Question: Will leave a like! Thanks! DEPRECIATION METHODS Charlene is evaluating a copital budgeting project that should last for 4 years. The project requires $900,000 of

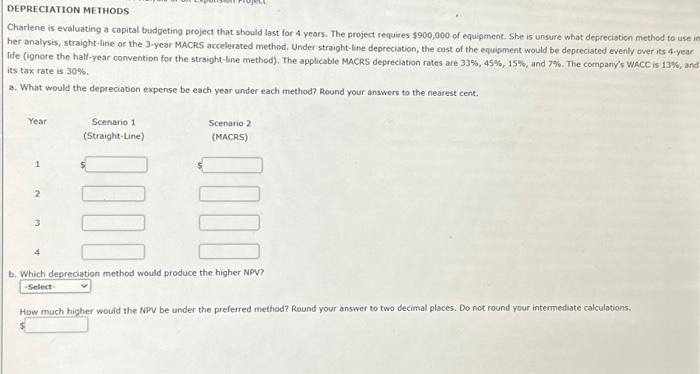

DEPRECIATION METHODS Charlene is evaluating a copital budgeting project that should last for 4 years. The project requires $900,000 of equipment. 5 he is unsure what depreciation method to use in her analysis, straight-line or the 3-year MACRS accelerated method. Under straight-line depreciation, the cost of the equipment would be depreciated evenly over its 4 -year life (ignore the half-year convention for the straight-line method). The applicable MACRS depreciation rates are 33%, 45\%, 15\%, and 7%. The company/5 WaCC is 13\%6, and its tax rate is 30%. a. What would the depreciation expense be each year under each method? Round your answers to the nearest cent. b. Which depreciation method would produce the higher NPv? How much hiaher would the NPV be under the preferred method? Round your answer to two decimal places. Do not round your intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts