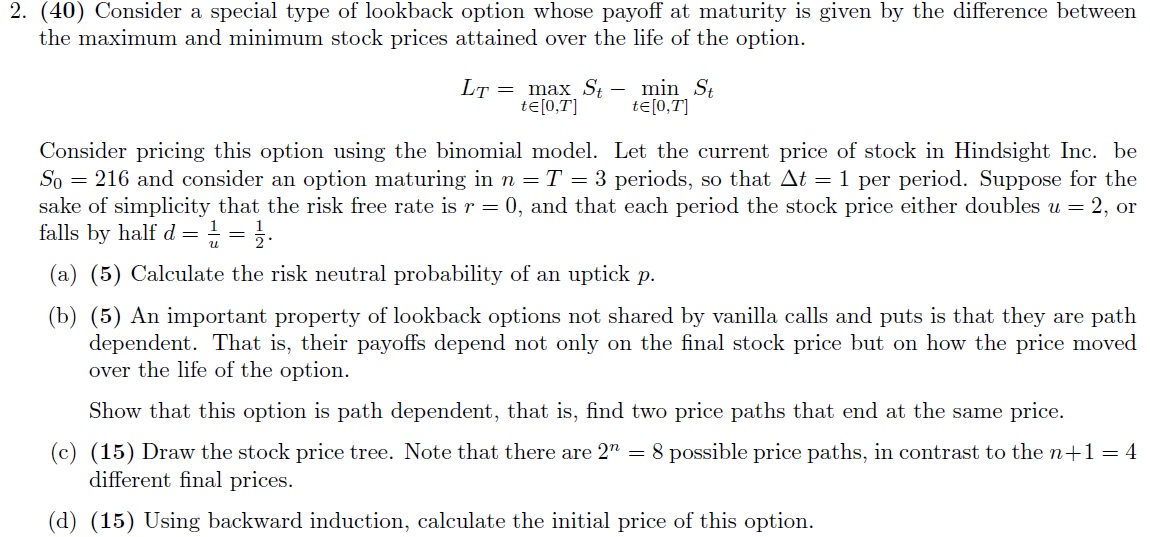

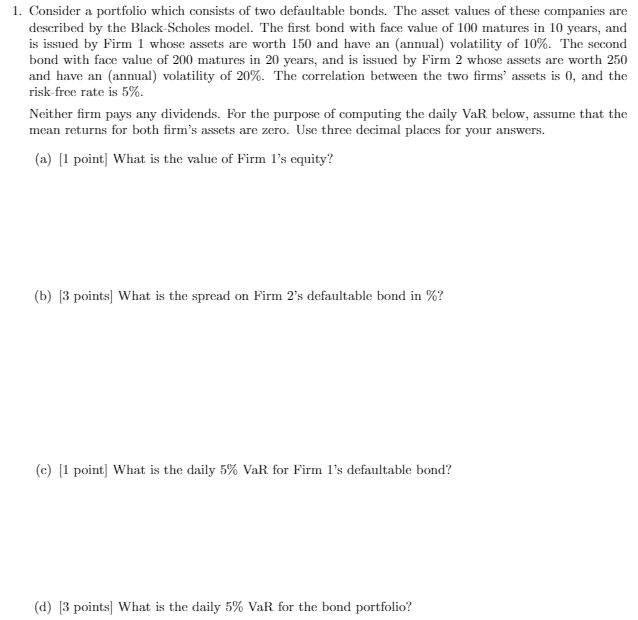

1. (35) Consider a variation of the Glosten-Milgrom sequential trade model where the asset's value V can take three values. Suppose that the true value of stock in Trident Corporation can be, with equal probability, either VH : %, VL : i, or some middle value VM. Let a: : % of the traders be informed insiders, while the remaining 1 o: : g are uninformed noise traders. Assume as always that informed traders always buy when V = VH and sell when V = VL, while uninformed traders buy or sell with equal probability. The focus of this problem is the traders' behavior when V 2 VM . (a) (5) Draw the tree diagram, leaving uncertain the action of informed traders when V 2 VM . (b) (5) Show that there is no value of VM for which informed traders randomize between buying and selling. (c) (10) Suppose that informed traders always buy when V 2 VM . i. (3) Calculate the conditional probabilities of a buy order at each value V can take and the uncondi- tional probability of a buy. ii. (3) Using Bayes' rule, calculate the posterior probabilities of V taking on each value conditional on a buy, and compute the ask price as a function of VM . iii. (4) Find the informed trader's payoff when V 2 VM and use this to nd the lowest value of VM at which the trader is willing to buy. (d) (10) Now suppose the informed traders always sell when V 2 VM . i. (3) Calculate the conditional probabilities of a sell order at each value V can take and the uncondi- tional probability of a sell. ii. (3) Using Bayes' rule, calculate the posterior probabilities of V taking on each value conditional on a sell, and compute the bid price as a function of VM . iii. (4) Find the informed trader's payoff when V 2 VM and use this to nd the highest value of VM at which the trader is willing to sell. (e) (5) What happens if VM satises neither of the bounds you found above? 2. (40) Consider a special type of lookback option whose payoff at maturity is given by the difference between the maximum and minimum stock prices attained over the life of the option. LT = max St - min St te[0,T] te[0,T] Consider pricing this option using the binomial model. Let the current price of stock in Hindsight Inc. be So = 216 and consider an option maturing in n = T = 3 periods, so that At = 1 per period. Suppose for the sake of simplicity that the risk free rate is r = 0, and that each period the stock price either doubles u = 2, or falls by half d = = = ?. (a) (5) Calculate the risk neutral probability of an uptick p. (b) (5) An important property of lookback options not shared by vanilla calls and puts is that they are path dependent. That is, their payoffs depend not only on the final stock price but on how the price moved over the life of the option. Show that this option is path dependent, that is, find two price paths that end at the same price. (c) (15) Draw the stock price tree. Note that there are 2" = 8 possible price paths, in contrast to the n+1 = 4 different final prices. (d) (15) Using backward induction, calculate the initial price of this option.1. Consider a portfolio which consists of two defaultable bonds. The asset values of these companies are described by the Black-Scholes model. The first bond with face value of 100 matures in 10 years, and is issued by Firm 1 whose assets are worth 150 and have an (annual) volatility of 10%. The second bond with face value of 200 matures in 20 years, and is issued by Firm 2 whose assets are worth 250 and have an (annual) volatility of 20%. The correlation between the two firms' assets is 0, and the risk-free rate is 5%. Neither firm pays any dividends. For the purpose of computing the daily Vak below, assume that the mean returns for both firm's assets are zero. Use three decimal places for your answers. (a) [1 point] What is the value of Firm I's equity? (b) [3 points] What is the spread on Firm 2's defaultable bond in %? (c) [1 point] What is the daily 5% VaR for Firm I's defaultable bond? (d) [3 points] What is the daily 5% VaR for the bond portfolio