Question: will leave review quick! The net present value (NPV) method estimates how much a potential project will contribute to and it is the best selection

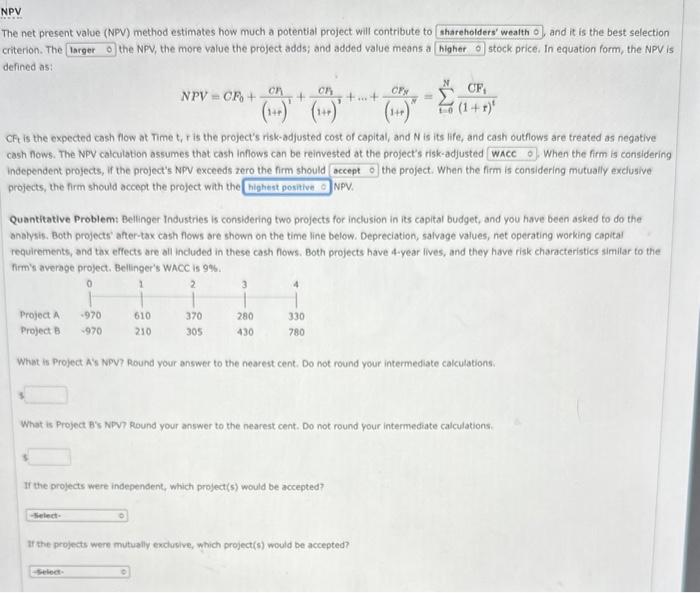

The net present value (NPV) method estimates how much a potential project will contribute to and it is the best selection criterion. The the NPV, the more value the project adds; and added value means a stock price, In equation form, the NPV is defined as: NPV=CF0+(1+r)1cF1+(1+r)1cF1++(1+r)NCFN=i=0N(1+r)tCFi CF is the expected cash flow at Time t,r is the project's risk-adjusted cost of capital, and N is its life, and cash outflows are treated as negative cash nows. The NPV calculation assumes that cash inflows can be reinvested at the project's risk-adjusted When the firm is considering independent projects, if the project's NPV exceeds zero the firm should the project. When the firm is considering mutually exclusive projects, the firm should accept the project with the NPV. Quantitative Problem: Belinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' aher-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WhCC is 9%. What is Project A's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations. What is Project Bis NPV7 Round your answer to the nearest cent. Do not round your intermediate calculations. If the projects were independent, which project(s) would be accepted? If the projects were mutually exclurive, which project(s) would be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts