Question: will give thumbs up for correct answer with work Mobil Appliance Company's earnings, dividends, and stock price are expected to grow at an annual rate

will give thumbs up for correct answer with work

will give thumbs up for correct answer with work

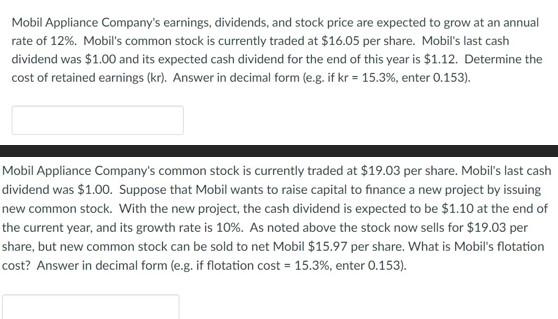

Mobil Appliance Company's earnings, dividends, and stock price are expected to grow at an annual rate of 12%. Mobil's common stock is currently traded at $16.05 per share. Mobil's last cash dividend was $1.00 and its expected cash dividend for the end of this year is $1.12. Determine the cost of retained earnings (kr). Answer in decimal form (e.g. if kr=15.3%, enter 0.153 ). Mobil Appliance Company's common stock is currently traded at $19.03 per share. Mobil's last cash dividend was $1.00. Suppose that Mobil wants to raise capital to finance a new project by issuing new common stock. With the new project, the cash dividend is expected to be $1.10 at the end of the current year, and its growth rate is 10%. As noted above the stock now sells for $19.03 per share, but new common stock can be sold to net Mobil $15.97 per share. What is Mobil's flotation cost? Answer in decimal form (e.g. if flotation cost =15.3%, enter 0.153 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts