Question: Will give thumbs up for quick and correct answer! Thank you. Laura Cervantes. Laura Cervantes is a currency speculator and she sells eight June futures

Will give thumbs up for quick and correct answer! Thank you.

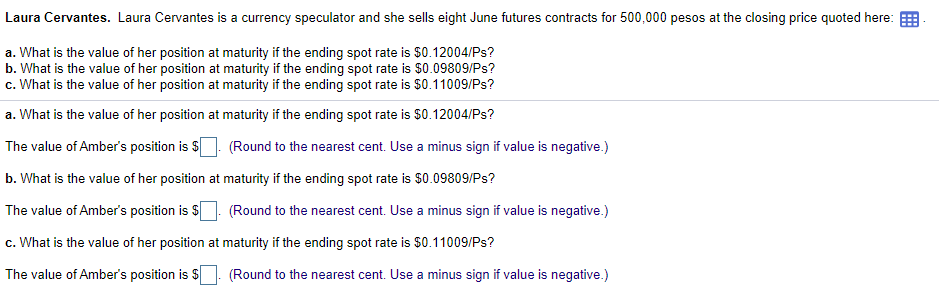

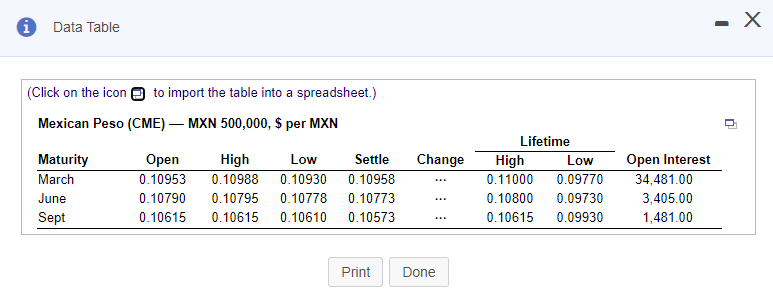

Laura Cervantes. Laura Cervantes is a currency speculator and she sells eight June futures contracts for 500,000 pesos at the closing price quoted here: a. What is the value of her position at maturity if the ending spot rate is $0.12004/Ps? b. What is the value of her position at maturity if the ending spot rate is $0.09809/Ps? c. What is the value of her position at maturity if the ending spot rate is $0.11009/Ps? a. What is the value of her position at maturity if the ending spot rate is $0.12004/Ps? The value of Amber's position is $ (Round to the nearest cent. Use a minus sign if value is negative.) b. What is the value of her position at maturity if the ending spot rate is $0.09809/Ps? The value of Amber's position is $ (Round to the nearest cent. Use a minus sign if value is negative.) c. What is the value of her position at maturity if the ending spot rate is $0.11009/Ps? The value of Amber's position is $ (Round to the nearest cent. Use a minus sign if value is negative.) - Data Table (Click on the icon to import the table into a spreadsheet.) Mexican Peso (CME) MXN 500,000, $ per MXN Change Maturity March June Sept Open 0.10953 0.10790 0.10615 High 0.10988 0.10795 0.10615 Low 0.10930 0.10778 0.10610 Settle 0.10958 0.10773 0.10573 Lifetime High Low 0.11000 0.09770 0.10800 0.09730 0.10615 0.09930 Open Interest 34,481.00 3,405.00 1,481.00 Print Done Laura Cervantes. Laura Cervantes is a currency speculator and she sells eight June futures contracts for 500,000 pesos at the closing price quoted here: a. What is the value of her position at maturity if the ending spot rate is $0.12004/Ps? b. What is the value of her position at maturity if the ending spot rate is $0.09809/Ps? c. What is the value of her position at maturity if the ending spot rate is $0.11009/Ps? a. What is the value of her position at maturity if the ending spot rate is $0.12004/Ps? The value of Amber's position is $ (Round to the nearest cent. Use a minus sign if value is negative.) b. What is the value of her position at maturity if the ending spot rate is $0.09809/Ps? The value of Amber's position is $ (Round to the nearest cent. Use a minus sign if value is negative.) c. What is the value of her position at maturity if the ending spot rate is $0.11009/Ps? The value of Amber's position is $ (Round to the nearest cent. Use a minus sign if value is negative.) - Data Table (Click on the icon to import the table into a spreadsheet.) Mexican Peso (CME) MXN 500,000, $ per MXN Change Maturity March June Sept Open 0.10953 0.10790 0.10615 High 0.10988 0.10795 0.10615 Low 0.10930 0.10778 0.10610 Settle 0.10958 0.10773 0.10573 Lifetime High Low 0.11000 0.09770 0.10800 0.09730 0.10615 0.09930 Open Interest 34,481.00 3,405.00 1,481.00 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts