Question: WILL RATE: Everything with in a red box is incorrect, I am having trouble with those specifically. HINTS: On Asset 3 the key is use

WILL RATE:

Everything with in a red box is incorrect, I am having trouble with those specifically.

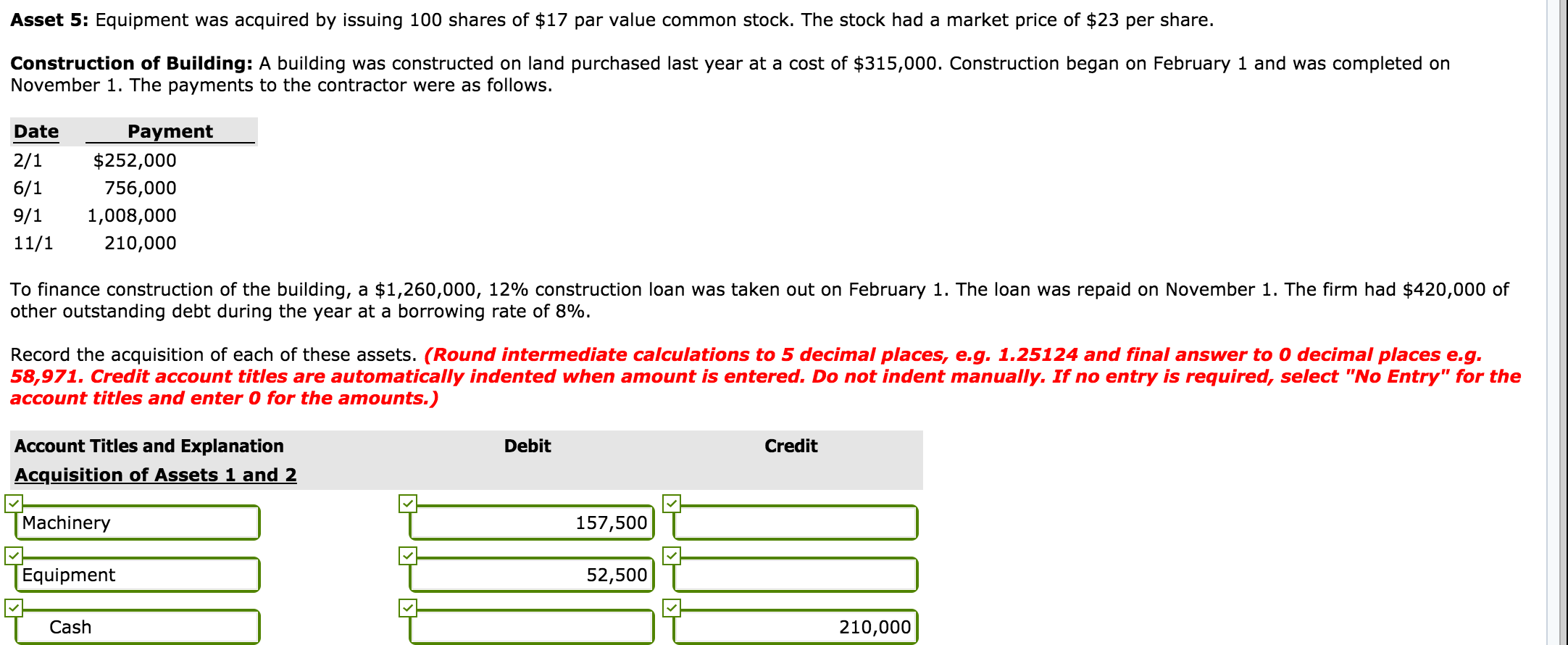

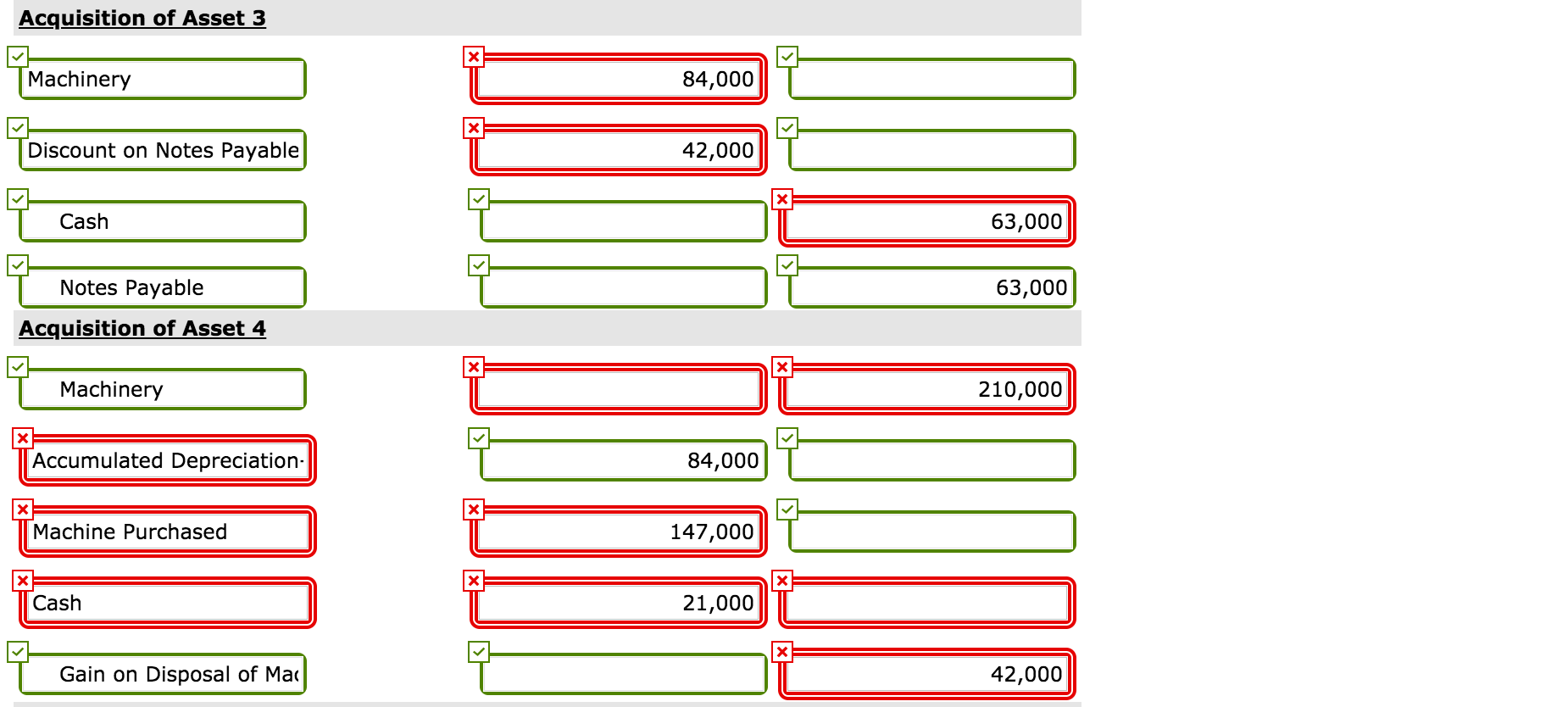

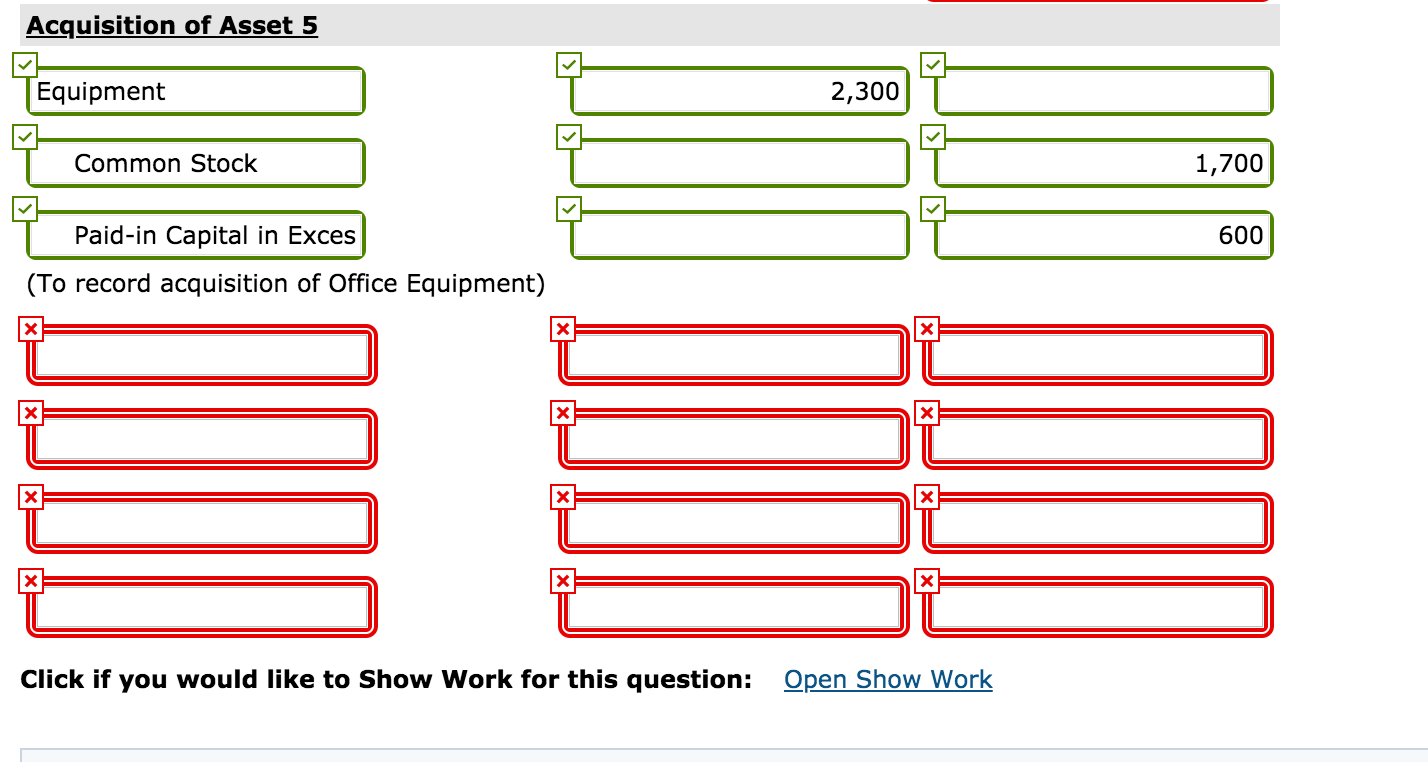

HINTS: On Asset 3 the key is use today's "outright purchase price" as the amount to debit Machinery for to set up the JE. The difference between today's cash downpayment + Note and the value is the "discount on note" that you would debit. Meanwhile you credit cash for the amount of the downpayment and credit notes payable for the amount of the note. By giving you the PV (today's purchase price) you don't have to try to figure it out on your calculator. On Asset 4 is a difficult one. The exchange lacked commercial substance and cash was received so if there is a gain you have to recognize part of the gain. The rest of the gain will be folded into the cost of the new machine in the journal entry. The percentage of the gain is based on (cash/ cash + Fair value of machine acquired). Take that percentage and multiply it by the gain to get the portion to be recorded. The rest of the gain is subtracted from the fair value of the machinery acquired. For Asset 5 you use the market value to determine the value of the Equipment debited in the JE. (shares x market value per share). Then on the credit side you credit Common Stock for just the par value and then credit the rest to Paid-in Capital in Excess of Par. The rest of part 5 is a big capitalized interest problem. One hint is that both the 2/1 construction cost and the 2/1 land cost (listed in the introduction sentence) are weighted the same.

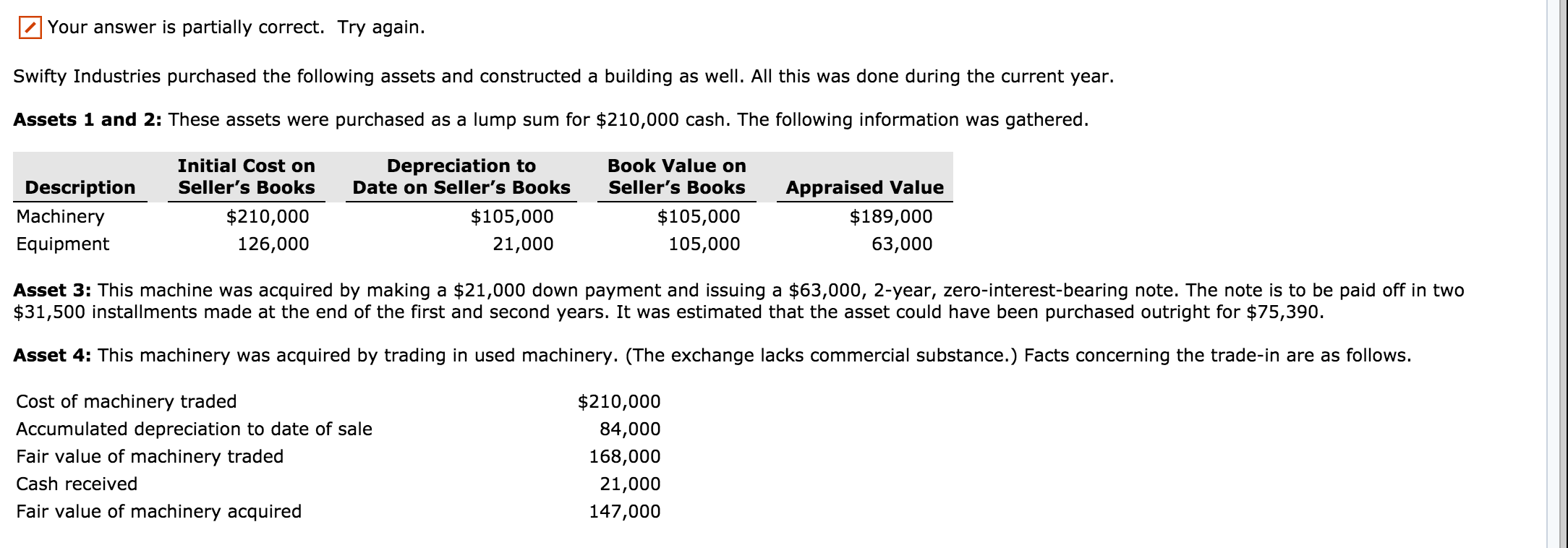

Your answer is partially correct. Try again. Swifty Industries purchased the following assets and constructed a building as well. All this was done during the current year. Assets 1 and 2: These assets were purchased as a lump sum for $210,000 cash. The following information was gathered. Initial Cost on Seller's Books Description OKS Depreciation to Date on Seller's Books $105,000 21,000 Book Value on Seller's Books $105,000 105,000 Machinery Equipment $210,000 126,000 Appraised Value $189,000 63,000 Asset 3: This machine was acquired by making a $21,000 down payment and issuing a $63,000, 2-year, zero-interest-bearing note. The note is to be paid off in two $31,500 installments made at the end of the first and second years. It was estimated that the asset could have been purchased outright for $75,390. Asset 4: This machinery was acquired by trading in used machinery. (The exchange lacks commercial substance.) Facts concerning the trade-in are as follows. Cost of machinery traded Accumulated depreciation to date of sale Fair value of machinery traded Cash received Fair value of machinery acquired $210,000 84,000 168,000 21,000 147,000 Asset 5: Equipment was acquired by issuing 100 shares of $17 par value common stock. The stock had a market price of $23 per share. Construction of Building: A building was constructed on land purchased last year at a cost of $315,000. Construction began on February 1 and was completed on November 1. The payments to the contractor were as follows. Date 2/1 6/1 9/1 11/1 Payment $252,000 756,000 1,008,000 210,000 To finance construction of the building, a $1,260,000, 12% construction loan was taken out on February 1. The loan was repaid on November 1. The firm had $420,000 of other outstanding debt during the year at a borrowing rate of 8%. Record the acquisition of each of these assets. (Round intermediate calculations to 5 decimal places, e.g. 1.25124 and final answer to O decimal places e.g. 58,971, Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Debit Credit Account Titles and Explanation Acquisition of Assets 1 and 2 Machinery 157,500 Equipment 52,500 Cash 210,000 Acquisition of Asset 3 TMachinery 84,000 TDiscount on Notes Payable | 42,000 T Cash 163,000 Notes Payable 163,000 Acquisition of Asset 4 UUVP UPUP NPUPUPPT T Machinery 1210,000 TAccumulated Depreciation: 84,000| Machine Purchased 147,000 Cash 21,000 Gain on Disposal of Mad 42,000 Acquisition of Asset 5 TEquipment Common Stock I 1,700 Paid-in Capital in Exces | 600 VRV (To record acquisition of Office Equipment PPP Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts