Question: will help you to make informed decisions about using them. Answer the following questions about credit lines. into trouble with it requires Remember that the

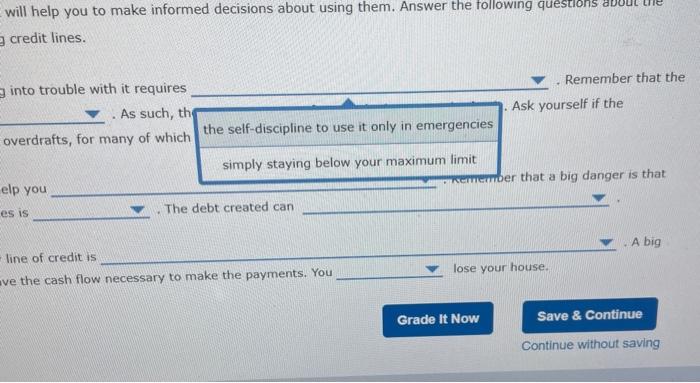

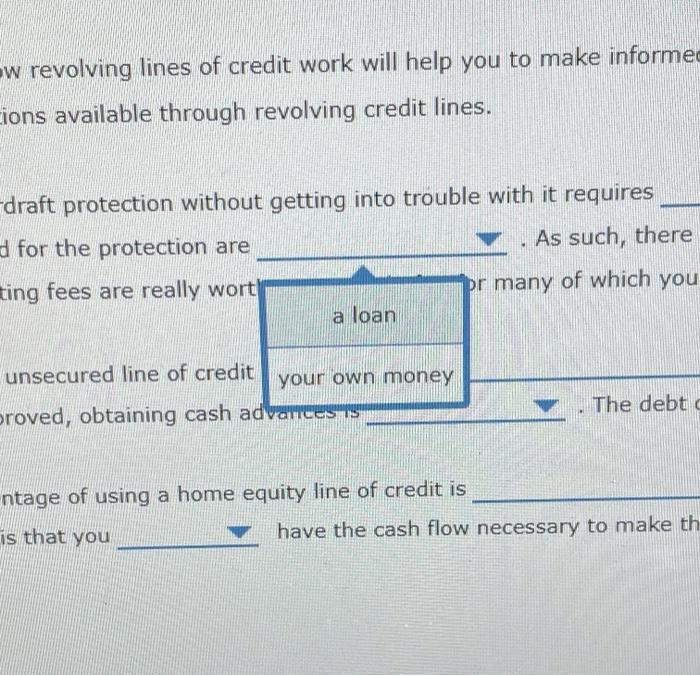

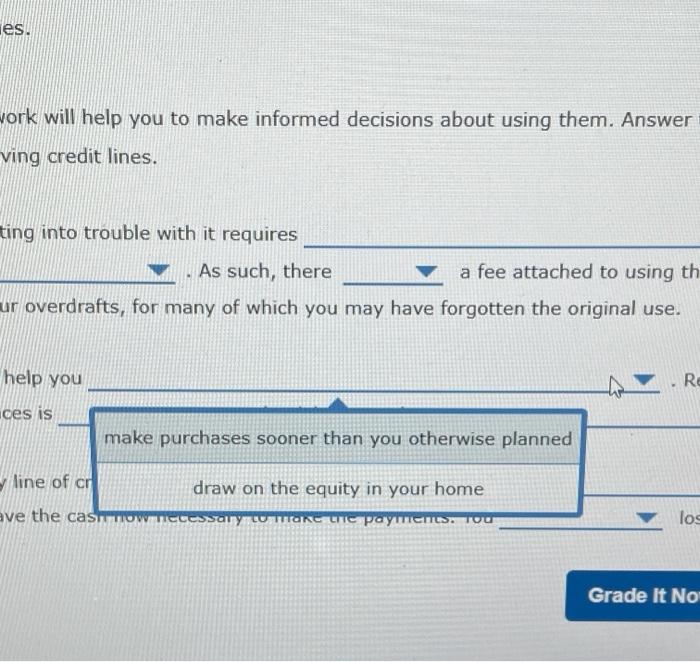

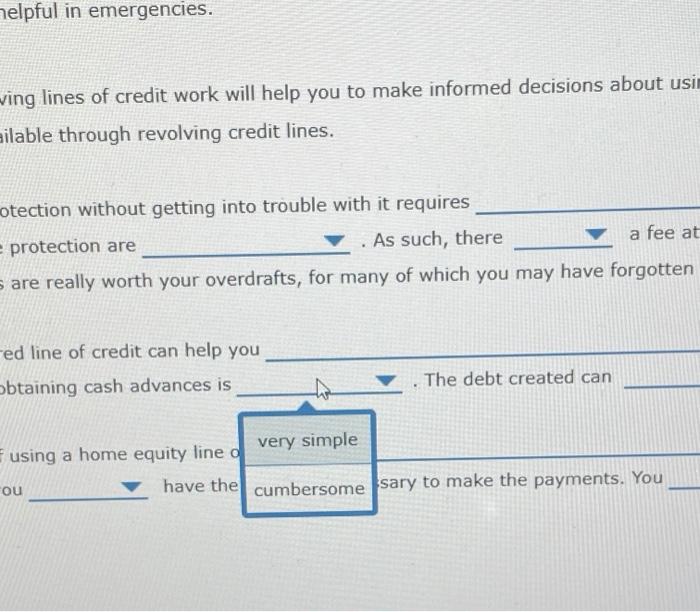

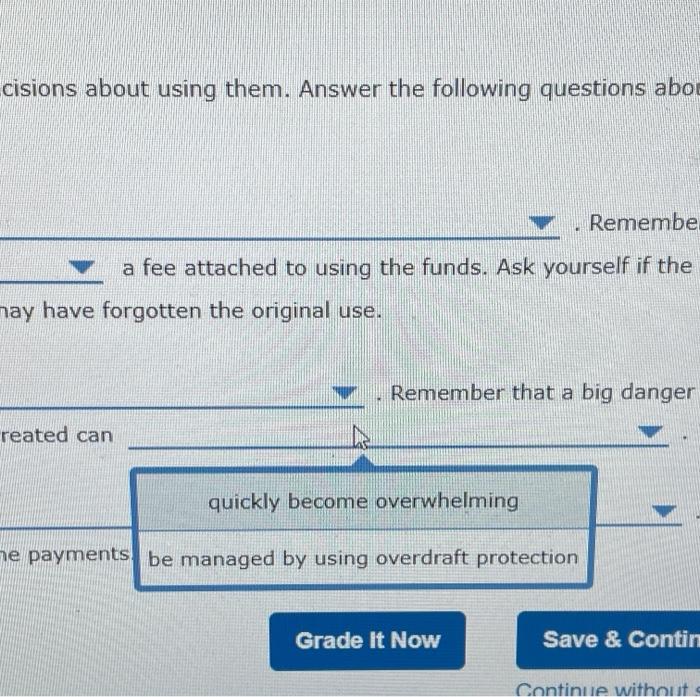

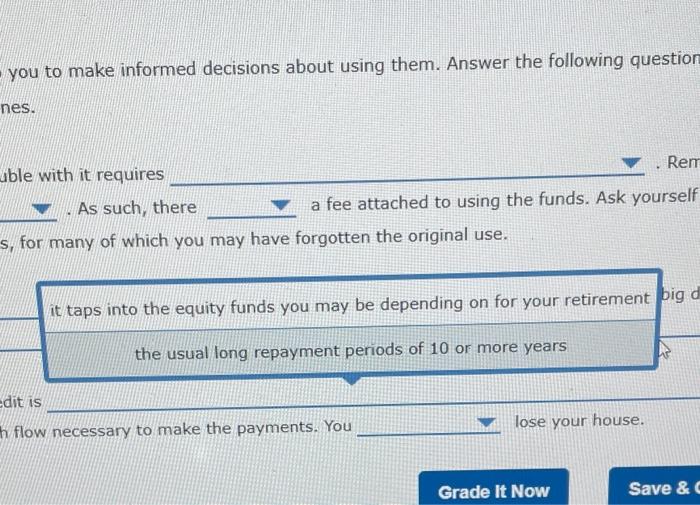

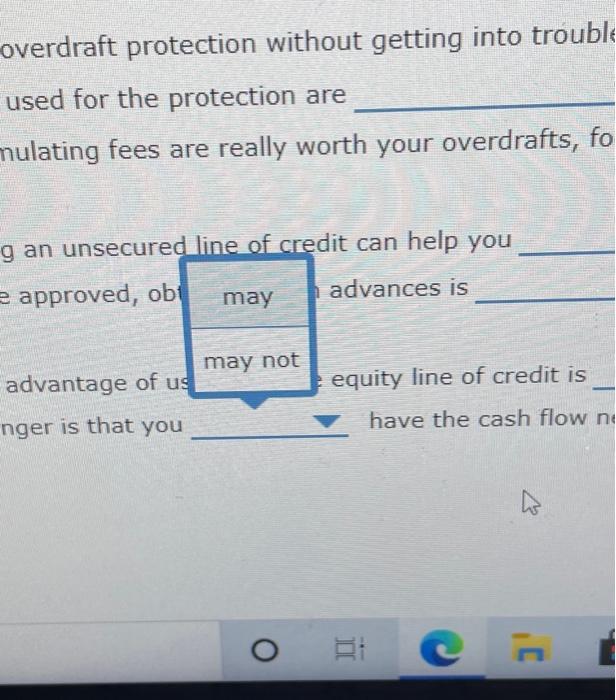

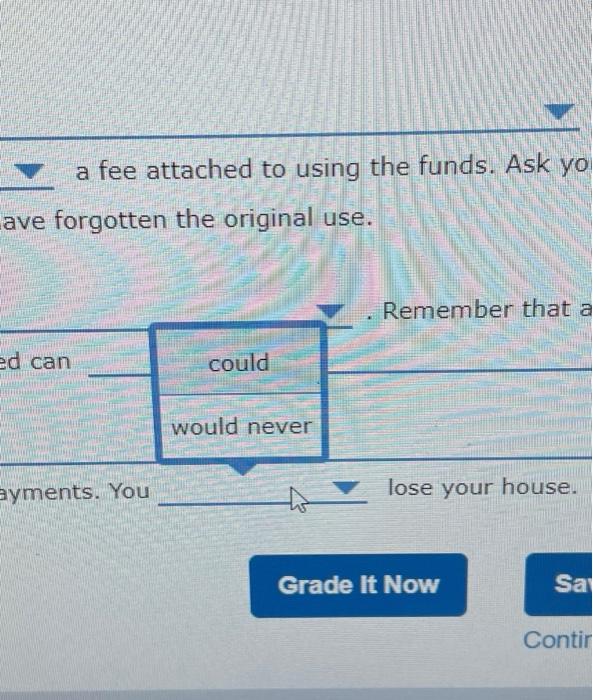

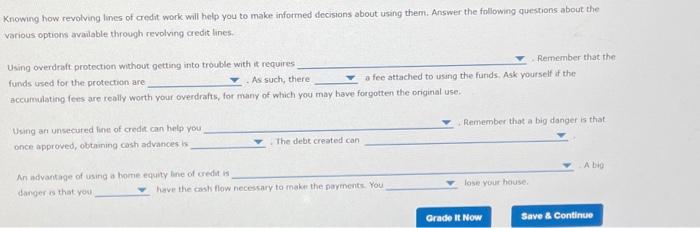

will help you to make informed decisions about using them. Answer the following questions about credit lines. into trouble with it requires Remember that the As such, the Ask yourself if the overdrafts, for many of which the self-discipline to use it only in emergencies simply staying below your maximum limit Remember that a big danger is that es is The debt created can elp you . A big line of credit is ve the cash flow necessary to make the payments. You lose your house. Grade It Now Save & Continue Continue without saving w revolving lines of credit work will help you to make informed cions available through revolving credit lines. draft protection without getting into trouble with it requires d for the protection are . As such, there ting fees are really wort pr many of which you a loan unsecured line of credit your own money roved, obtaining cash advances The debto ntage of using a home equity line of credit is is that you have the cash flow necessary to make th you to make informed decisions about using them. Answe es. ole with it requires a fee attached to using As such, there for many of which you e forgotten the original use is is not V The debt Creatcu can t is low necessary to make the payments. You Grade 1 es. work will help you to make informed decisions about using them. Answer ving credit lines. ting into trouble with it requires - As such, there a fee attached to using th ur overdrafts, for many of which you may have forgotten the original use. help you Re ces is make purchases sooner than you otherwise planned line of cr ave the cast TOW draw on the equity in your home Sally CU TITIKE THIC payments. Tou los Grade it No helpful in emergencies. ving lines of credit work will help you to make informed decisions about usim ailable through revolving credit lines. otection without getting into trouble with it requires - protection are As such, there a fee at s are really worth your overdrafts, for many of which you may have forgotten ed line of credit can help you Obtaining cash advances is The debt created can using a home equity line o very simple ou have the cumbersome sary to make the payments. You cisions about using them. Answer the following questions abo Remembe a fee attached to using the funds. Ask yourself if the may have forgotten the original use. Remember that a big danger reated can quickly become overwhelming ne payments be managed by using overdraft protection Grade It Now Save & Contin Continue without - you to make informed decisions about using them. Answer the following question nes. able with it requires Rem As such, there a fee attached to using the funds. Ask yourself s, for many of which you may have forgotten the original use. it taps into the equity funds you may be depending on for your retirement big d the usual long repayment periods of 10 or more years dit is lose your house. h flow necessary to make the payments. You Grade It Now Save & C overdraft protection without getting into trouble used for the protection are mulating fees are really worth your overdrafts, fo g an unsecured line of credit can help you e approved, obt may h advances is equity line of credit is may not advantage of us nger is that you have the cash flow ni x JUL c a fee attached to using the funds. Ask yo ave forgotten the original use. Remember that a ed can could would never ayments. You lose your house. Grade It Now Sa Contir Knowing how revolving lines of credit work will help you to make informed decisions about using them. Answer the following questions about the various options available through revolving credit lines Using overdraft protection without getting into trouble with it requires Remember that the funds used for the protection are As such, there a fee attached to using the funds. Ask yourself if the accumulating fees are really worth your overdrafts, for many of which you may have forgotten the original use. Remember that a big danger is that Using an unsecured line of credit can help you once approved, obtaining cash advances is The debt created can A An advantage of using a home equity line of credits danger that you have the cash flow necessary to make the payments. You lose your house Grade It Now Save & Continue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts