Question: Will only appreciate correct answer (e) What equity stake does the firm need to offer new shareholders to raise the required finance ing? Given these

Will only appreciate correct answer

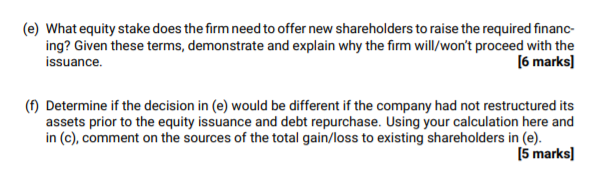

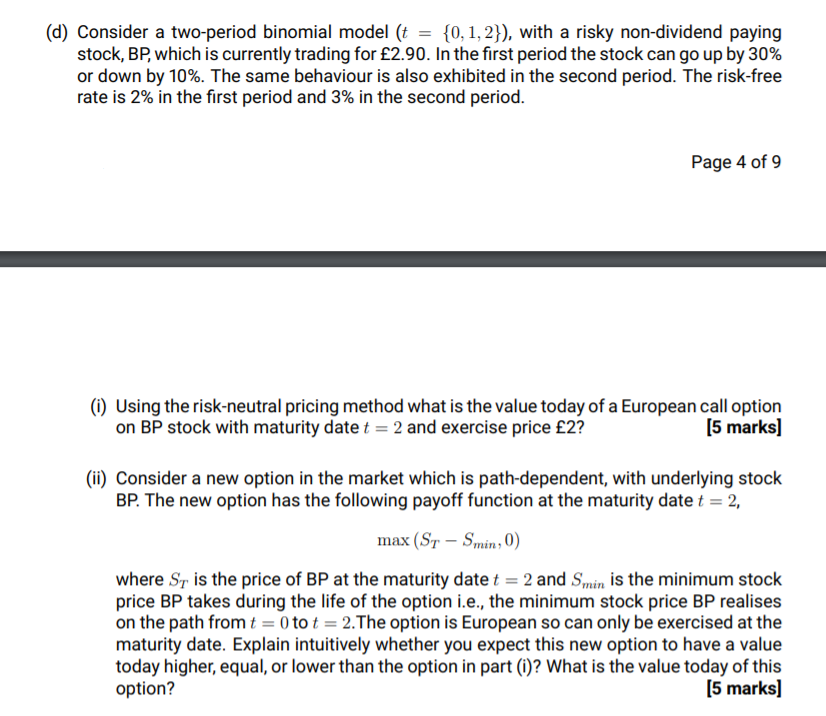

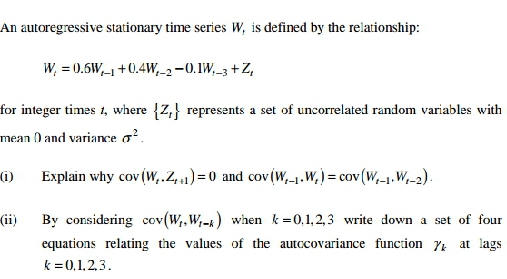

(e) What equity stake does the firm need to offer new shareholders to raise the required finance ing? Given these terms, demonstrate and explain why the firm will/won't proceed with the issuance. [6 marks] (f) Determine if the decision in (e) would be different if the company had not restructured its assets prior to the equity issuance and debt repurchase. Using your calculation here and in (c), comment on the sources of the total gain/loss to existing shareholders in (e). [5 marks](d) Consider a two-period binomial model {t = {0,1,2}l. with a risky non-dividend paying stock, BP, which is currently trading for 2.90. In therst period the stock can go up by 30% or down by 10%. The same behaviour is also exhibited in the second period. The risk-free rate is 2% in the rst period and 3% in the second period. Page 4 of 9 (i) Using the risk-neutral pricing method what is the value today of a European call option on BP stock with maturity date: = 2 and exercise price 2? [5 marks] (Ii) Consider a new option in the market which is path-dependent; with underlying stock BF". The new option has the following payoff function at the maturity date t = 2. max (ST SmiHIU} where ST Is the price of BP at the maturity date 1 = 2 and S,,,,-,, is the minimum stock price BP takes during the life of the option i.e.. the minimum stock price BF realises on the path from t = [ito t = 2+The option is European so can only be exercised at the maturity date. Explain intuitively whether you expect this new option to have a value today higher. equal, or lower than the option in part (i)? What is the value today of this option? I5 marks] An autoregressive stationary time series W, is defined by the relationship: W, =0.6W/_1 +0.4W/-2-0.1W,_3+2, for integer times , where Z- represents a set of uncorrelated random variables with mean 0) and variance or- (i) Explain why cov (W,.Z, , ) =0 and cov (W,_1. W, ) = cov (W,-1. W,-2) ii) By considering cov(W,, W,_ ) when =0.1,2,3 write down a set of four equations relating the values of the autocovariance function y at lags k = 0.1.2.3