Question: ****** WILL GIVE THUMB UP RESPONSE! ****** Here are 2018 federal personal income tax brackets for individuals under original and new tax rules. Taxable Gross

****** WILL GIVE THUMB UP RESPONSE! ******

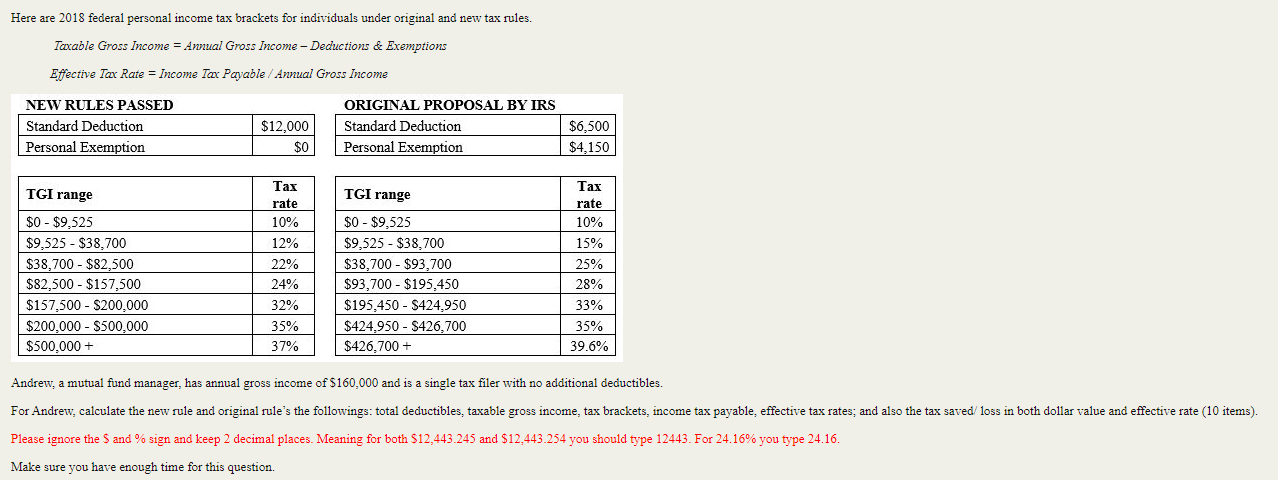

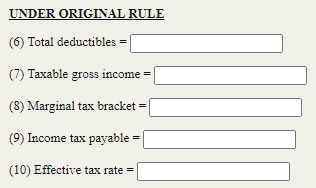

Here are 2018 federal personal income tax brackets for individuals under original and new tax rules. Taxable Gross Income = Annual Gross Income - Deductions & Exemptions Effective Tax Rate = Income Tone Payable / Annual Gross Income NEW RULES PASSED Standard Deduction Personal Exemption $12,000 $0 ORIGINAL PROPOSAL BY IRS Standard Deduction Personal Exemption $6,500 $4,150 TGI range TGI range Tax rate 10% 12% 22% $0-$9,525 $9,525 - $38,700 $38,700 - $82,500 $82,500 - $157,500 $157,500 - $200,000 $200,000 - $500,000 $500,000+ Tax rate 10% 15% 25% 28% 33% 35% 39.6% $0-$9,525 $9,525 - $38,700 $38,700 - $93,700 $93,700 - $195,450 $195,450 - $424,950 $424,950 - $426,700 $426.700 + 24% 32% 35% 37% Andrew, a mutual fund manager, has annual gross income of $160,000 and is a single tax filer with no additional deductibles. For Andrew, calculate the new rule and original rule's the followings: total deductibles, taxable gross income, tax brackets, income tax payable, effective tax rates, and also the tax saved loss in both dollar value and effective rate (10 items) Please ignore the S and % sign and keep 2 decimal places. Meaning for both $12.443.245 and $12.443.254 you should type 12443. For 24.16% you type 24.16. Make sure you have enough time for this question. UNDER ORIGINAL RULE (6) Total deductibles = (7) Taxable gross income = (8) Marginal tax bracket = (9) Income tax payable (10) Effective tax rate =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts